Question: Please answer the quantitative problem. Show your work, thanks! 4. 4: Multinational Financial Management International Capital Budgeting Although the same basic principles of capital budgeting

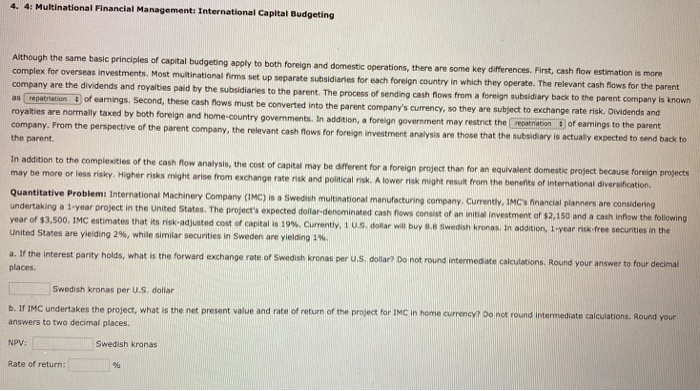

4. 4: Multinational Financial Management International Capital Budgeting Although the same basic principles of capital budgeting apply to both foreign and domestic operations, there are some key differences. First, cash flow estimation is more complex for overseas investments. Most multinational firms set up separate subsidiaries for each foreign country in which they operate. The relevant cash flows for the parent company are the dividends and royalties paid by the subsidiaries to the parent. The process of sending cash flows from a foreign subsidiary back to the parent company is known as repatriation of earnings. Second, these cash flows must be converted into the parent company's currency, so they are subject to exchange rate risk. Dividends and royalties are normally taxed by both foreign and home-country governments. In addition, a foreign government may restrict the reparation of earnings to the parent company. From the perspective of the parent company, the relevant cash flows for foreign investment analysis are those that the subsidiary is actually expected to send back to the parent In addition to the complexities of the cash flow analysis, the cost of capital may be different for a foreign project than for an equivalent domestic project because foreign projects may be more or less risky. Higher risks might arise from exchange rate risk and political risk. A lower risk might result from the benefits of international diversification Quantitative Problemi International Machinery Company (IMC) is a Swedish multinational manufacturing company. Currently, IMC's financial planners are considering undertaking a 1-year project in the United States. The project's expected dollar denominated cash flows consist of an initial investment of $2,150 and a cash inflow the following year of $3,500. IMC estimates that its risk-adjusted cost of capital is 19%. Currently, 1 US dollar will buy 8. Swedish Kronas. In addition, 1-year risk-free securities in the United States are yielding 2%, while similar securities in Sweden are yielding 1%. a. If the interest parity holds, what is the forward exchange rate of Swedish kronas per US dollar? Do not round intermediate calculations. Round your answer to four decimal places Swedish Kronas per U.S. dollar b. If IMC undertakes the project, what is the net present value and rate of return of the project for IMC in home currency? Do not round intermediate calculations. Round your answers to two decimal places NPV: Swedish Kronas Rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts