Question: Please answer the following questions Please interpret the regression coefficient for REL(Dummy) [i.e., -10.55] What is the number in the parenthesis [i.e., 2.44]? What is

![REL(Dummy) [i.e., -10.55] What is the number in the parenthesis [i.e., 2.44]?](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffe9aedd6a4_53466ffe9ae5d9f9.jpg)

Please answer the following questions

- Please interpret the regression coefficient for REL(Dummy) [i.e., -10.55]

- What is the number in the parenthesis [i.e., 2.44]?

- What is the potentil problem of the estimated coefficient [i.e., -10.55] in the regression model used in this research? please provide some justifications for your anser.

- What is your proposed solutio to solve the identified problem in (3)? Please provide some justifications for your answer.

Note: What Are Basis Points? (from investopedia.com)

Basis points, otherwise known as bps or "bips," are a unit of measure used in finance to describe the percentage change in the value of financial instruments or the rate change in an index or other benchmark. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form.

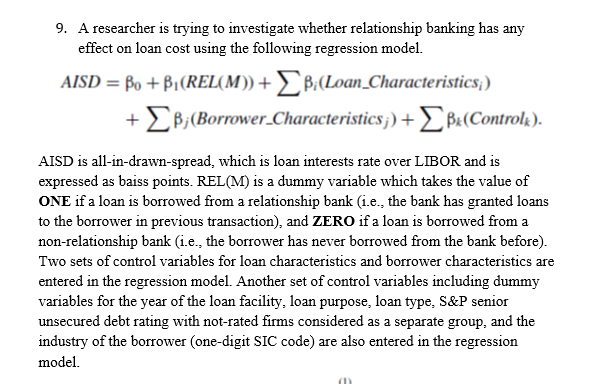

9. A researcher is trying to investigate whether relationship banking has any effect on loan cost using the following regression model. AISD = bo +B, (REL(M) + B:(Loan_Characteristics;) +B;(Borrower Characteristics ;) + Bx(Controlk). AISD is all-in-drawn-spread, which is loan interests rate over LIBOR and is expressed as baiss points. REL(M) is a dummy variable which takes the value of ONE if a loan is borrowed from a relationship bank (i.e., the bank has granted loans to the borrower in previous transaction), and ZERO if a loan is borrowed from a non-relationship bank (i.e., the borrower has never borrowed from the bank before). Two sets of control variables for loan characteristics and borrower characteristics are entered in the regression model. Another set of control variables including dummy variables for the year of the loan facility, loan purpose, loan type, S&P senior unsecured debt rating with not-rated firms considered as a separate group, and the industry of the borrower (one-digit SIC code) are also entered in the regression model. (1) Const. REL Duny) REL Number) 903. 21 (22.76) - 10:55 -18.07 RELLAmount Log Maturity) Collateral Default spread Log.oan sine) 60.0 LogAssets) Log(l+Coverage) Leverage Profitability Tangibility Current ratio Market-to-book -16.17 (1.56) -9.71 (1.57) -23.91 (1.69) 21.6.3" (8.73) -44.01 (13.65) -12.00 (6.73) -2.71 (0.74) -1.13 (0.96) 13.158 Obs. R 0:57 9. A researcher is trying to investigate whether relationship banking has any effect on loan cost using the following regression model. AISD = bo +B, (REL(M) + B:(Loan_Characteristics;) +B;(Borrower Characteristics ;) + Bx(Controlk). AISD is all-in-drawn-spread, which is loan interests rate over LIBOR and is expressed as baiss points. REL(M) is a dummy variable which takes the value of ONE if a loan is borrowed from a relationship bank (i.e., the bank has granted loans to the borrower in previous transaction), and ZERO if a loan is borrowed from a non-relationship bank (i.e., the borrower has never borrowed from the bank before). Two sets of control variables for loan characteristics and borrower characteristics are entered in the regression model. Another set of control variables including dummy variables for the year of the loan facility, loan purpose, loan type, S&P senior unsecured debt rating with not-rated firms considered as a separate group, and the industry of the borrower (one-digit SIC code) are also entered in the regression model. (1) Const. REL Duny) REL Number) 903. 21 (22.76) - 10:55 -18.07 RELLAmount Log Maturity) Collateral Default spread Log.oan sine) 60.0 LogAssets) Log(l+Coverage) Leverage Profitability Tangibility Current ratio Market-to-book -16.17 (1.56) -9.71 (1.57) -23.91 (1.69) 21.6.3" (8.73) -44.01 (13.65) -12.00 (6.73) -2.71 (0.74) -1.13 (0.96) 13.158 Obs. R 0:57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts