Question: please answer the following questions, thank you!! Which statement below regarding the direct writeoff method of accounting for bad debts is incorrect? Does not make

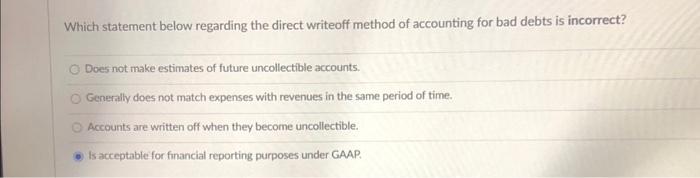

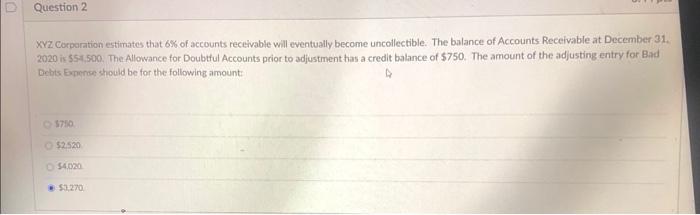

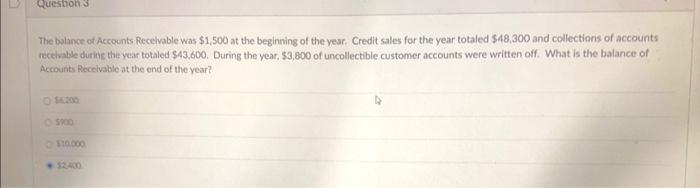

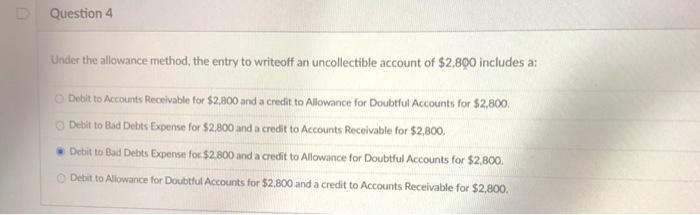

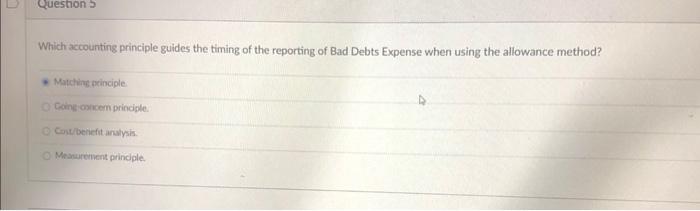

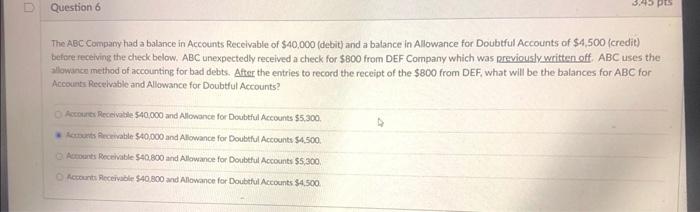

Which statement below regarding the direct writeoff method of accounting for bad debts is incorrect? Does not make estimates of future uncollectible accounts. Generally does not match expenses with revenues in the same period of time. Accounts are written off when they become uncollectible. Is acceptable for financial reporting purposes under GAAP. D Question 2 XYZ Corporation estimates that 6% of accounts receivable will eventually become uncollectible. The balance of Accounts Receivable at December 31 2020 is 554,500. The Allowance for Doubtful Accounts prior to adjustment has a credit balance of $750. The amount of the adjusting entry for Bad Debts Expense should be for the following amounts 5750 52520 54.020 $1270 Questions The balance of Accounts Recevable was $1.500 at the beginning of the year. Credit sales for the year totaled $48,300 and collections of accounts receivable during the year totaled 843,600. During the year, $3,800 of uncollectible customer accounts were written off. What is the balance of Accounts Receivable at the end of the year? 1300 5900 D Question 4 Under the allowance method, the entry to writeoff an uncollectible account of $2,800 includes a: Debit to Accounts Receivable for $2.800 and a credit to Allowance for Doubtful Accounts for $2,800, Debit to Bad Debts Expense for $2,800 and a credit to Accounts Receivable for $2,800. Debit to Bad Debts Expense for $2.800 and a credit to Allowance for Doubtful Accounts for $2,800. Debit to Allowance for Doubtful Accounts for $2,800 and a credit to Accounts Receivable for $2,800. Question 5 Which accounting principle guides the timing of the reporting of Bad Debts Expense when using the allowance method? Matching cinciple Going concern principle Cost/benefit aralysis Measurement principle. D Question 6 43 pts The ABC Company had a balance in Accounts Receivable of $40,000 (debit) and a balance in Allowance for Doubtful Accounts of $4.500 (credit) before receiving the check below. ABC unexpectedly received a check for $800 from DEF Company which was previously written off ABC uses the allowance method of accounting for bad debts. After the entries to record the receipt of the $800 from DEF, what will be the balances for ABC for Accounts Receivable and Allowance for Doubtful Accounts? Accounts Receivable 540.000 and Allowance for Doubtful Accounts $5,300 unts Receivable 340,000 and Alowance for Doubtful Accounts 54.500 Accounts Receivable $40.800 and Allowance for Doubtful Accounts $5.300 Accounts Receivable $40.800 and Allowance for Doubtful Accounts 34.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts