Question: Please answer the following questions: This is based on the Harvard case study called Asset Allocation at the Cook County Pension Fund 1. Is it

Please answer the following questions: This is based on the Harvard case study called Asset Allocation at the Cook County Pension Fund

1. Is it reasonable to assume that past performance is a good indication of future performance? Is there a specific asset class that you would be wary of using past performance as a good indication of future performance? Why or why not?

2. What should Hackett do with the portfolio? Are there other options that Cook County should explore?

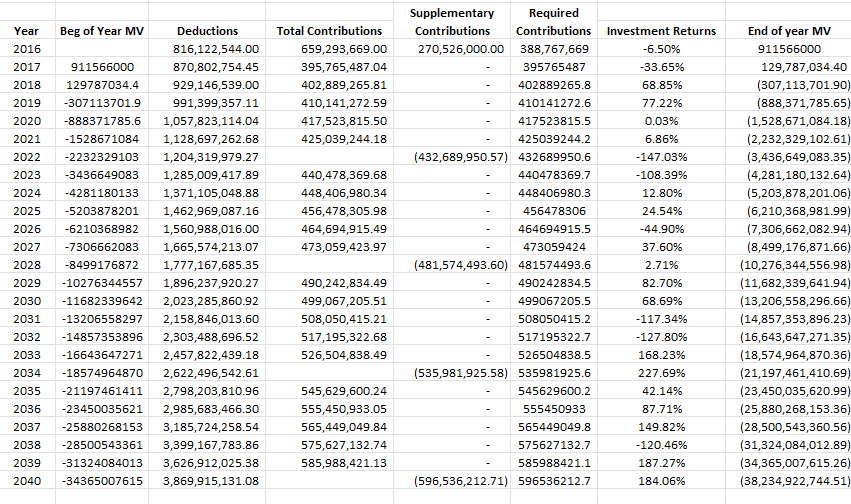

3. Find the standard deviation to measure of risk and average return to measure reward

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock