Question: Please answer the incorrect correctly! Will give like after checking, thanks! Ch 6 Problem Set Date Transaction Jan. 1 Inventory 10 Purchase 28 Sale 30

Please answer the incorrect correctly! Will give like after checking, thanks!

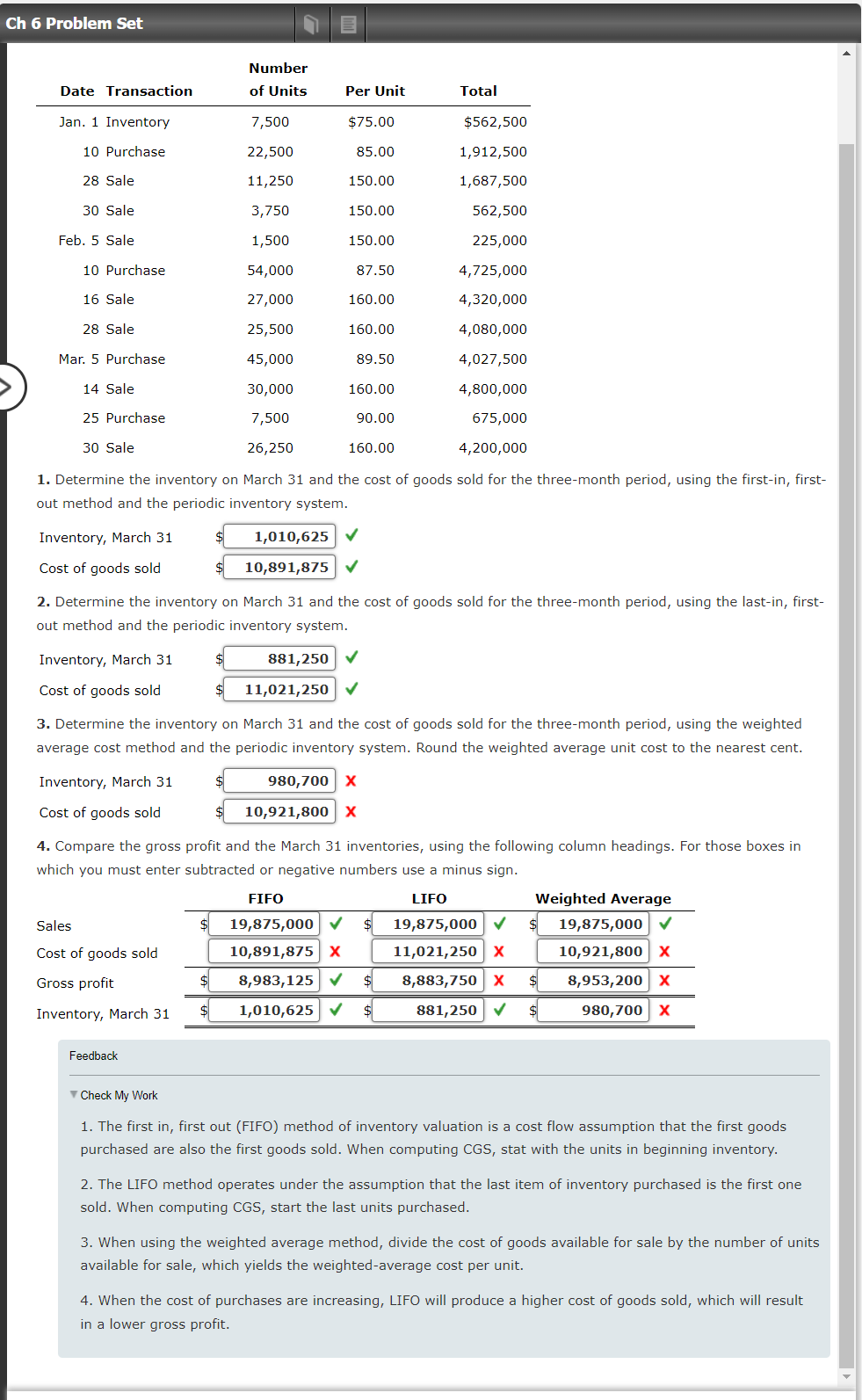

Ch 6 Problem Set Date Transaction Jan. 1 Inventory 10 Purchase 28 Sale 30 Sale Feb. 5 Sale 10 Purchase 16 Sale 28 Sale $562,500 1,912,500 1,687,500 562,500 225,000 4,725,000 4,320,000 4,080,000 4,027,500 4,800,000 675,000 4,200,000 1. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the first-in, first- out method and the periodic inventory system. Mar. 5 Purchase 14 Sale 25 Purchase 30 Sale Inventory, March 31 Cost of goods sold Inventory, March 31 Cost of goods sold Number of Units Sales Cost of goods sold Gross profit Inventory, March 31 Per Unit 7,500 22,500 11,250 3,750 1,500 54,000 27,000 25,500 45,000 30,000 7,500 26,250 Feedback $ $75.00 85.00 150.00 150.00 150.00 87.50 160.00 160.00 89.50 2. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the last-in, first- out method and the periodic inventory system. 160.00 90.00 160.00 1,010,625 10,891,875 881,250 11,021,250 3. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the nearest cent. Inventory, March 31 Cost of goods sold Total 4. Compare the gross profit and the March 31 inventories, using the following column headings. For those boxes in which you must enter subtracted or negative numbers use a minus sign. LIFO 19,875,000 11,021,250 X 8,883,750 X $ 881,250 $ 980,700 X 10,921,800 X FIFO 19,875,000 $ 10,891,875 X 8,983,125 $ 1,010,625 $ Weighted Average 19,875,000 10,921,800 X 8,953,200 X 980,700 X Check My Work 1. The first in, first out (FIFO) method of inventory valuation is a cost flow assumption that the first goods purchased are also the first goods sold. When computing CGS, stat with the units in beginning inventory. 2. The LIFO method operates under the assumption that the last item of inventory purchased is the first one sold. When computing CGS, start the last units purchased. 3. When using the weighted average method, divide the cost of goods available for sale by the number of units available for sale, which yields the weighted-average cost per unit. 4. When the cost of purchases are increasing, LIFO will produce a higher cost of goods sold, which will result in a lower gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts