Question: please answer the last three question( q3, q4 and q5) 1. Financial ratio by itself tells us little about a company because financial ratios vary

please answer the last three question( q3, q4 and q5)

please answer the last three question( q3, q4 and q5)

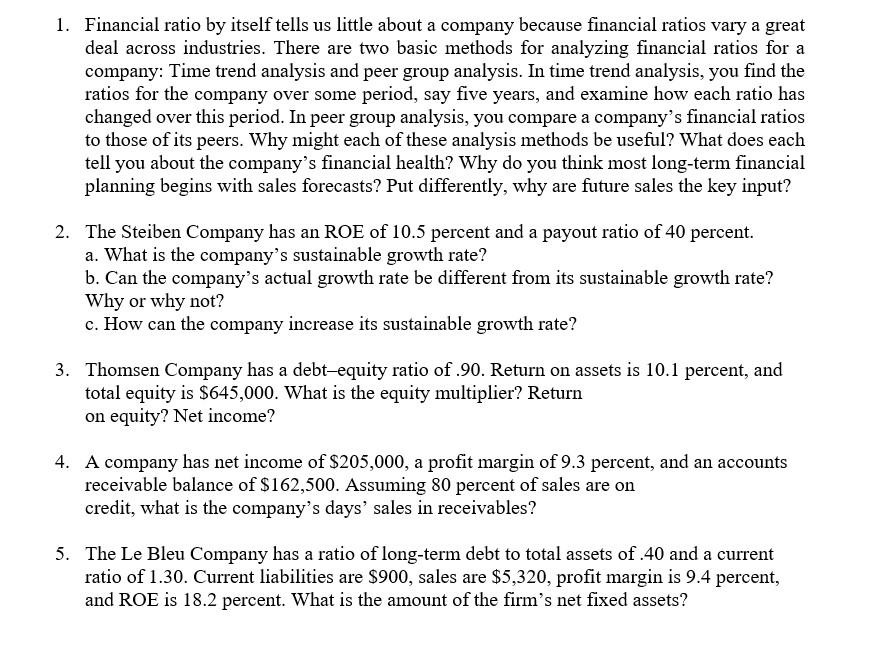

1. Financial ratio by itself tells us little about a company because financial ratios vary a great deal across industries. There are two basic methods for analyzing financial ratios for a company: Time trend analysis and peer group analysis. In time trend analysis, you find the ratios for the company over some period, say five years, and examine how each ratio has changed over this period. In peer group analysis, you compare a company's financial ratios to those of its peers. Why might each of these analysis methods be useful? What does each tell you about the company's financial health? Why do you think most long-term financial planning begins with sales forecasts? Put differently, why are future sales the key input? 2. The Steiben Company has an ROE of 10.5 percent and a payout ratio of 40 percent. a. What is the company's sustainable growth rate? b. Can the company's actual growth rate be different from its sustainable growth rate? Why or why not? c. How can the company increase its sustainable growth rate? 3. Thomsen Company has a debt-equity ratio of .90. Return on assets is 10.1 percent, and total equity is $645,000. What is the equity multiplier? Return on equity? Net income? 4. A company has net income of $205,000, a profit margin of 9.3 percent, and an accounts receivable balance of $162,500. Assuming 80 percent of sales are on credit, what is the company's days' sales in receivables? 5. The Le Bleu Company has a ratio of long-term debt to total assets of 40 and a current ratio of 1.30. Current liabilities are $900, sales are $5,320, profit margin is 9.4 percent, and ROE is 18.2 percent. What is the amount of the firm's net fixed assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts