Question: please answer the following with reference to the table. please make the answer clear $ 243,848 $345,202 BETHESDA MINING COMPANY Balance Sheets as of December

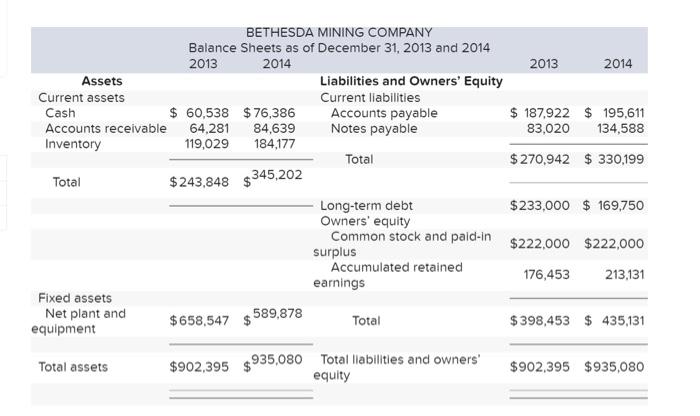

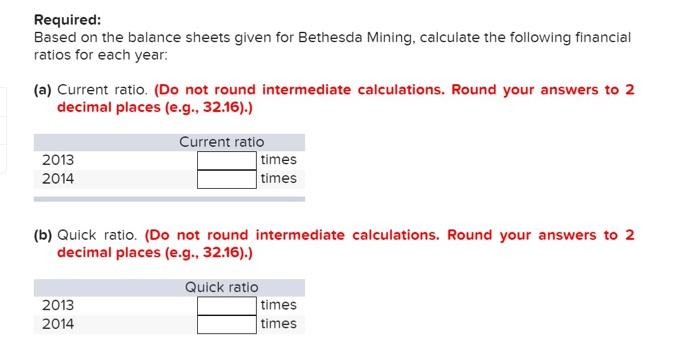

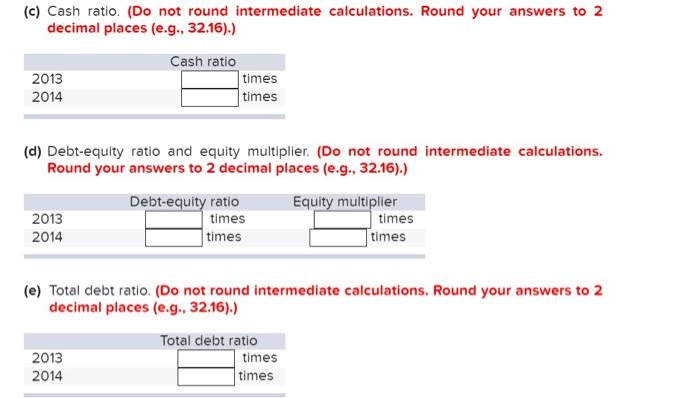

$ 243,848 $345,202 BETHESDA MINING COMPANY Balance Sheets as of December 31, 2013 and 2014 2013 2014 2013 2014 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 60,538 $ 76,386 Accounts payable $ 187,922 $ 195,611 Accounts receivable 64,281 84,639 Notes payable 83,020 134,588 Inventory 119,029 184,177 Total $ 270.942 $ 330,199 Total Long-term debt $233.000 $ 169,750 Owners' equity Common stock and pald-in $222,000 $222,000 surplus Accumulated retained 176,453 213,131 earnings Fixed assets Net plant and $658,547 $ 589,878 Total $398,453 $ 435,131 equipment Total assets $902,395 $ 935,080 Total llabilities and owners' $902,395 $935,080 equity Required: Based on the balance sheets given for Bethesda Mining, calculate the following financial ratios for each year: (a) Current ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) 2013 2014 Current ratio times times (b) Quick ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) Quick ratio 2013 times 2014 times (c) Cash ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) 2013 2014 Cash ratio times times (d) Debt-equity ratio and equity multiplier. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) Debt-equity ratio Equity multiplier 2013 times times 2014 times times (e) Total debt ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) 2013 2014 Total debt ratio times times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts