Question: Please answer the incorrect responses Described below are certain transactions of Oriole Corporation. The company uses the periodic inventory system. 1. 2. On February 2,

Please answer the incorrect responses

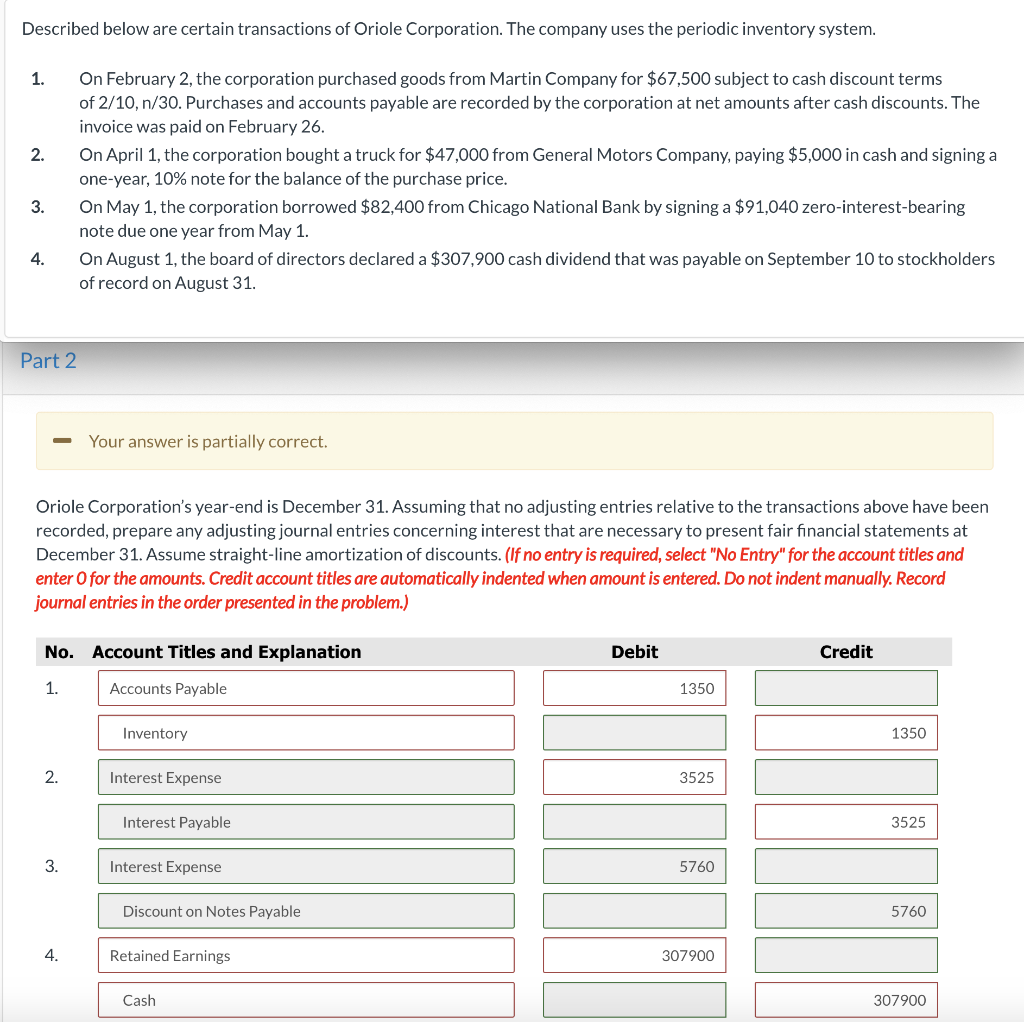

Described below are certain transactions of Oriole Corporation. The company uses the periodic inventory system. 1. 2. On February 2, the corporation purchased goods from Martin Company for $67,500 subject to cash discount terms of 2/10,n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was paid on February 26. On April 1, the corporation bought a truck for $47,000 from General Motors Company, paying $5,000 in cash and signing a one-year, 10% note for the balance of the purchase price. On May 1, the corporation borrowed $82,400 from Chicago National Bank by signing a $91,040 zero-interest-bearing note due one year from May 1. On August 1, the board of directors declared a $307,900 cash dividend that was payable on September 10 to stockholders of record on August 31. 3. 4. Part 2 Your answer is partially correct. Oriole Corporation's year-end is December 31. Assuming that no adjusting entries relative to the transactions above have been recorded, prepare any adjusting journal entries concerning interest that are necessary to present fair financial statements at December 31. Assume straight-line amortization of discounts. (If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) No. Account Titles and Explanation Debit Credit 1. Accounts Payable 1350 Inventory 1350 2. Interest Expense 3525 Interest Payable 3525 3. Interest Expense 5760 Discount on Notes Payable 5760 4. Retained Earnings 307900 Cash 307900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts