Question: Please answer the multiple choices given below 18, 19, 20, 21, 22 Please answer the questions 18 and 19 bu using the information given below:

Please answer the multiple choices given below 18, 19, 20, 21, 22

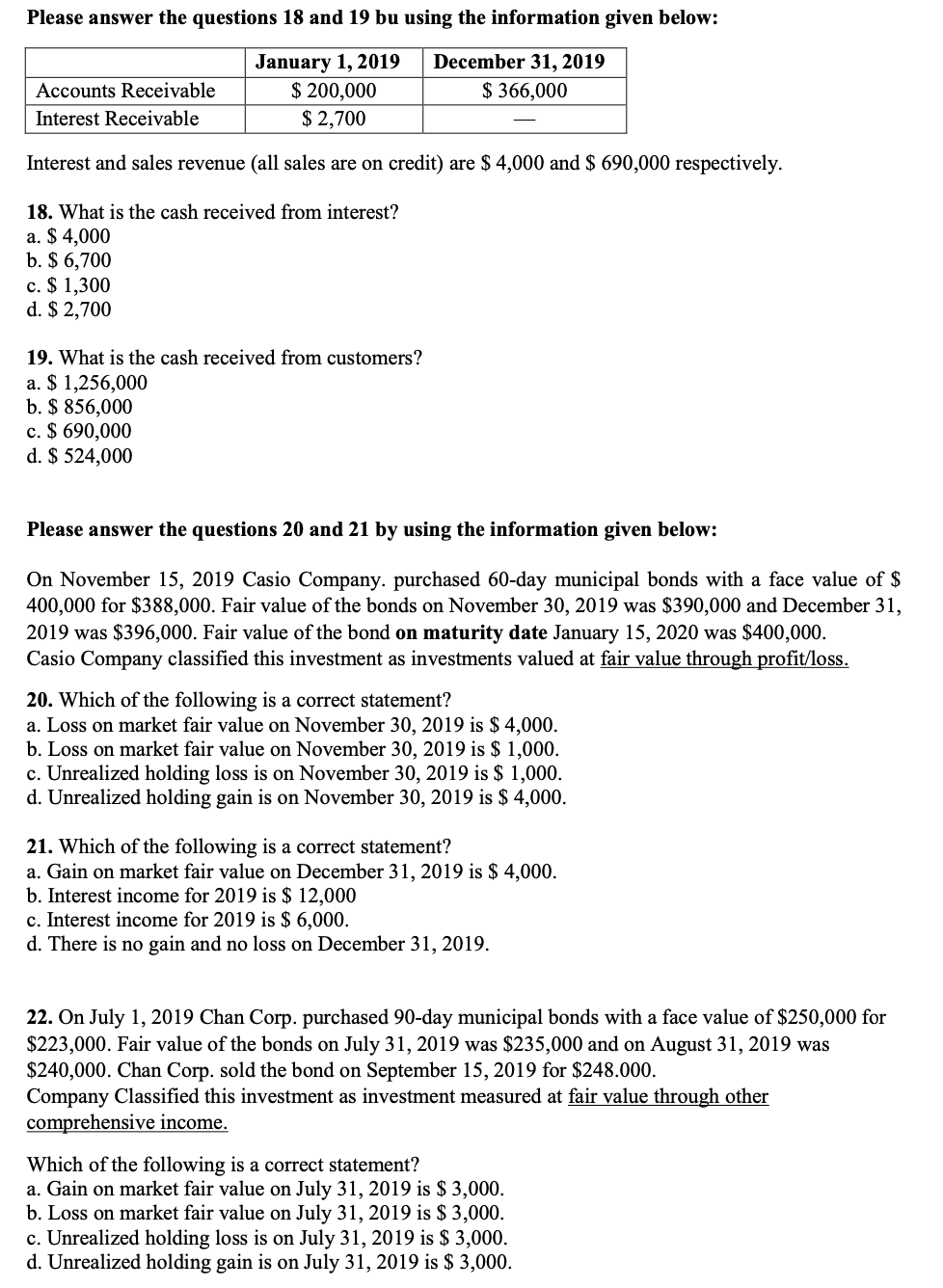

Please answer the questions 18 and 19 bu using the information given below: January 1, 2019 $ 200,000 $ 2,700 December 31, 2019 $ 366,000 Accounts Receivable Interest Receivable Interest and sales revenue (all sales are on credit) are $ 4,000 and $ 690,000 respectively. 18. What is the cash received from interest? a. $ 4,000 b. $ 6,700 c. $ 1,300 d. $ 2,700 19. What is the cash received from customers? a. $ 1,256,000 b. $ 856,000 c. $ 690,000 d. $ 524,000 Please answer the questions 20 and 21 by using the information given below: On November 15, 2019 Casio Company. purchased 60-day municipal bonds with a face value of $ 400,000 for $388,000. Fair value of the bonds on November 30, 2019 was $390,000 and December 31, 2019 was $396,000. Fair value of the bond on maturity date January 15, 2020 was $400,000. Casio Company classified this investment as investments valued at fair value through profit/loss. 20. Which of the following is a correct statement? a. Loss on market fair value on November 30, 2019 is $ 4,000. b. Loss on market fair value on November 30, 2019 is $ 1,000. c. Unrealized holding loss is on November 30, 2019 is $ 1,000. d. Unrealized holding gain is on November 30, 2019 is $ 4,000. 21. Which of the following is a correct statement? a. Gain on market fair value on December 31, 2019 is $ 4,000. b. Interest income for 2019 is $ 12,000 c. Interest income for 2019 is $ 6,000. d. There is no gain and no loss on December 31, 2019. 22. On July 1, 2019 Chan Corp. purchased 90-day municipal bonds with a face value of $250,000 for $223,000. Fair value of the bonds on July 31, 2019 was $235,000 and on August 31, 2019 was $240,000. Chan Corp. sold the bond on September 15, 2019 for $248.000. Company Classified this investment as investment measured at fair value through other comprehensive income. Which of the following is a correct statement? a. Gain on market fair value on July 31, 2019 is $ 3,000. b. Loss on market fair value on July 31, 2019 is $3,000. c. Unrealized holding loss is on July 31, 2019 is $3,000. d. Unrealized holding gain is on July 31, 2019 is $ 3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts