Question: Please answer the multiple choice questions. Provide an explanation if possible. Thank you! 1) Which type of contracts are exchange-traded in the U.S.? A. Forward

Please answer the multiple choice questions. Provide an explanation if possible. Thank you!

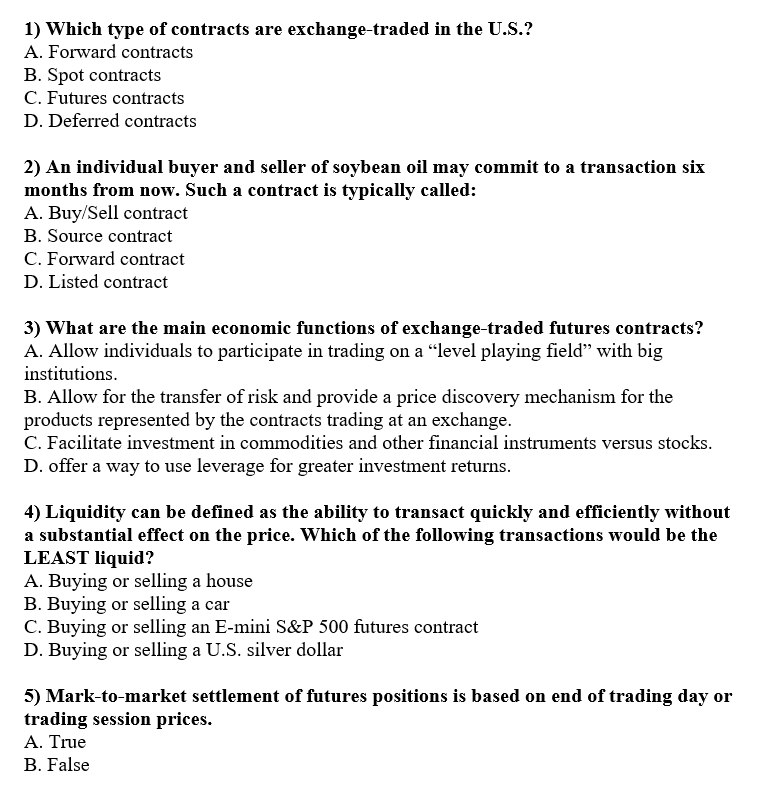

1) Which type of contracts are exchange-traded in the U.S.? A. Forward contracts B. Spot contracts C. Futures contracts D. Deferred contracts 2) An individual buyer and seller of soybean oil may commit to a transaction six months from now. Such a contract is typically called: A. Buy/Sell contract B. Source contract C. Forward contract D. Listed contract 3) What are the main economic functions of exchange-traded futures contracts? A. Allow individuals to participate in trading on a level playing field with big institutions. B. Allow for the transfer of risk and provide a price discovery mechanism for the products represented by the contracts trading at an exchange. C. Facilitate investment in commodities and other financial instruments versus stocks. D. offer a way to use leverage for greater investment returns. 4) Liquidity can be defined as the ability to transact quickly and efficiently without a substantial effect on the price. Which of the following transactions would be the LEAST liquid? A. Buying or selling a house B. Buying or selling a car C. Buying or selling an E-mini S&P 500 futures contract D. Buying or selling a U.S. silver dollar 5) Mark-to-market settlement of futures positions is based on end of trading day or trading session prices. A. True B. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts