Question: Please answer the following questions: Question 4 (1 point) For this question start fresh, do not carry over data from earlier questions. You are analyzing

Please answer the following questions:

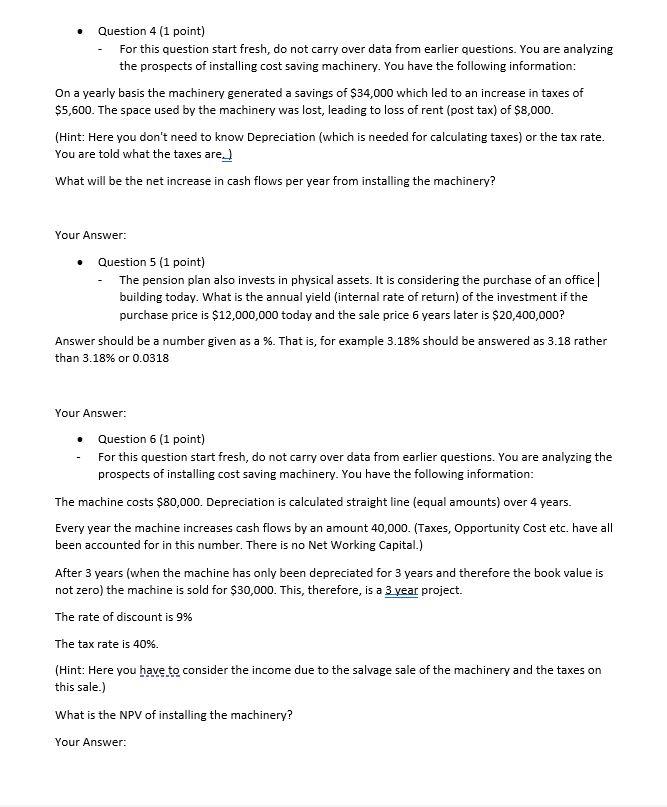

Question 4 (1 point) For this question start fresh, do not carry over data from earlier questions. You are analyzing the prospects of installing cost saving machinery. You have the following information: On a yearly basis the machinery generated a savings of $34,000 which led to an increase in taxes of $5,600. The space used by the machinery was lost, leading to loss of rent (post tax) of $8,000. (Hint: Here you don't need to know Depreciation (which is needed for calculating taxes) or the tax rate. You are told what the taxes are. What will be the net increase in cash flows per year from installing the machinery? Your Answer: Question 5 (1 point) The pension plan also invests in physical assets. It is considering the purchase of an office building today. What is the annual yield (internal rate of return) of the investment if the purchase price is $12,000,000 today and the sale price 6 years later is $20,400,000? Answer should be a number given as a %. That is, for example 3.18% should be answered as 3.18 rather than 3.18% or 0.0318 Your Answer: Question 6 (1 point) - For this question start fresh, do not carry over data from earlier questions. You are analyzing the prospects of installing cost saving machinery. You have the following information: The machine costs $80,000. Depreciation is calculated straight line (equal amounts) over 4 years. Every year the machine increases cash flows by an amount 40,000. (Taxes, Opportunity Cost etc. have all been accounted for in this number. There is no Net Working Capital.) After 3 years (when the machine has only been depreciated for 3 years and therefore the book value is not zero) the machine is sold for $30,000. This, therefore, is a 3 year project. The rate of discount is 9% The tax rate is 40%. (Hint: Here you have to consider the income due to the salvage sale of the machinery and the taxes on this sale.) What is the NPV of installing the machinery? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts