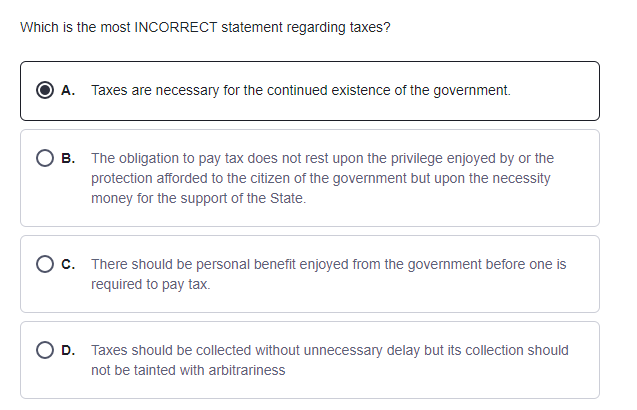

Question: Please answer the question. 1. Which is the most INCORRECT statement regarding taxes? O A. Taxes are necessary for the continued existence of the government.

Please answer the question.

1.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock