Question: Please answer the multiple choice questions 20, 21. If it's possible 22 as well, thanks. Please answer the questions 20 and 21 by using the

Please answer the multiple choice questions 20, 21. If it's possible 22 as well, thanks.

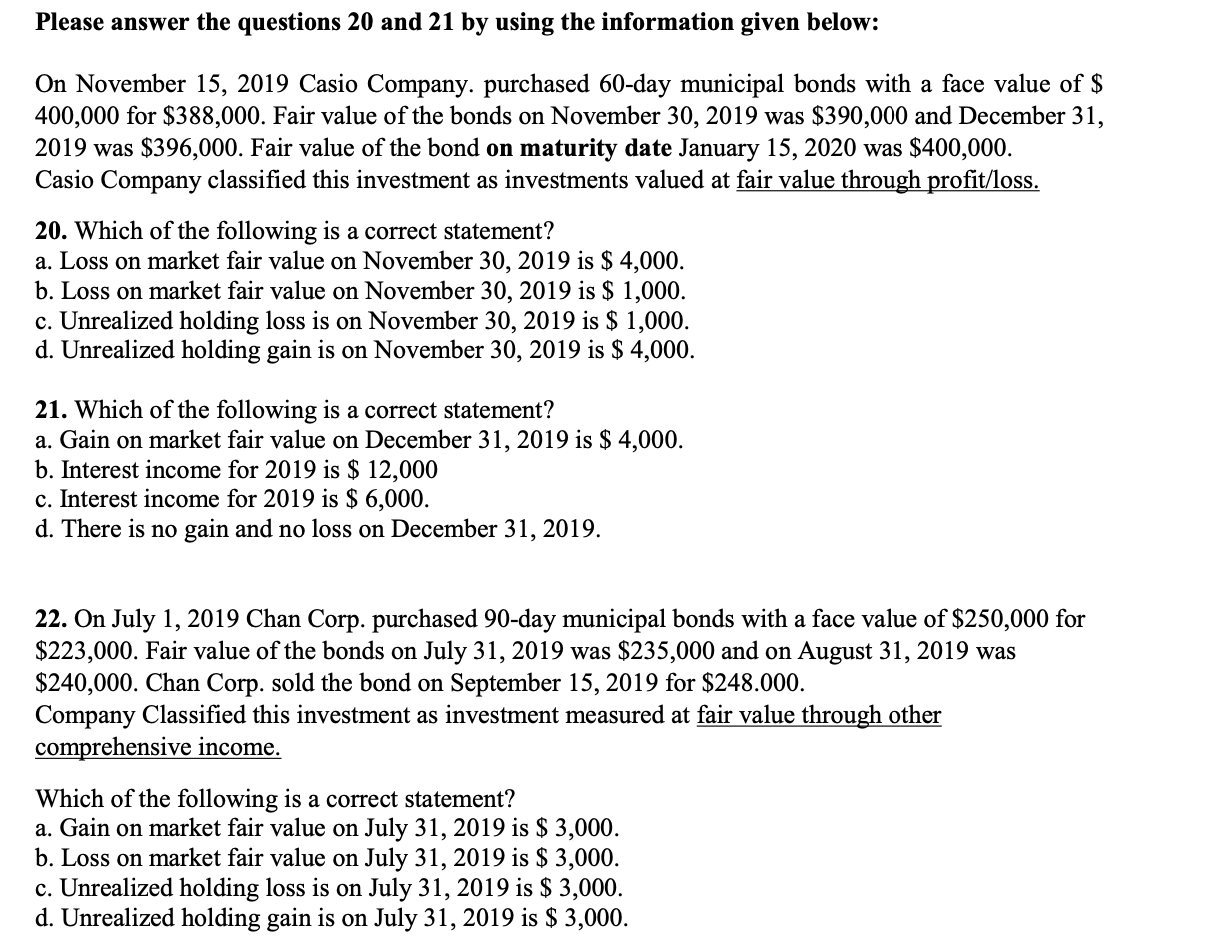

Please answer the questions 20 and 21 by using the information given below: On November 15, 2019 Casio Company. purchased 60-day municipal bonds with a face value of $ 400,000 for $388,000. Fair value of the bonds on November 30, 2019 was $390,000 and December 31, 2019 was $396,000. Fair value of the bond on maturity date January 15, 2020 was $400,000. Casio Company classified this investment as investments valued at fair value through profit/loss. 20. Which of the following is a correct statement? a. Loss on market fair value on November 30, 2019 is $ 4,000. b. Loss on market fair value on November 30, 2019 is $ 1,000. c. Unrealized holding loss is on November 30, 2019 is $ 1,000. d. Unrealized holding gain is on November 30, 2019 is $ 4,000. 21. Which of the following is a correct statement? a. Gain on market fair value on December 31, 2019 is $ 4,000. b. Interest income for 2019 is $ 12,000 c. Interest income for 2019 is $ 6,000. d. There is no gain and no loss on December 31, 2019. 22. On July 1, 2019 Chan Corp. purchased 90-day municipal bonds with a face value of $250,000 for $223,000. Fair value of the bonds on July 31, 2019 was $235,000 and on August 31, 2019 was $240,000. Chan Corp. sold the bond on September 15, 2019 for $248.000. Company Classified this investment as investment measured at fair value through other comprehensive income. Which of the following is a correct statement? a. Gain on market fair value on July 31, 2019 is $ 3,000. b. Loss on market fair value on July 31, 2019 is $ 3,000. c. Unrealized holding loss is on July 31, 2019 is $ 3,000. d. Unrealized holding gain is on July 31, 2019 is $ 3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts