Question: Please answer the following questions, Thanks Question 1 Instructions: Complete the requirements specied for each of the following independent situations. A. A major portion of

Please answer the following questions, Thanks

Question 1

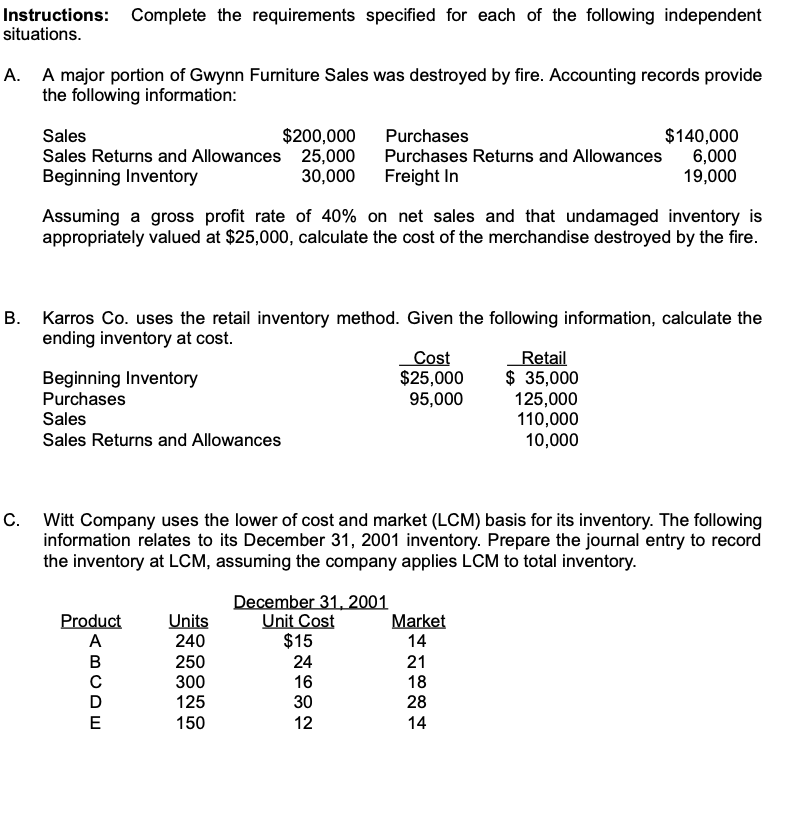

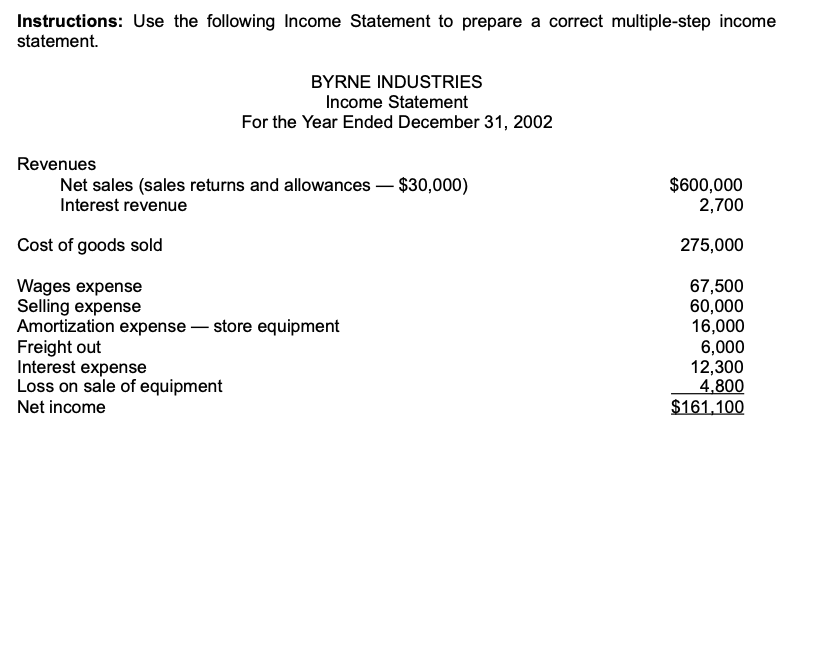

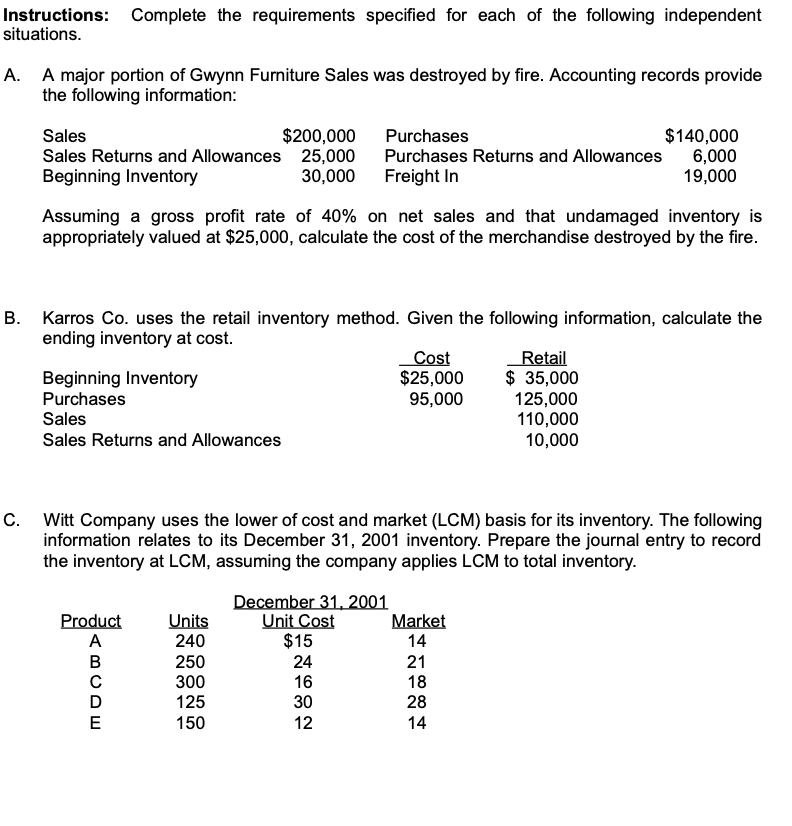

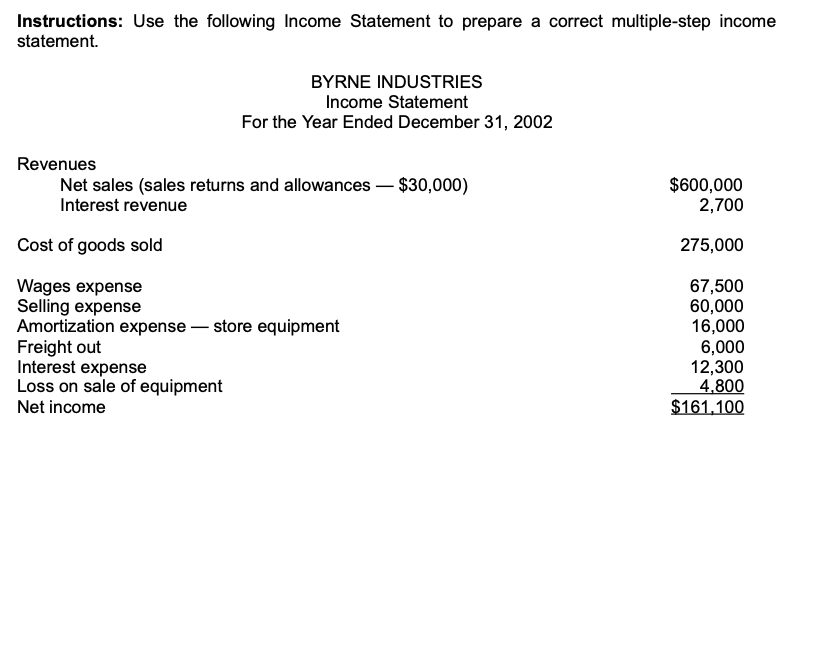

Instructions: Complete the requirements specied for each of the following independent situations. A. A major portion of Gwynn Furniture Sales was destroyed by fire. Accounting records provide the following information: Sales $200,000 Purchases $140,000 Sales Returns and Allowances 25,000 Purchases Returns and Allowances 6,000 Beginning Inventory 30,000 Freight In 19,000 Assuming a gross prot rate of 40% on net sales and that undamaged inventory is appropriately valued at $25,000, calculate the cost of the merchandise destroyed by the fire. B. Karros Co. uses the retail inventory method. Given the following information, calculate the ending inventory at cost. _Cn.t_Blail Beginning Inventory $25,000 $ 35,000 Purchases 95,000 125,000 Sales 110,000 Sales Returns and Allowances 10,000 C. Witt Company uses the lower of cost and market (LCM) basis for its inventory. The following information relates to its December 31, 2001 inventory. Prepare the journal entry to record the inventory at LCM, assuming the company applies LCM to total inventory. W Elndut Units Liniisi Manta A 240 $15 14 B 250 24 21 C 300 16 18 D 125 30 28 E 150 12 14 Instructions: Use the following Income Statement to prepare a correct multiple-step income statement BYRNE INDUSTRIES Income Statement For the Year Ended December 31, 2002 Revenues Net sales (sales retums and allowances $30,000} $600,000 Interest revenue 2,700 Cost of goods sold 275,000 Wages expense 67,500 Selling expense 60.000 Amortization expense store equipment 16,000 Freight out 6,000 Interest expense 12,300 Loss on sale of equipment 4 800 Net income 5151.100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts