Question: Please Answer The MCQ's and explain for me how did you answer it Please Its important because i didn't understand Solve it then Explain by

Please Answer The MCQ's and explain for me how did you answer it

Please Its important because i didn't understand

Solve it then Explain by detail

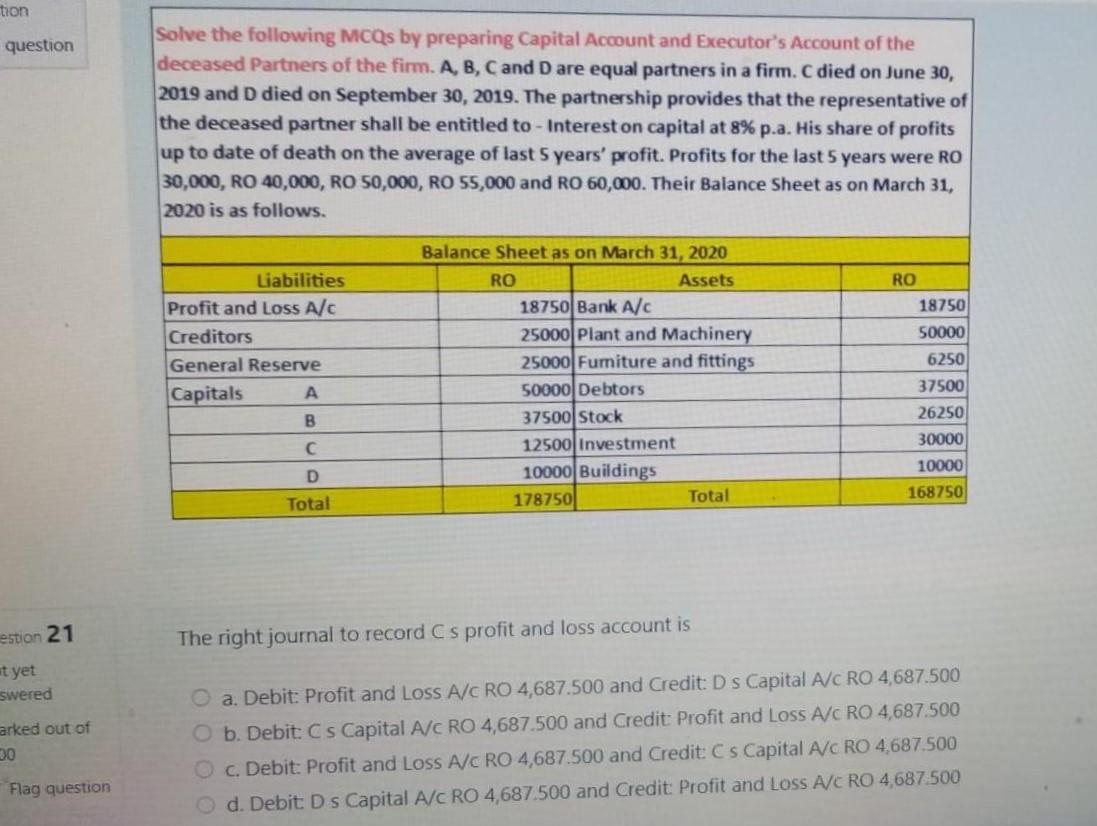

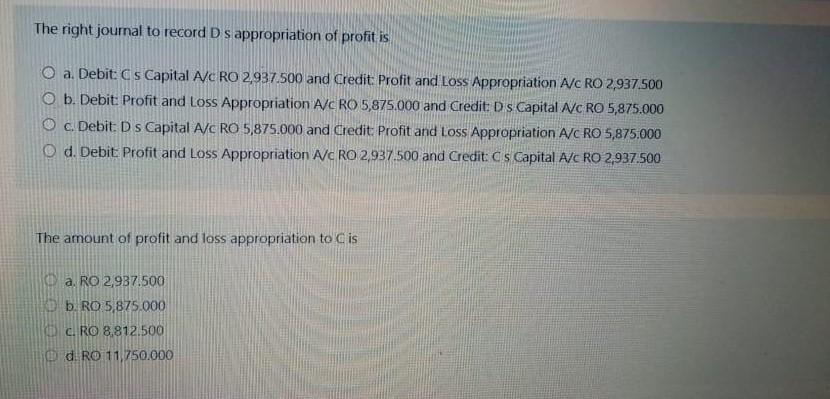

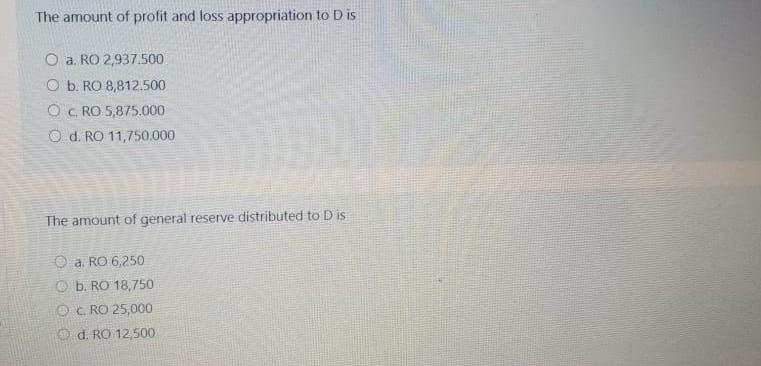

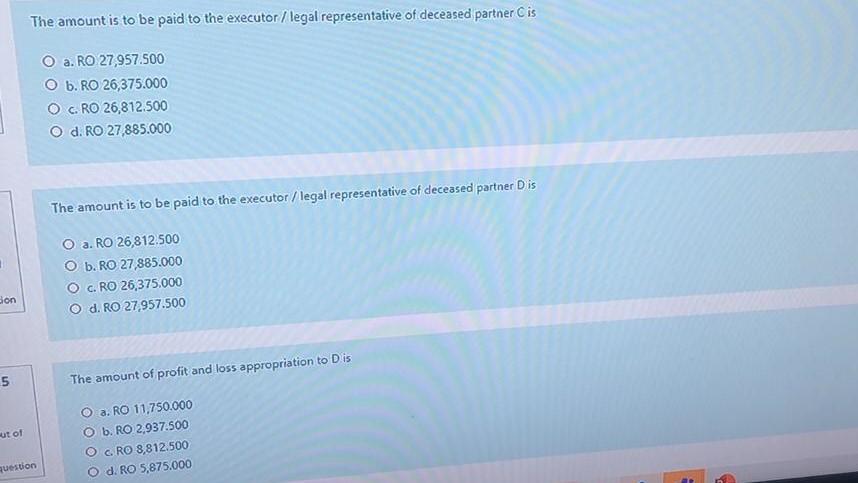

tion question Solve the following MCQs by preparing Capital Account and Executor's Account of the deceased Partners of the firm. A, B, C and D are equal partners in a firm. C died on June 30, 2019 and D died on September 30, 2019. The partnership provides that the representative of the deceased partner shall be entitled to - Interest on capital at 8% p.a. His share of profits up to date of death on the average of last 5 years' profit. Profits for the last 5 years were RO 30,000, RO 40,000, RO 50,000, RO 55,000 and RO 60,000. Their Balance Sheet as on March 31, 2020 is as follows. RO 18750 Liabilities Profit and Loss Alc Creditors General Reserve Capitals A B 50000 6250 Balance Sheet as on March 31, 2020 RO Assets 18750 Bank A/C 25000 Plant and Machinery 25000| Fumiture and fittings 50000 Debtors 37500 Stock 12500 investment 10000 Buildings 178750 Total 37500 26250 30000 10000 168750 D Total estion 21 The right journal to record C s profit and loss account is at yet swered arked out of 30 O a. Debit: Profit and Loss A/C RO 4,687.500 and Credit: Ds Capital A/C RO 4,687.500 b. Debit: Cs Capital A/C RO 4,687.500 and Credit: Profit and Loss A/C RO 4,687.500 C. Debit: Profit and Loss A/C RO 4,687.500 and Credit: Cs Capital A/C RO 4.687.500 d. Debit: D s Capital A/C RO 4,687.500 and Credit: Profit and Loss A/C RO 4,687.500 Flag question The right journal to record D s appropriation of profit is O a. Debit: Cs Capital A/c RO 2,937.500 and Credit Profit and Loss Appropriation A/c RO 2,937.500 O b. Debit: Profit and Loss Appropriation A/c RO 5,875.000 and Credit: Ds Capital NC RO 5,875.000 O c. Debit: D s Capital A/c RO 5,875.000 and Credit: Profit and Loss Appropriation A/C RO 5,875.000 O d. Debit. Profit and Loss Appropriation Ac RO 2, 937.500 and Credit: Cs Capital A/c RO 2,937.500 The amount of profit and loss appropriation to C is @a, RO 2,937.500 b. RO 5,875.000 CRO 8,812.500 d. RO 11,750,000 The amount of profit and loss appropriation to Dis O a. RO 2,937.500 O b. RO 8,812.500 O c RO 5,875.000 O d. RO 11,750.000 The amount of general reserve distributed to Dis a RO 6,250 b. RO 18,750 CRO 25,000 d. RO 12,500 The amount is to be paid to the executor / legal representative of deceased partner is O a. RO 27,957.500 O b.RO 26,375.000 C. RO 26,812.500 O d.RO 27,885.000 The amount is to be paid to the executor / legal representative of deceased partner Dis O a. RO 26,812.500 O b. RO 27,885.000 C. RO 26,375.000 O d.RO 27,957.500 Son 5 The amount of profit and loss appropriation to Dis ut of O a. RO 11,750.000 O b.RO 2,937.500 C. RO 8,812.500 d.RO 5,875.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts