Question: Please answer the following question through formulas(calculations) and try to explain as much as possible for the last 2 parts. Thanks. University Portfolio | Basis

Please answer the following question through formulas(calculations) and try to explain as much as possible for the last 2 parts. Thanks.

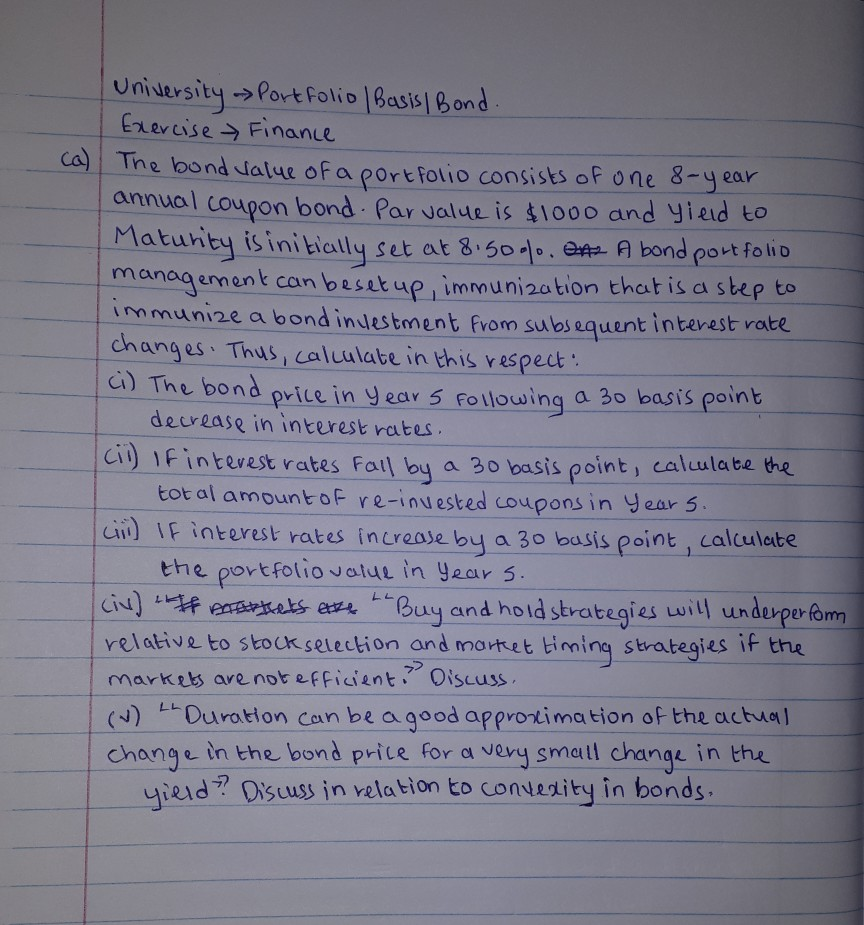

University Portfolio | Basis Bond. Exercise Finance The bond value of a portfolio consists of one 8-year annual coupon bond. Par value is $1000 and yield to Maturity is initially set at 8.50%. On2 A bond portfolio management can besetup, immunization that is a step to immunize a bond investment from subsequent interest rate. changes. Thus, calculate in this respect: (1) The bond price in years following a 30 basis point. decrease in interest rates. Cil) If interest rates Fall by a 30 basis point, calculate the total amount of re-invested coupons in Years.. cili If interest rates increase by a 30 basis point calculate. the portfolio value in years. Iciv) If prettets ette Buy and hold strategies will underperform relative to stock selection and market timing strategies if the markets are not efficient? Discuss. (W) 2 Duration can be a good approximation of the actual change in the bond price for a very small change in the yield? Discuss in relation to convexity in bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts