Question: please answer the missing pleaseee ! ELABORATE Budgeting for Your Wheels in Personal Finance A Credit 2, you began the process of making a personal

please answer the missing pleaseee !

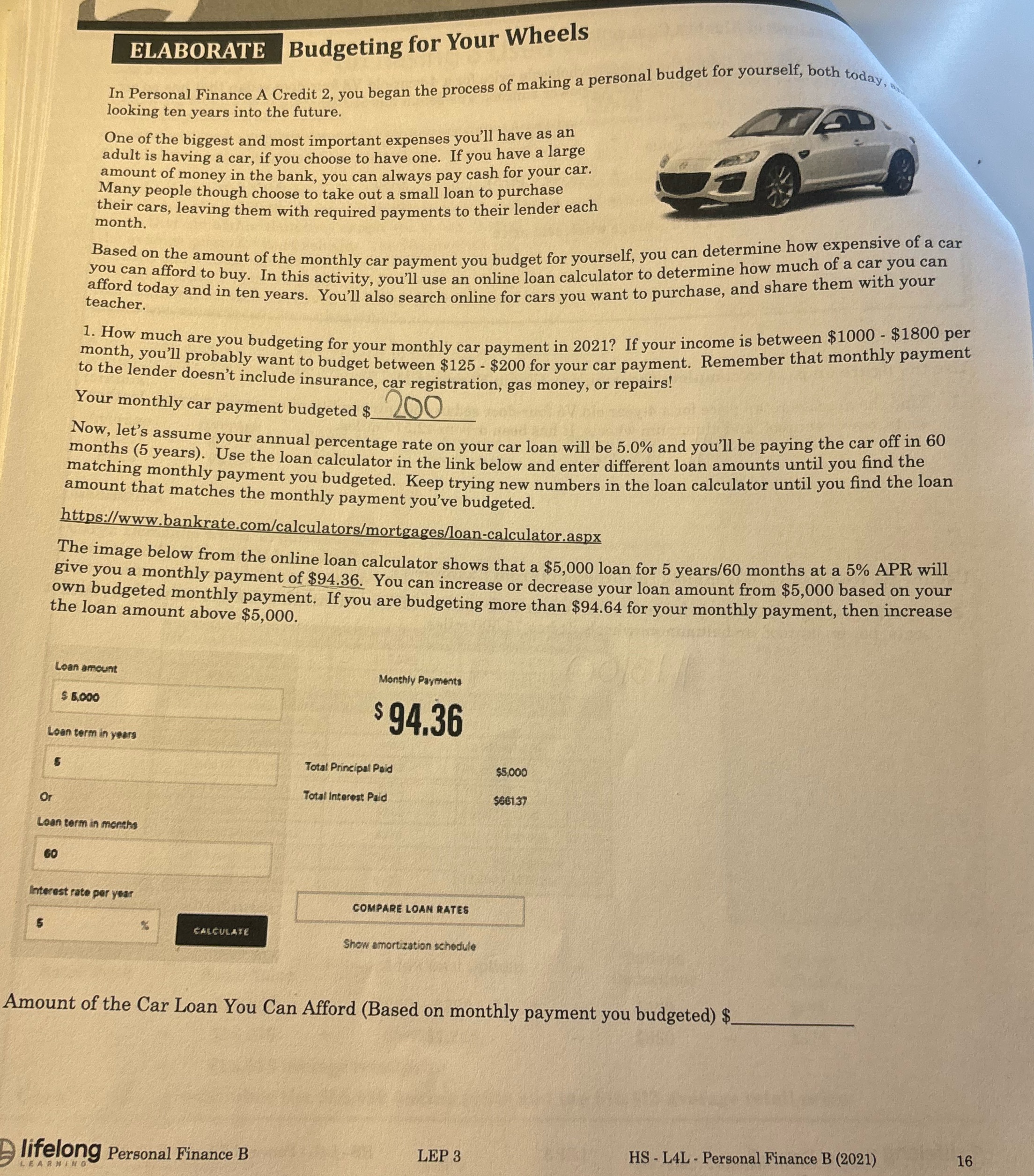

ELABORATE Budgeting for Your Wheels in Personal Finance A Credit 2, you began the process of making a personal budget for yourself, both today. looking ten years into the future. One of the biggest and most important expenses you'll have as an adult is having a car, if you choose to have one. If you have a large amount of money in the bank, you can always pay cash for your car. Many people though choose to take out a small loan to purchase their cars, leaving them with required payments to their lender each month. Based on the amount of the monthly car payment you budget for yourself, you can determine how expensive of a car you can afford to buy. In this activity, you'll use an online loan calculator to determine how much of a car you can afford today and in ten years. You'll also search online for cars you want to purchase, and share them with your teacher. 1. How much are you budgeting for your monthly car payment in 2021? If your income is between $1000 - $1800 per month, you'll probably want to budget between $125 - $200 for your car payment. Remember that monthly payment to the lender doesn't include insurance, car registration, gas money, or repairs! Your monthly car payment budgeted $_ 200 Now, let's assume your annual percentage rate on your car loan will be 5.0% and you'll be paying the car off in 60 months (5 years). Use the loan calculator in the link below and enter different loan amounts until you find the matching monthly payment you budgeted. Keep trying new numbers in the loan calculator until you find the loan amount that matches the monthly payment you've budgeted. https://www.bankrate.com/calculators/mortgages/loan-calculator.aspx The image below from the online loan calculator shows that a $5,000 loan for 5 years/60 months at a 5% APR will give you a monthly payment of $94.36. You can increase or decrease your loan amount from $5,000 based on your own budgeted monthly payment. If you are budgeting more than $94.64 for your monthly payment, then increase the loan amount above $5,000. Loan amount Monthly Payments $ 5,000 $ 94.36 Loan term in years Total Principal Paid $5,000 Or Total Interest Paid $661 37 Loan term in merit Interest rate per year COMPARE LOAN RATES CALCULATE Show amortization schedule Amount of the Car Loan You Can Afford (Based on monthly payment you budgeted) $. lifelong Personal Finance B LEP 3 HS - LAL - Personal Finance B (2021) 16 LEARNING

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts