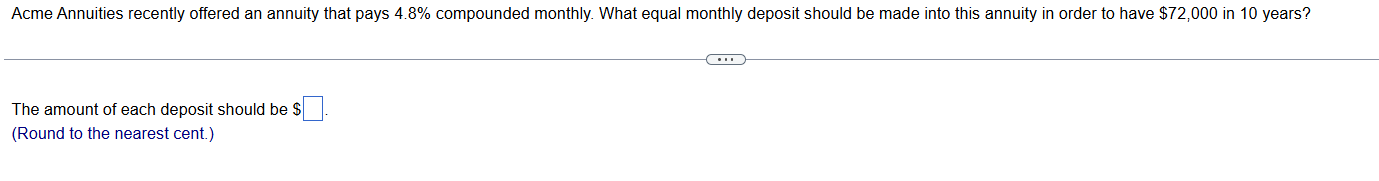

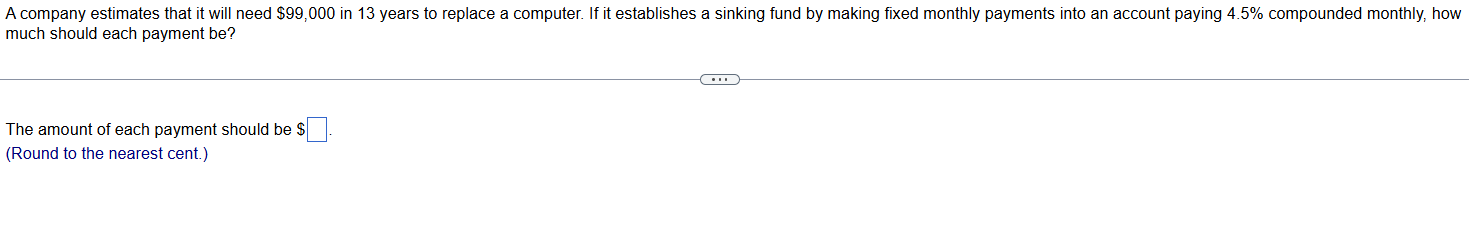

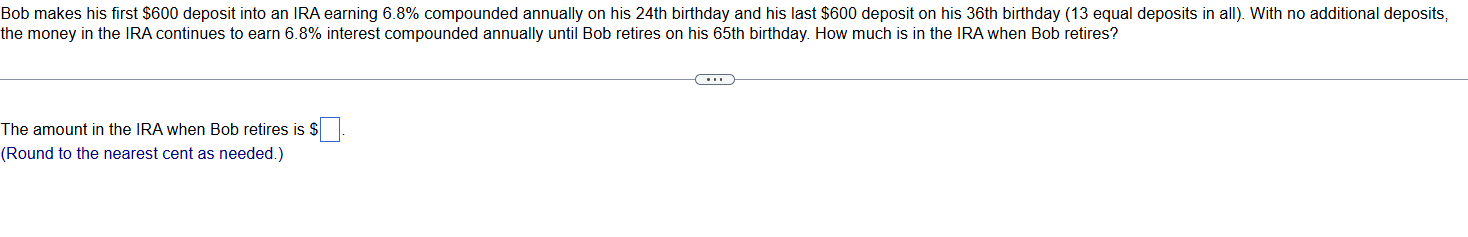

Question: Please answer the following questions on the topic Future Value of an Annuity; Sinking Funds Acme Annuities recently offered an annuity that pays 4.8% compounded

Please answer the following questions on the topic Future Value of an Annuity; Sinking Funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts