Question: Please answer the questins 2 and 3. A and B form the AB partnership. According to the agreement, A contributed $40.000 in cash while B

Please answer the questins 2 and 3.

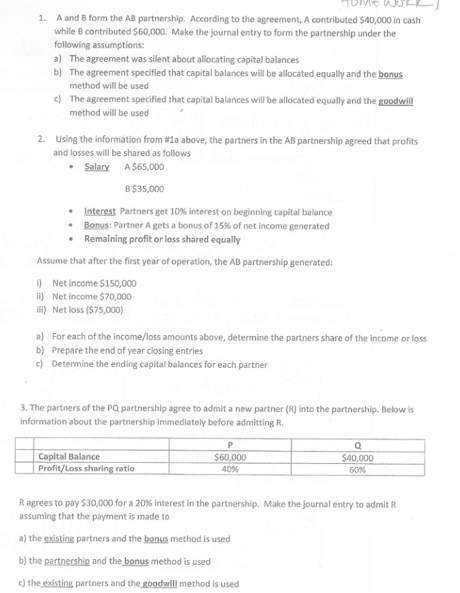

A and B form the AB partnership. According to the agreement, A contributed $40.000 in cash while B contributed $60,000. Make the journal entry to form the partnership under the following assumptions: a) The agreement was silent about allocating capital balances b) The agreement specified that capital balances will be allocated equally and the bonus method win be used c) The agreement specified that capital balances will be allocated equally and the goodwill method will be used Using the information from # 1a above, the partners in the AB partnership agreed that profits and losses will be shared as follows Salary A $65.000 B $35.000 Interest Partners get 10% interest on beginning capital balance Bonus: Partner A gets a bonus of 15% of net income generated Remaining profit or loss shared equally Assume that after the first year of operation, the AB partnership generated: i) Net income $150,000 ii) Net income $70,000 iii) Net loss ($75,000) a) For each of the income/loss amounts above, determine the partners share of the income or loss b) Prepare the end of year closing entries c) Determine the ending capital balances for each partner 3. The partners of the PQ partnership agree to admit a new partner (R) into the partnership. Below information about the partnership immediately before admitting R. R agrees to pay $30,000 for a 20% Interest in the partnership. Make the journal entry to admit R assuming that the payment is made to a) the existing partners and the bonus method Is used b) the partnership and the bonus method is used c) the existing partners and the goodwill method is used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts