Question: Please answer the following questions: A balance sheet hedge seeks to nate any mismatch of net assets er accounting exposure to transaction exposure. e cumulative

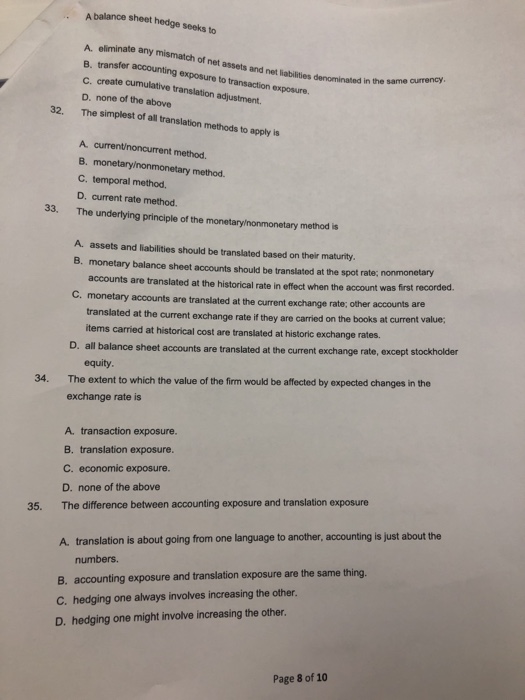

A balance sheet hedge seeks to nate any mismatch of net assets er accounting exposure to transaction exposure. e cumulative translation adjustment. and net liabilities denominated in the same B. transfer c. creat D. none of the above The simplest of all translation methods to 32. apply is A currentoncurrent method. B. monetaryonmonetary method. C. temporal method. D. current rate method. 33. The underlying principle of the monetaryonmonetary method is A. assets and liabilities should be translated based on their maturity B. monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded. C. monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current items carried at historical cost are translated at historic exchange rates. , except stockholder D. all balance sheet accounts are translated at the current exchange rate equity The extent to which the value of the firm would be affected by expected changes in the exchange rate is 34. A. transaction exposure. B. translation exposure. C. economic exposure. D. none of the above The difference between accounting exposure and translation exposure 35. A. translation is about going from one language to another, accounting is just about the numbers. B. accounting exposure and translation exposure are the same thing C. hedging one always involves increasing the other. D. hedging one might involve increasing the other. Page 8 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts