Question: Please answer the Free Cash Flow using both the EBIT and the CFO method: Question 1: The forecasts of the financial statements of a privatelyowned

Please answer the Free Cash Flow using both the EBIT and the CFO method:

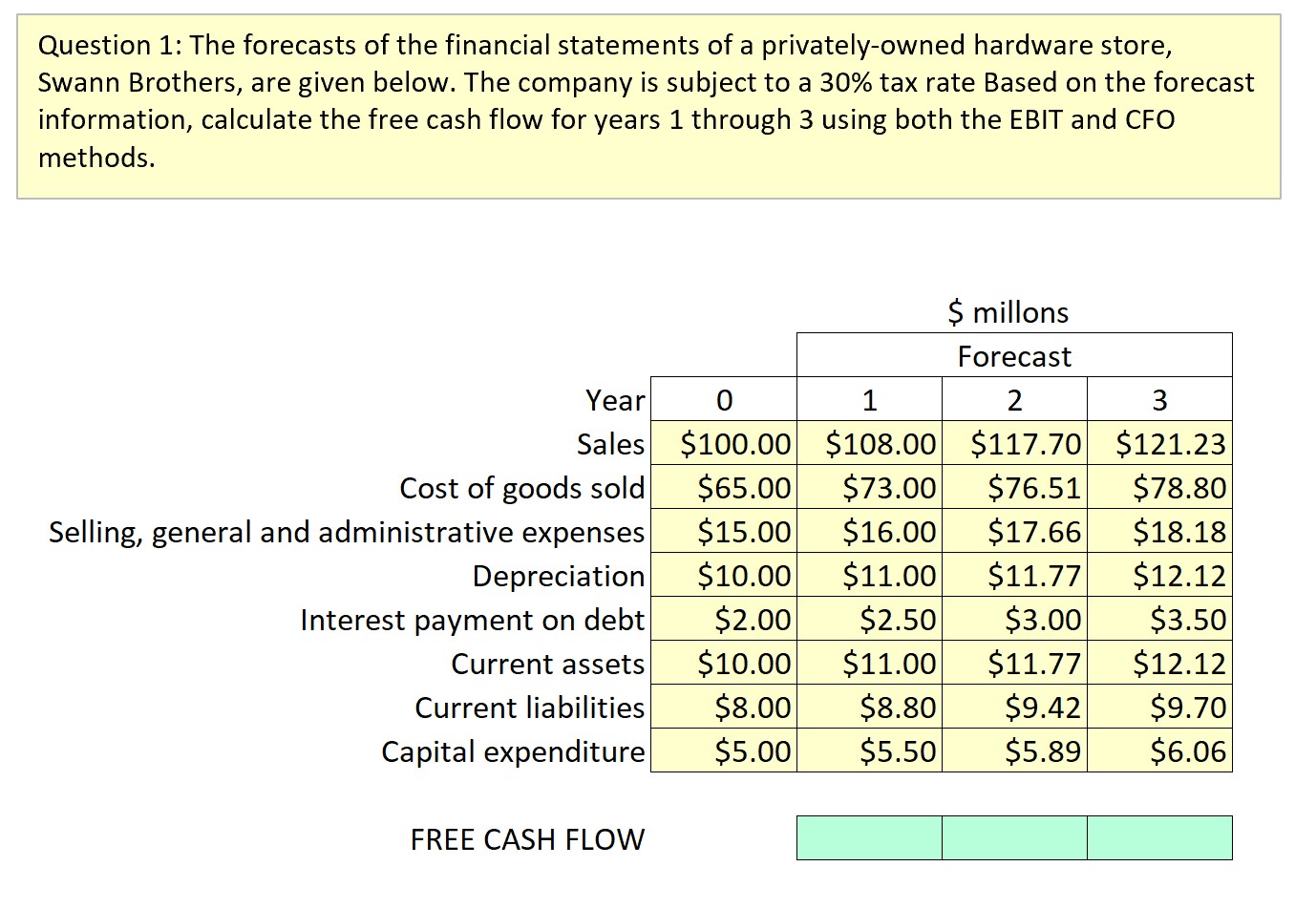

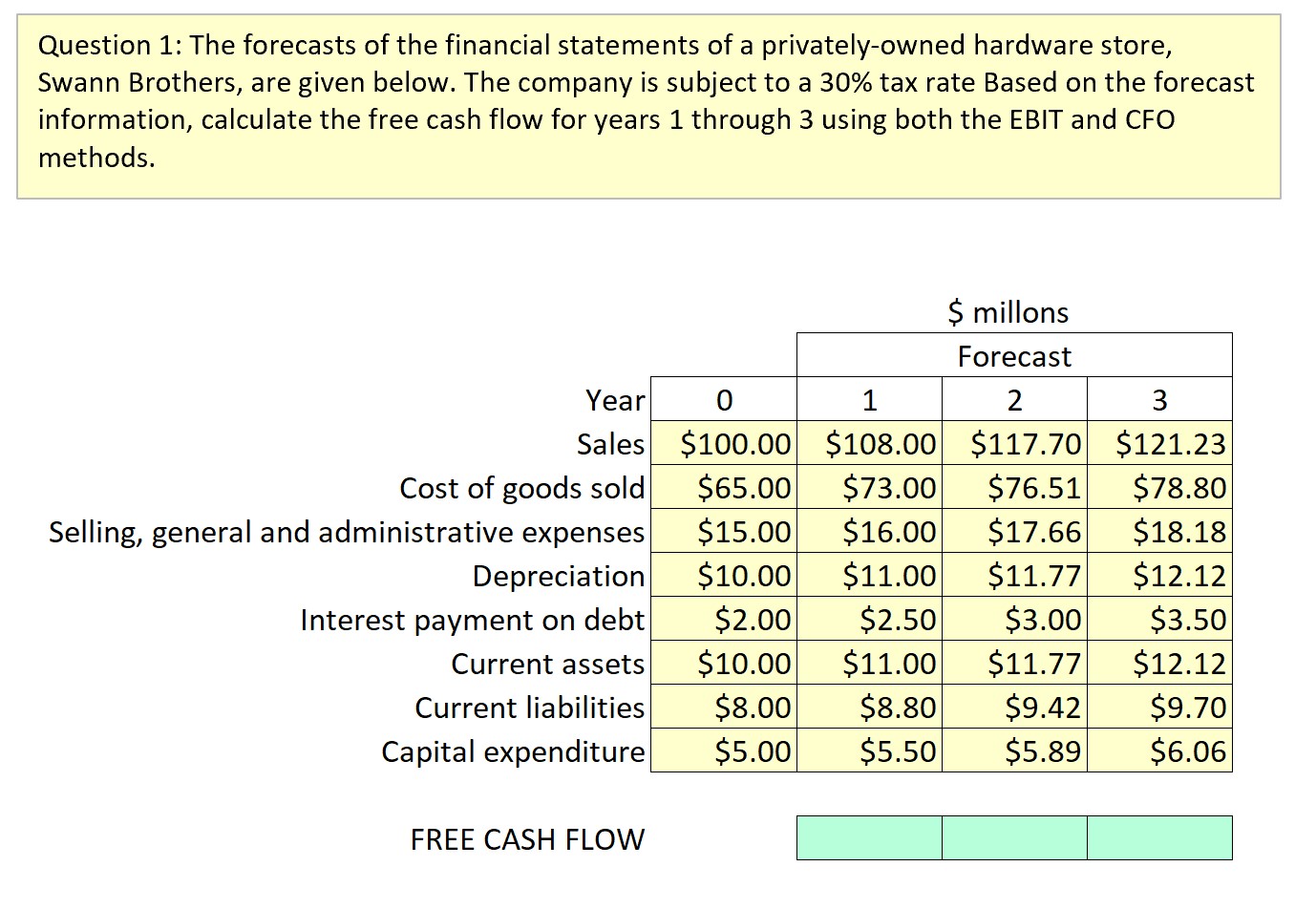

Question 1: The forecasts of the financial statements of a privatelyowned hardware store, Swarm Brothers, are given below. The company is subject to a 30% tax rate Based on the forecast information, calculate the free cash flow for years 1 through 3 using both the EBIT and CFO methods. $ millons Forecast Year 0 1 2 3 Sales $100.00 $108.00 $117.70 $121.23 Cost of goods sold $65.00 $73.00 $76.51 $78.80 Selling, general and administrative expenses $15.00 $16.00 $17.66 $18.18 Depreciation $10.00 $11.00 $11.77 $12.12 Interest payment on debt $2.00 $2.50 $3.00 $3.50 Current assets $10.00 $11.00 $11.77 $12.12 Current liabilities $8.00 $8.80 $9.42 $9.70 Capital expenditure $5.00 $5.50 $5.89 $6.06 FREE CASH FLOW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts