Question: please answer the front & back of the worksheet & show all the work someone has Previously Answered the question but there was no numbers

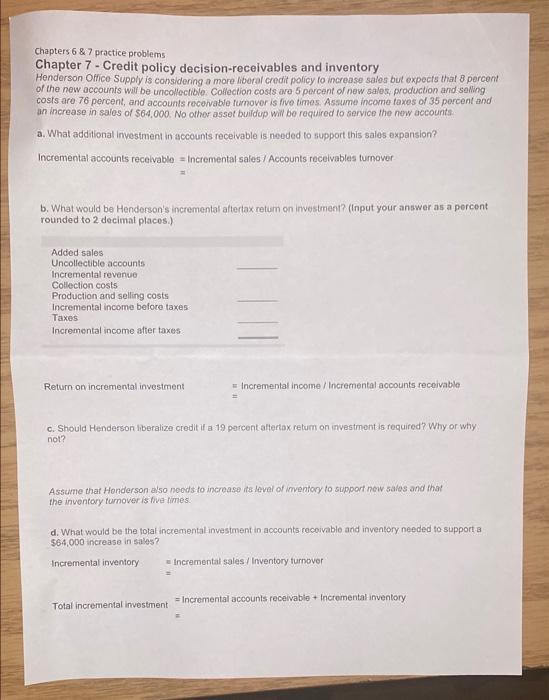

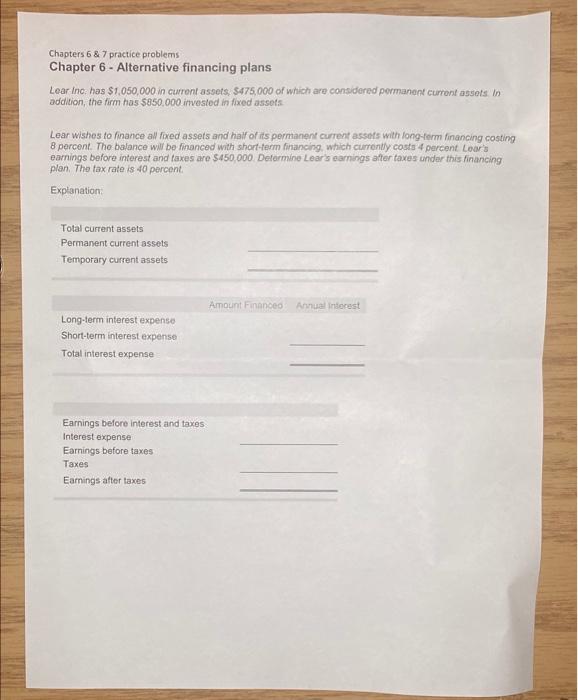

Chapters 6 & 7 practice problems Chapter 7 - Credit policy decision-receivables and inventory Henderson Office Supply is considering a more liberal credit policy to increase sales but expects that 8 percent of the new accounts will be uncollectibles Collection costs are 5 percent of new sales, production and selling costs aro 76 percent, and accounts receivable turnover is five times. Assume income taxes of 35 percent and an increase in sales of $64,000. No other asser buildup will be required to service the new accounts a. What additional Investment in accounts receivable is needed to support this sales expansion? Incremental accounts recevable = Incremental sales / Accounts receivables turnover b. What would be Henderson's incremental aftertax return on investment? (Input your answer as a percent rounded to 2 decimal places.) Added sales Uncollectible accounts Incremental revenue Collection costs Production and selling costs Incremental income before taxes Taxes Incremental income after taxes Return on incremental investment = Incremental income / Incremental accounts receivable c. Should Henderson liberalize credit il a 19 percent aftertax retum on investment is required? Why or why not? Assume that Henderson also needs to increase its level of inventory to support new sales and that the inventory turnover is five times d. What would be the total incremental investment in accounts recoivable and inventory needed to support a 564,000 increase in sales? Incremental inventory Incremental sales / Inventory turnover Total incremental investment = Incremental accounts receivable + Incremental inventory Chapters 6 & 7 practice problems Chapter 6 - Alternative financing plans Lear Inc. has $1,050,000 in current assets. 475,000 of which are considered pormanent current assets. In addition, the firm has $850,000 invested in fixed assets Lear wishes to finance all fixed assets and half of its permanent current assets with long-term financing costing 8 percent. The balance will be financed with short-term financing, which currently costs 4 percent Loans earnings before interest and taxes are $450,000 Determine Lear's earnings after taxes under this financing plan The tax rate is 40 percent Explanation Total current assets Permanent current assets Temporary current assets Amount Finance Annual interest Long-term interest expense Short-term interest expense Total interest expense Earnings before interest and taxes Interest expense Earnings before taxes Taxes Earnings after taxes Chapters 6 & 7 practice problems Chapter 7 - Credit policy decision-receivables and inventory Henderson Office Supply is considering a more liberal credit policy to increase sales but expects that 8 percent of the new accounts will be uncollectibles Collection costs are 5 percent of new sales, production and selling costs aro 76 percent, and accounts receivable turnover is five times. Assume income taxes of 35 percent and an increase in sales of $64,000. No other asser buildup will be required to service the new accounts a. What additional Investment in accounts receivable is needed to support this sales expansion? Incremental accounts recevable = Incremental sales / Accounts receivables turnover b. What would be Henderson's incremental aftertax return on investment? (Input your answer as a percent rounded to 2 decimal places.) Added sales Uncollectible accounts Incremental revenue Collection costs Production and selling costs Incremental income before taxes Taxes Incremental income after taxes Return on incremental investment = Incremental income / Incremental accounts receivable c. Should Henderson liberalize credit il a 19 percent aftertax retum on investment is required? Why or why not? Assume that Henderson also needs to increase its level of inventory to support new sales and that the inventory turnover is five times d. What would be the total incremental investment in accounts recoivable and inventory needed to support a 564,000 increase in sales? Incremental inventory Incremental sales / Inventory turnover Total incremental investment = Incremental accounts receivable + Incremental inventory Chapters 6 & 7 practice problems Chapter 6 - Alternative financing plans Lear Inc. has $1,050,000 in current assets. 475,000 of which are considered pormanent current assets. In addition, the firm has $850,000 invested in fixed assets Lear wishes to finance all fixed assets and half of its permanent current assets with long-term financing costing 8 percent. The balance will be financed with short-term financing, which currently costs 4 percent Loans earnings before interest and taxes are $450,000 Determine Lear's earnings after taxes under this financing plan The tax rate is 40 percent Explanation Total current assets Permanent current assets Temporary current assets Amount Finance Annual interest Long-term interest expense Short-term interest expense Total interest expense Earnings before interest and taxes Interest expense Earnings before taxes Taxes Earnings after taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts