Question: please answer the FULL question. thank you. 14% FIFO versus LIFO: Ratio Analysis. Presented below is financial data for two companies that are identical TA

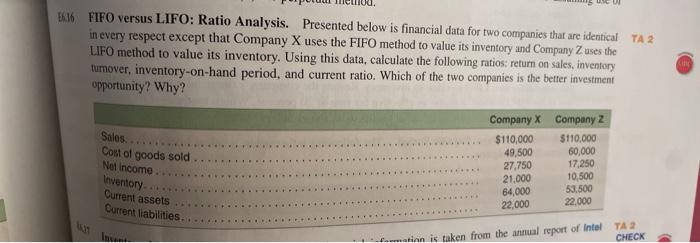

14% FIFO versus LIFO: Ratio Analysis. Presented below is financial data for two companies that are identical TA 2 in every respect except that Company X uses the FIFO method to value its inventory and Company Z uses the LIFO method to value its inventory. Using this data, calculate the following ratios: retum on sales, inventory turnover, inventory-on-hand period, and current ratio. Which of the two companies is the better investment opportunity? Why? Company x Company w z $110,000 $110,000 49,500 60,000 27.750 17,250 21,000 10,500 64,000 53.500 22.000 22.000 Sales Cost of goods sold Ne income Inventory Current assets Current liabilities Inu inn is taken from the annual report of Intel TA 2 CHECK 14% FIFO versus LIFO: Ratio Analysis. Presented below is financial data for two companies that are identical TA 2 in every respect except that Company X uses the FIFO method to value its inventory and Company Z uses the LIFO method to value its inventory. Using this data, calculate the following ratios: retum on sales, inventory turnover, inventory-on-hand period, and current ratio. Which of the two companies is the better investment opportunity? Why? Company x Company w z $110,000 $110,000 49,500 60,000 27.750 17,250 21,000 10,500 64,000 53.500 22.000 22.000 Sales Cost of goods sold Ne income Inventory Current assets Current liabilities Inu inn is taken from the annual report of Intel TA 2 CHECK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts