Question: Please answer the quesion and note that this is a question from a new edition. thank you LO2, 3 15:38 Analysis and Interpretation of Return

Please answer the quesion and note that this is a question from a new edition. thank you

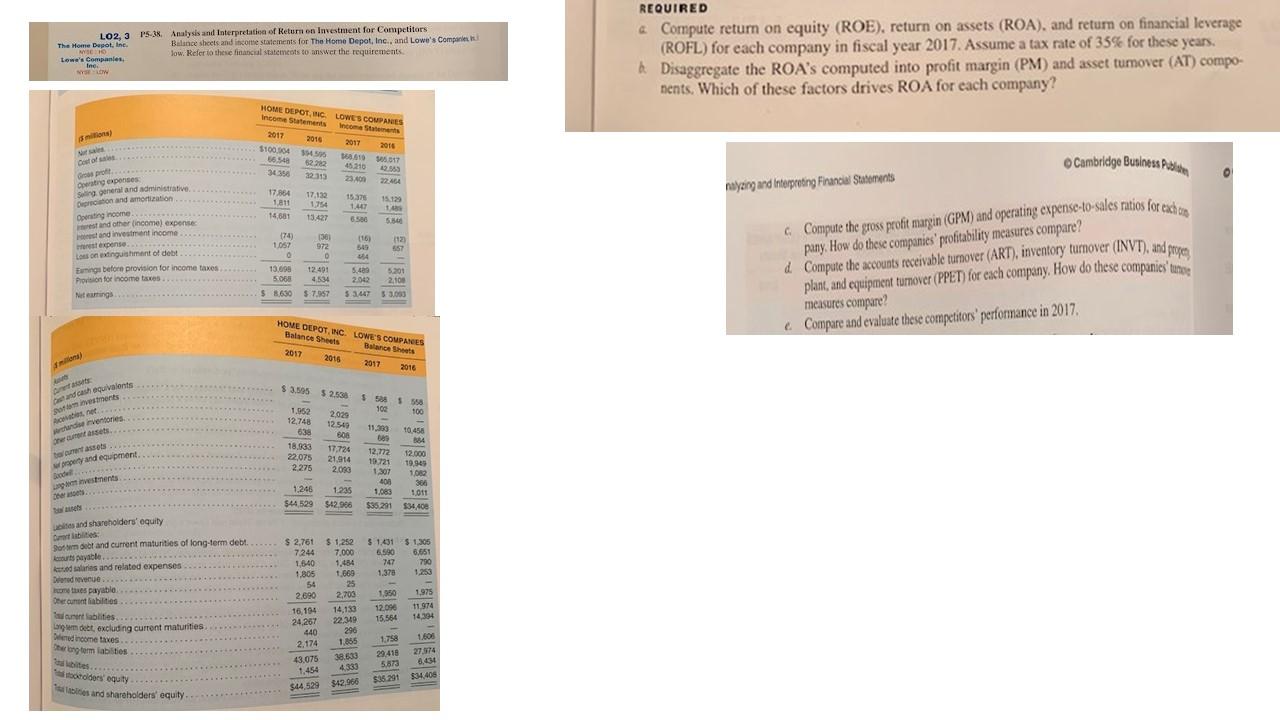

LO2, 3 15:38 Analysis and Interpretation of Return on Investment for Competitors The Home Depot, Inc. Balance sheets and income statements for The Home Depot, Inc., and Lowe's Component NIE TO low. Refer to these financial statements to answer the requirements Lowe's Companies Ine. w REQUIRED Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for each company in fiscal year 2017. Assume a tax rate of 35% for these years. & Disaggregate the ROA's computed into profit margin (PM) and asset turnover (AT) compo- nents. Which of these factors drives ROA for each company? ins) HOME DEPOT, INCLOWES COMPANIES Income Statements 2017 2016 2017 2016 $100.504 15 8.617 56.54 5229 45210 34 35 32319 23.400 22464 Caso Gospol Cambridge Business Publisher O nalyzing and interpreting Financial Statements 15.129 17.864 1811 14,681 17,130 1.754 13.427 15 15378 1.447 6.566 5.54 er expenses Sang general and administrative Dion and amortization Opening income and other income) expense and investment income este expense...... Loson extinguishment of debt Ewing before provision for income taxes Provision for income taxes Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each 361 972 74) 1057 o 13.000 5068 12.491 4534 116 112 549 57 14 5.40 5291 2042 2,100 $ 3,447 3.000 pany. How do these companies' profitability measures compare? d. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and pres plant, and equipment turnover (PPET) for each company. How do these companies' measures compare? Compare and evaluate these competitors' performance in 2017, Neringe $ 8630 $ 7.357 HOME DEPOT INCLOWES COMPARES Balance Sheets Balance Sheets 2017 2016 2017 2016 min) $ 3.505 $2.538 $ 588 558 100 100 Os and cash equivalents of investments One di ventones set 11,333 1.952 12.748 638 18.333 22,075 2.275 2029 12549 800 17,724 21.914 2.000 Der er assets . wety and equipment, 10.458 384 12.000 19.99 1082 366 1.011 $34.400 12,772 19.721 1307 408 1.089 $35291 estinents 1.246 $44529 1.22 $42.966 ise and shareholders' equity $ 1.431 $ 1,305 6.590 6,651 747 790 1.378 1253 Son debt and current maturities of long-term debt. curts payable............ ked sales and related expenses Dend venues. con tus payable Obeculabilities Sunt abilities germett, excluding current maturities Denne income taxes Sherlong term labilities $ 2,761 $ 1.252 7244 7.000 1,640 1.454 1.805 1.669 54 25 2.690 2,700 16.194 14,139 24 257 22,349 440 290 2.174 1.855 43.075 38 69 1.454 4333 $44 520 $42986 1.950 12.00 15.554 1.975 11 974 14394 1.758 29 418 5873 $15.291 1.606 27574 6.834 $3408 doo olders equity a labies and shareholders equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts