Question: Please answer the following question with steps and explaination. An investor makes a strap strategy using the following asset when spot price of underlying is

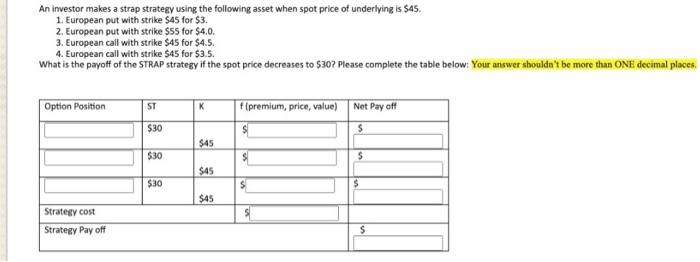

An investor makes a strap strategy using the following asset when spot price of underlying is $45. 1. European put with strike $45 for $3. 2. European put with strike $55 for $4.0. 3. European call with strike $45 for $4.5. 4. European call with strike $45 for $3.5. What is the payoff of the STRAP strategy if the spot price decreases to $30? Please complete the table below: Your answer shouldn't be more than ONE decimal places. Option Position ST K f (premium, price, value) Net Pay off $30 $ $ $45 $30 $ 5 $45 $30 $45 Strategy cost Strategy Pay off $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts