Question: Please answer the incorrect portion of the question Identifying and Analyzing Financial Statement Effects of Stock-Based Compensation The stockholders' equity of Aspen Corporation at December

Please answer the incorrect portion of the question

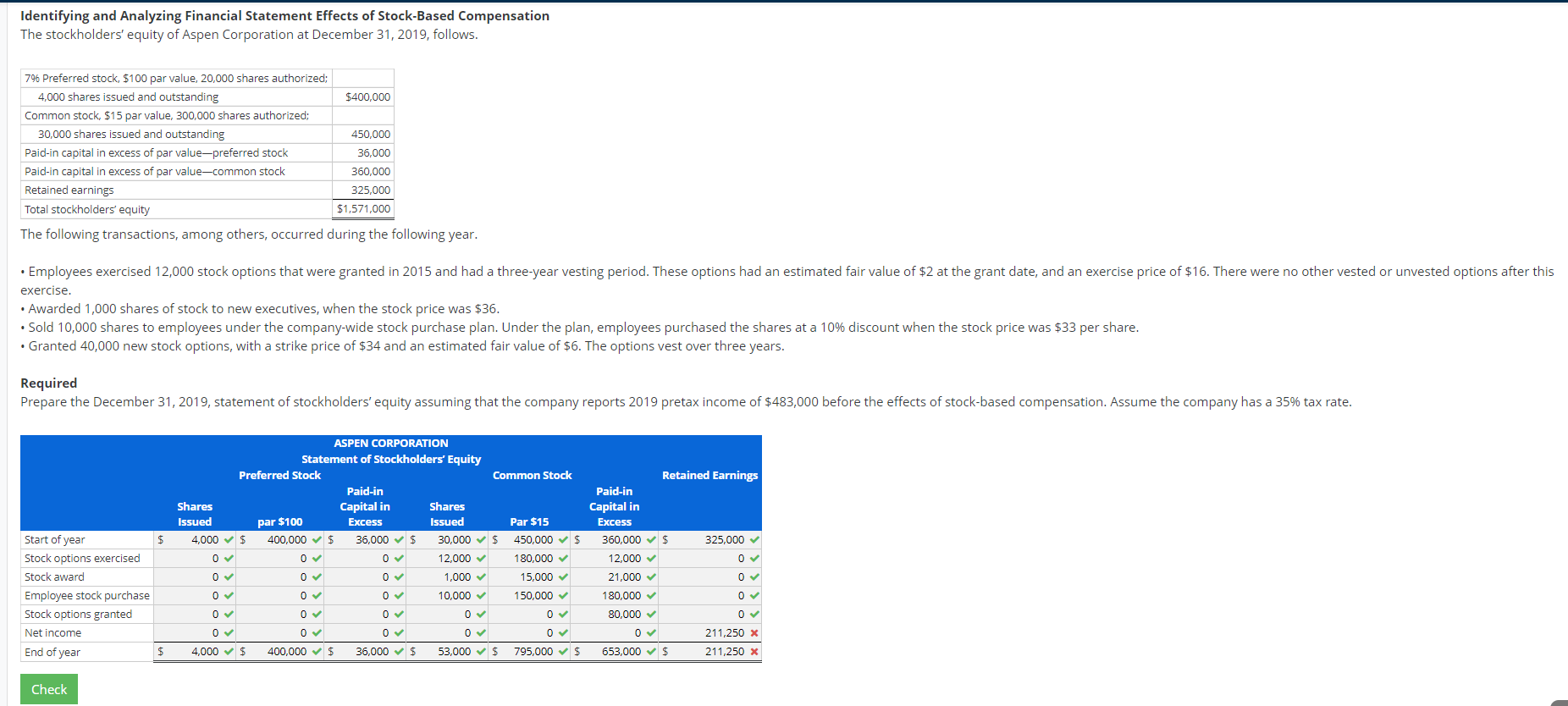

Identifying and Analyzing Financial Statement Effects of Stock-Based Compensation The stockholders' equity of Aspen Corporation at December 31, 2019, follows. $400,000 450,000 796 Preferred stock, $100 par value, 20,000 shares authorized; 4,000 shares issued and outstanding Common stock, $15 par value, 300,000 shares authorized; 30,000 shares issued and outstanding Paid-in capital in excess of par value-preferred stock Paid-in capital in excess of par value-common stock Retained earnings Total stockholders' equity 36,000 360,000 325,000 $1,571,000 The following transactions, among others, occurred during the following year. Employees exercised 12,000 stock options that were granted in 2015 and had a three-year vesting period. These options had an estimated fair value of $2 at the grant date, and an exercise price of $16. There were no other vested or unvested options after this exercise. Awarded 1,000 shares of stock to new executives, when the stock price was $36. Sold 10,000 shares to employees under the company-wide stock purchase plan. Under the plan, employees purchased the shares at a 10% discount when the stock price was $33 per share. . Granted 40,000 new stock options, with a strike price of $34 and an estimated fair value of $6. The options vest over three years. Required Prepare the December 31, 2019, statement of stockholders' equity assuming that the company reports 2019 pretax income of $483,000 before the effects of stock-based compensation. Assume the company has a 35% tax rate. ASPEN CORPORATION Statement of Stockholders' Equity Preferred Stock Common Stock Paid-in Shares Capital in Shares Issued Excess Issued Par $15 4,000 $ 400,000 $ 36,000 $ 30,000 $ 450,000 0 12,000 180,000 0 1,000 15,000 0 10,000 150,000 0 0 0 par $100 $ Start of year Stock options exercised Stock award Employee stock purchase Stock options granted Net income End of year Retained Earnings Paid-in Capital in Excess 360,000 $ 325,000 12,000 21,000 0 180,000 80,000 211,250 x 653,000 $ 211,250 x 0 0 $ 4,000 $ 400,000 $ 36,000 $ 53,000 $ 795,000 $ Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts