Question: Please answer the following with full explanation and solution, I badly need help thank you Use the following information for the next three items: A,

Please answer the following with full explanation and solution, I badly need help thank you

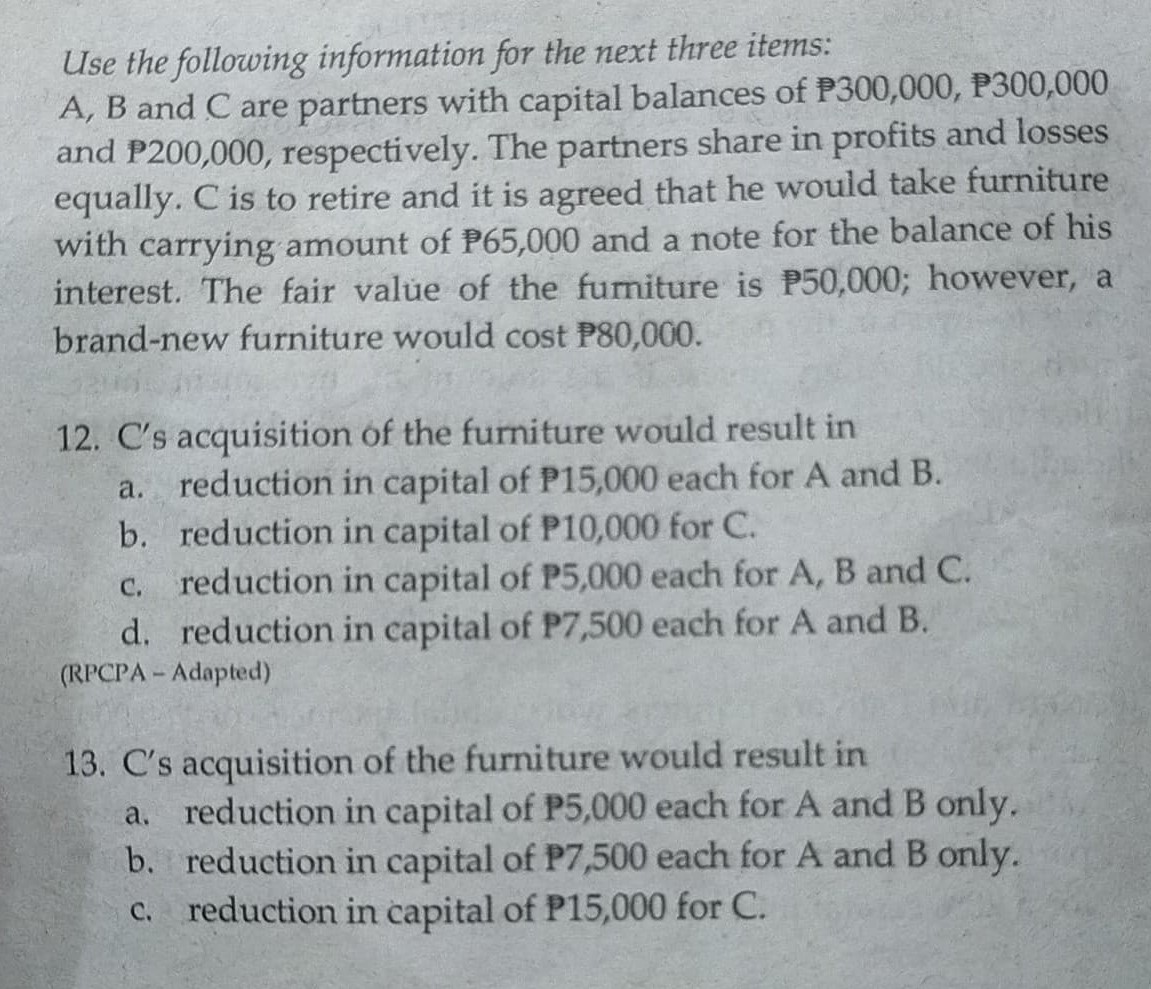

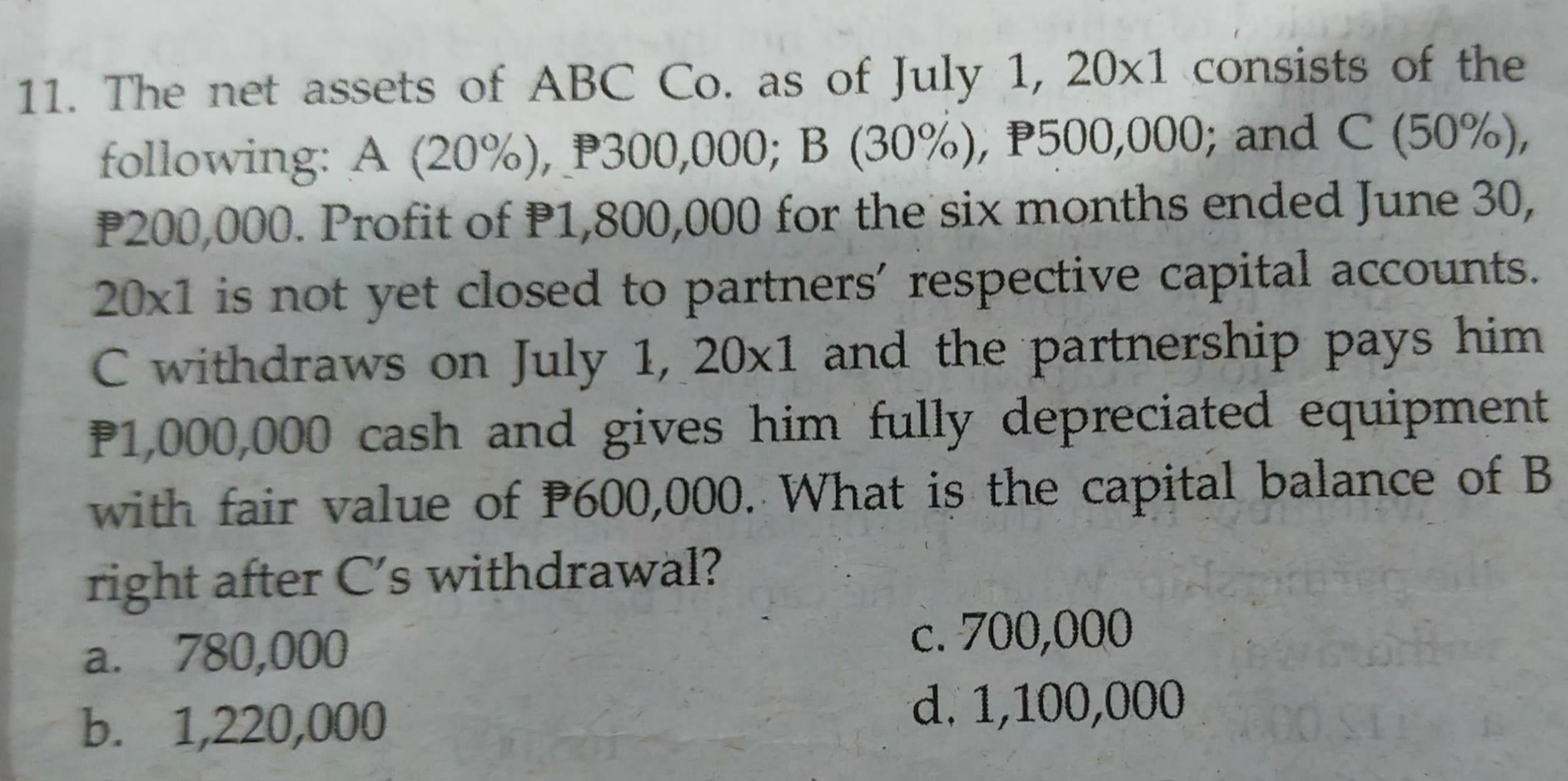

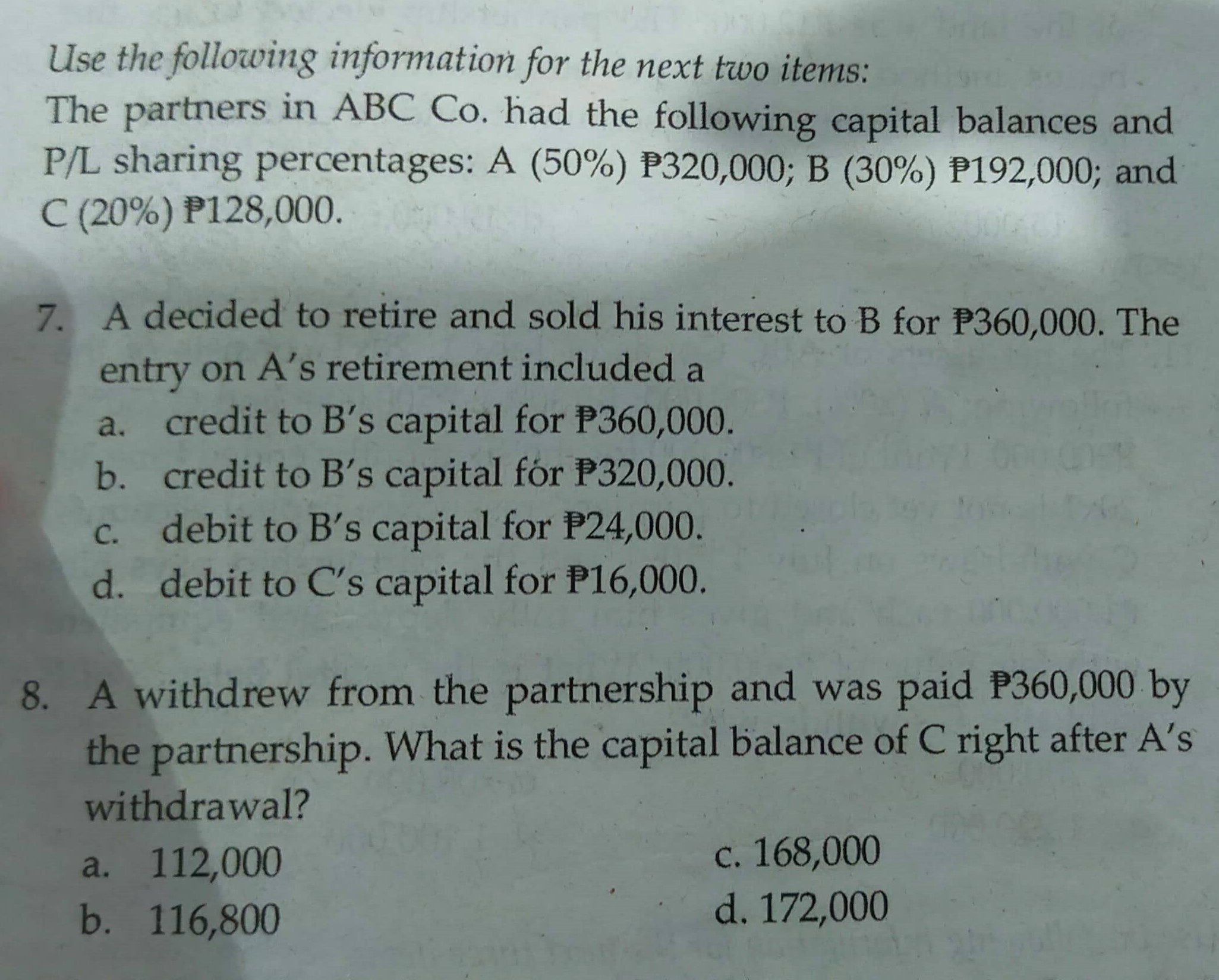

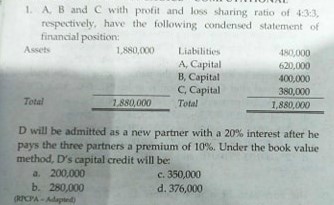

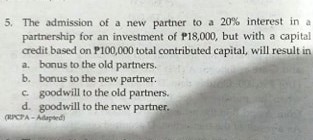

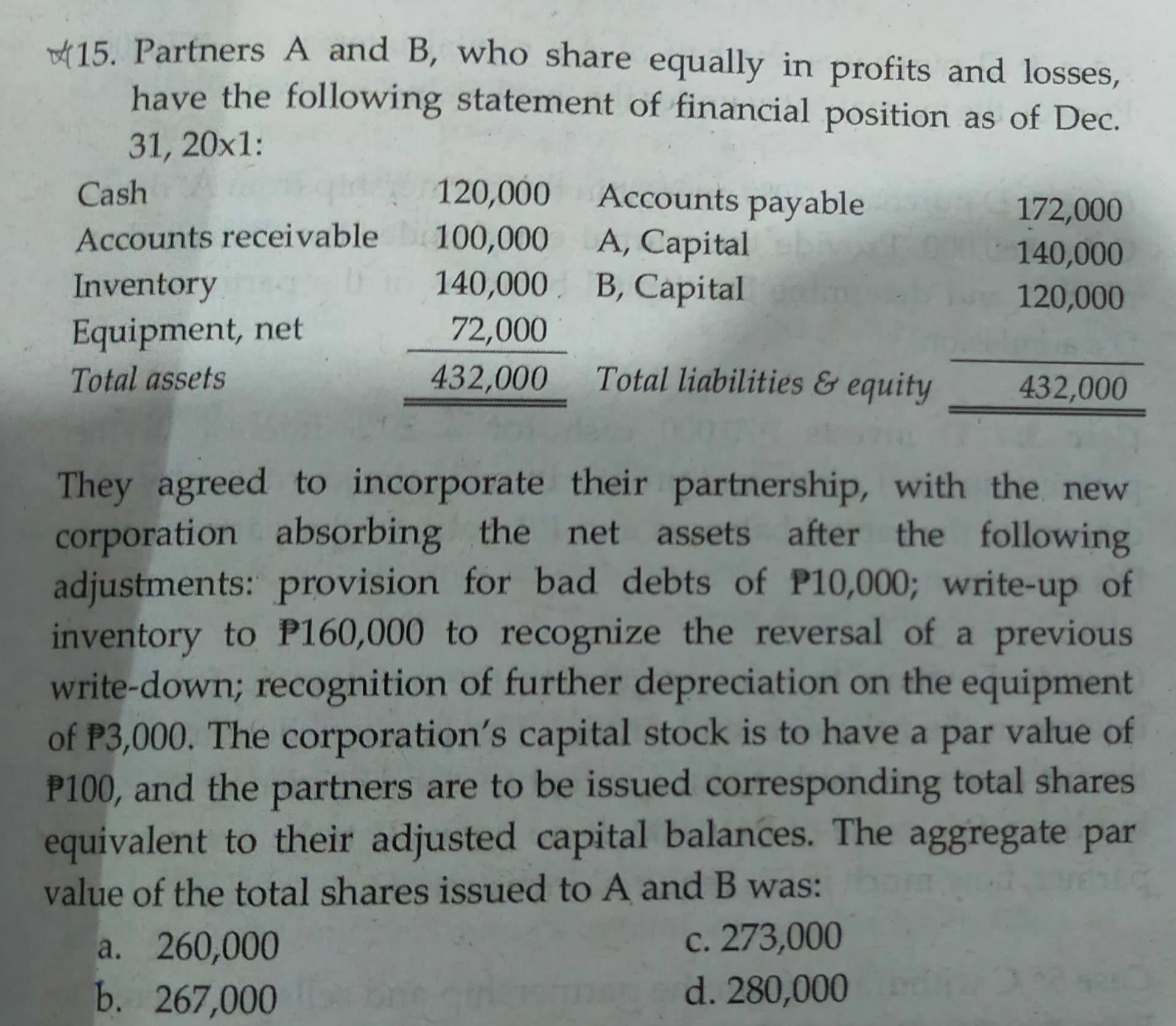

Use the following information for the next three items: A, B and C are partners with capital balances of P300,000, P300,000 and P200,000, respectively. The partners share in profits and losses equally. C is to retire and it is agreed that he would take furniture with carrying amount of P65,000 and a note for the balance of his interest. The fair value of the furniture is P50,000; however, a brand-new furniture would cost P80,000. 12. C's acquisition of the furniture would result in a. reduction in capital of P15,000 each for A and B. b. reduction in capital of P10,000 for C. c. reduction in capital of P5,000 each for A, B and C. d. reduction in capital of P7,500 each for A and B. (RPCPA - Adapted) 13. C's acquisition of the furniture would result in a. reduction in capital of P5,000 each for A and B only. b. reduction in capital of P7,500 each for A and B only. c. reduction in capital of P15,000 for C.11. The net assets of ABC Co. as of July 1, 20x1 consists of the following: A (20%), P300,000; B (30%), P500,000; and C (50%), P200,000. Profit of P1,800,000 for the six months ended June 30, 20x1 is not yet closed to partners' respective capital accounts. C withdraws on July 1, 20x1 and the partnership pays him P1,000,000 cash and gives him fully depreciated equipment with fair value of P600,000. What is the capital balance of B right after C's withdrawal? a. 780,000 c. 700,000 b. 1,220,000 d. 1,100,000Use the following information for the next two items: The partners in ABC Co. had the following capital balances and P/L sharing percentages: A (50%) P320,000; B (30%) P192,000; and C (20%) P128,000. 7. A decided to retire and sold his interest to B for P360,000. The entry on A's retirement included a a. credit to B's capital for P360,000. b. credit to B's capital for P320,000. c. debit to B's capital for P24,000. d. debit to C's capital for P16,000. 8. A withdrew from the partnership and was paid P360,000 by the partnership. What is the capital balance of C right after A's withdrawal? a. 112,000 c. 168,000 b. 116,800 d. 172,0001. A B and C with profil and loss sharing ratio of 4:3:3, respectively, have the following condensed statement of financial position: Assris 1.890,000 Liabilities 480.000 A, Capital 620.000 B, Capital 400:000 C. Capital 380.000 Total 1.850, 070 Total 1, 850 000 D will be admitted as a new partner with a 20% interest after he pays the three partners a premium of 10%. Under the book value method, D's capital credit will be: a. 200,000 c. 350,000 b. 280,000 d. 376,0005, The admission of a new partner to a 20% interest in a partnership for an investment of P18,000, but with a capital credit based on P100,000 total contributed capital, will result in a. bonus to the old partners, b. bonus to the new partner. @ goodwill to the old partners. d. goodwill to the new partner415. Partners A and B, who share equally in profits and losses, have the following statement of financial position as of Dec. 31, 20x1: Cash 120,000 Accounts payable 172,000 Accounts receivable 100,000 A, Capital 140,000 Inventory 140,000 . B, Capital 120,000 Equipment, net 72,000 Total assets 432,000 Total liabilities & equity 432,000 They agreed to incorporate their partnership, with the new corporation absorbing the net assets after the following adjustments: provision for bad debts of P10,000; write-up of inventory to P160,000 to recognize the reversal of a previous write-down; recognition of further depreciation on the equipment of P3,000. The corporation's capital stock is to have a par value of P100, and the partners are to be issued corresponding total shares equivalent to their adjusted capital balances. The aggregate par value of the total shares issued to A and B was: a. 260,000 c. 273,000 b. 267,000 d. 280,000