Question: please answer the full question clearly There are two projects. Project Everest has an outliow of cash of $84,000 in years 0 and 1 ,

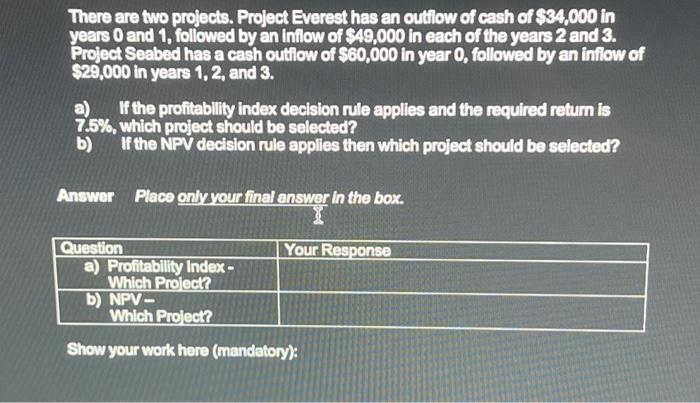

There are two projects. Project Everest has an outliow of cash of $84,000 in years 0 and 1 , followed by an inflow of 49,000 in each of the years 2 and 3 . Project Seabed has a cash outtiow of $60,000 in year 0 , followed by an inflow of $29,000 in years 1,2 , and 3 . a) If the profitablity index decision rule applies and the required retum is 7.5%, which project should be selected? b) If the NPV decision rule applies then which project should be selected? Answer Place onlyyour final answer in the box

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts