Question: please answer the math questions as well dropdown options: 1. HO-6/ HO- 8/ HO-4/ HO-1/ HO-3/ HO-2 2. Ho-6/ HO-8/HO-1/HO-2/HO-3/HO-4 3. replacement value/actual cash value

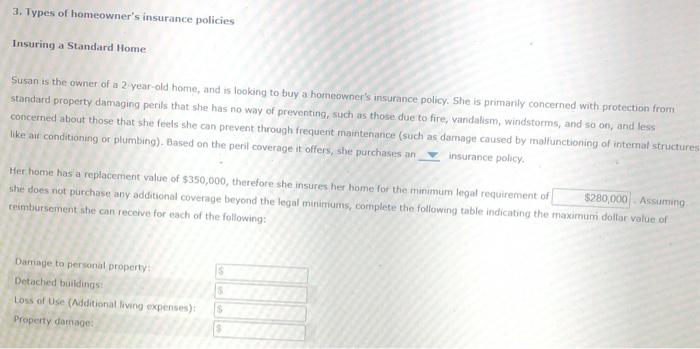

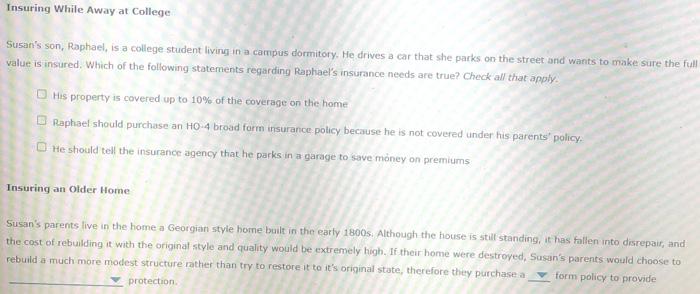

3. Types of homeowner's insurance policies Insuring a Standard Home Susan is the owner of a 2 year old home, and is looking to buy a homeowner's insurance policy. She is primanly concerned with protection from standard property damaging perils that she has no way of preventing, such as those due to fire, vandalism, windstorms, and so on, and less concerned about those that she feels she can prevent through frequent maintenance (such as damage caused by malfunctioning of internal structures like air conditioning or plumbing). Based on the peril coverage it offers, she purchases an insurance policy Her home has a replacement value of $350,000, therefore she insures her home for the minimum legal requirement of $280,000 Assuming she does not purchase any additional coverage beyond the legal minimums, complete the following table indicating the maximum dollar value of reimbursement she can receive for each of the following: Damage to personal property Detached buildings Loss of Use (Additional living expenses): Property damage: Insuring While Away at College Susan's son, Raphael, is a college student living in a campus dormitory. He drives a car that she packs on the street and wants to make sure the full value is insured. Which of the following statements regarding Raphael's insurance needs are true? Check all that apply. His property is covered up to 10% of the coverage on the home Raphael should purchase an H0-4 broad form insurance policy because he is not covered under his parents' policy He should tell the insurance agency that he parks in a garage to save money on premiums Insuring an Older Home Susan's parents live in the home a Georgian style home built in the earty 1800s. Although the house is still standing, it has fallen into disrepair, and the cost of rebuilding it with the original style and quality would be extremely high. If their home were destroyed, Susan's parents would choose to rebuild a much more modest structure rather than try to restore it to it's original state, therefore they purchase a form policy to provide protection 3. Types of homeowner's insurance policies Insuring a Standard Home Susan is the owner of 2-year-old home, and is looking to buy a homeowner's insurance policy. She is primarily concerned with protection from standard property damaging perils that she has no way of preventing, such as those due to hire vandalism, windstorms, and so on, and less Concemed about those that she feels she can prevent through frequent maintenance (such as damage caused by malfunctioning of internal structures tal conditioning or plumbing Based on the perl coverage it offers she purchases an insurance policy Her home is a replacement value of $350,000, therefore she res her home for the minimum tegol cequirement of Assumind she does not purchase any additional coverage beyond the legal minimums, complete the following table indicating the maximum dollar value of reimbursement she can receive for each of the following: Damage to personal property Detached buildings Loss of Use (Additional living expenses) Property dange: Insuring While Away at College Susan's son, Flaphael, is a college student living in a campus dormitory. He drives a car that she parks on the street and wants to make sure the full value is insured. Which of the following statements regarding Raphael's Insurance needs are true? Check all that apply: Mis property is covered up to 10% of the coverage on the home Raphael should purchase an HO-4 broad form insurance policy because he is not covered under his parents' policy He should tell the insurance agency that he packs in a garage to save money on premiums Insuring an Older Home Susan's parents live in the home a Georgian style home built in the early 1800s. Although the house is still standing. It has fallen into disrepair and the cost of rebuilding it with the original style and quality would be extremely high. If the home were destroyed Susan's parents would choose to rebuild a much more modest structure rather than try to restore it to its original state, therefore they purchase a form policy to provide & protection 3. Types of homeowner's insurance policies Insuring a Standard Home Susan is the owner of a 2 year old home, and is looking to buy a homeowner's insurance policy. She is primanly concerned with protection from standard property damaging perils that she has no way of preventing, such as those due to fire, vandalism, windstorms, and so on, and less concerned about those that she feels she can prevent through frequent maintenance (such as damage caused by malfunctioning of internal structures like air conditioning or plumbing). Based on the peril coverage it offers, she purchases an insurance policy Her home has a replacement value of $350,000, therefore she insures her home for the minimum legal requirement of $280,000 Assuming she does not purchase any additional coverage beyond the legal minimums, complete the following table indicating the maximum dollar value of reimbursement she can receive for each of the following: Damage to personal property Detached buildings Loss of Use (Additional living expenses): Property damage: Insuring While Away at College Susan's son, Raphael, is a college student living in a campus dormitory. He drives a car that she packs on the street and wants to make sure the full value is insured. Which of the following statements regarding Raphael's insurance needs are true? Check all that apply. His property is covered up to 10% of the coverage on the home Raphael should purchase an H0-4 broad form insurance policy because he is not covered under his parents' policy He should tell the insurance agency that he parks in a garage to save money on premiums Insuring an Older Home Susan's parents live in the home a Georgian style home built in the earty 1800s. Although the house is still standing, it has fallen into disrepair, and the cost of rebuilding it with the original style and quality would be extremely high. If their home were destroyed, Susan's parents would choose to rebuild a much more modest structure rather than try to restore it to it's original state, therefore they purchase a form policy to provide protection 3. Types of homeowner's insurance policies Insuring a Standard Home Susan is the owner of 2-year-old home, and is looking to buy a homeowner's insurance policy. She is primarily concerned with protection from standard property damaging perils that she has no way of preventing, such as those due to hire vandalism, windstorms, and so on, and less Concemed about those that she feels she can prevent through frequent maintenance (such as damage caused by malfunctioning of internal structures tal conditioning or plumbing Based on the perl coverage it offers she purchases an insurance policy Her home is a replacement value of $350,000, therefore she res her home for the minimum tegol cequirement of Assumind she does not purchase any additional coverage beyond the legal minimums, complete the following table indicating the maximum dollar value of reimbursement she can receive for each of the following: Damage to personal property Detached buildings Loss of Use (Additional living expenses) Property dange: Insuring While Away at College Susan's son, Flaphael, is a college student living in a campus dormitory. He drives a car that she parks on the street and wants to make sure the full value is insured. Which of the following statements regarding Raphael's Insurance needs are true? Check all that apply: Mis property is covered up to 10% of the coverage on the home Raphael should purchase an HO-4 broad form insurance policy because he is not covered under his parents' policy He should tell the insurance agency that he packs in a garage to save money on premiums Insuring an Older Home Susan's parents live in the home a Georgian style home built in the early 1800s. Although the house is still standing. It has fallen into disrepair and the cost of rebuilding it with the original style and quality would be extremely high. If the home were destroyed Susan's parents would choose to rebuild a much more modest structure rather than try to restore it to its original state, therefore they purchase a form policy to provide & protection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts