Question: Please answer the following question with explanation. 5. Shaky Position, Inc. is unable to meet its next several coupon payments. The bonds have a face

Please answer the following question with explanation.

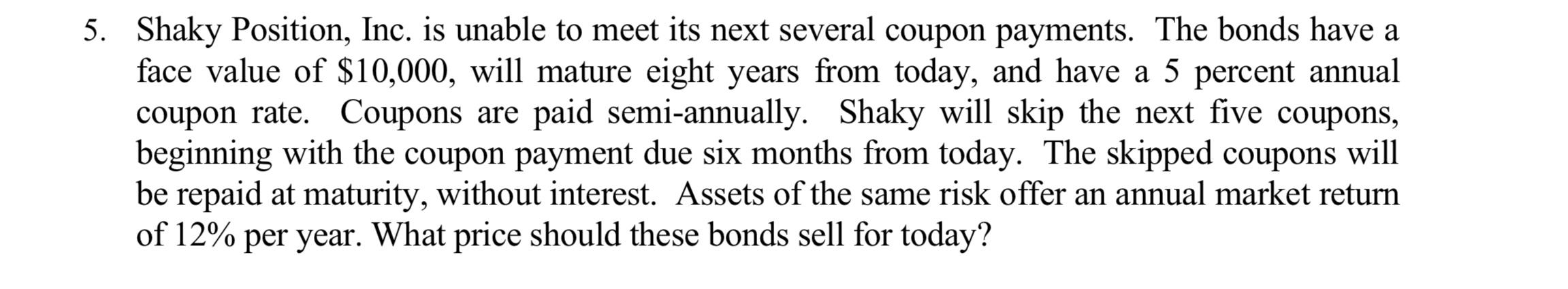

5. Shaky Position, Inc. is unable to meet its next several coupon payments. The bonds have a face value of $10,000, will mature eight years from today, and have a 5 percent annual coupon rate. Coupons are paid semi-annually. Shaky will skip the next five coupons, beginning with the coupon payment due six months from today. The skipped coupons will be repaid at maturity, without interest. Assets of the same risk offer an annual market return of 12% per year. What price should these bonds sell for today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts