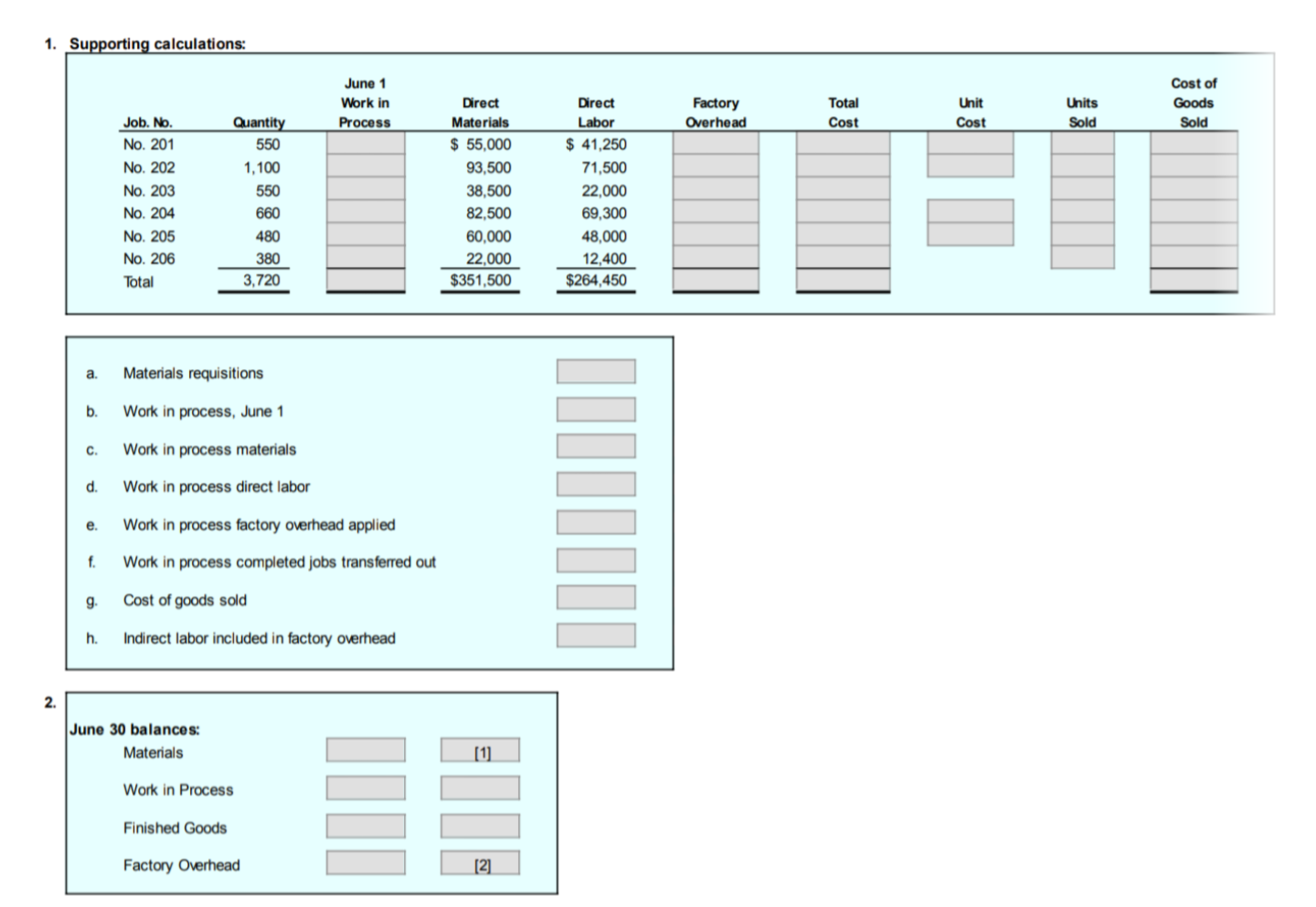

Question: Please answer the question 16-4A 1. Supporting calculations: PR 16-4A Analyzing manufacturing cost accounts Obj. 2 Fire Rock Company manufactures designer paddle boards in a

Please answer the question 16-4A

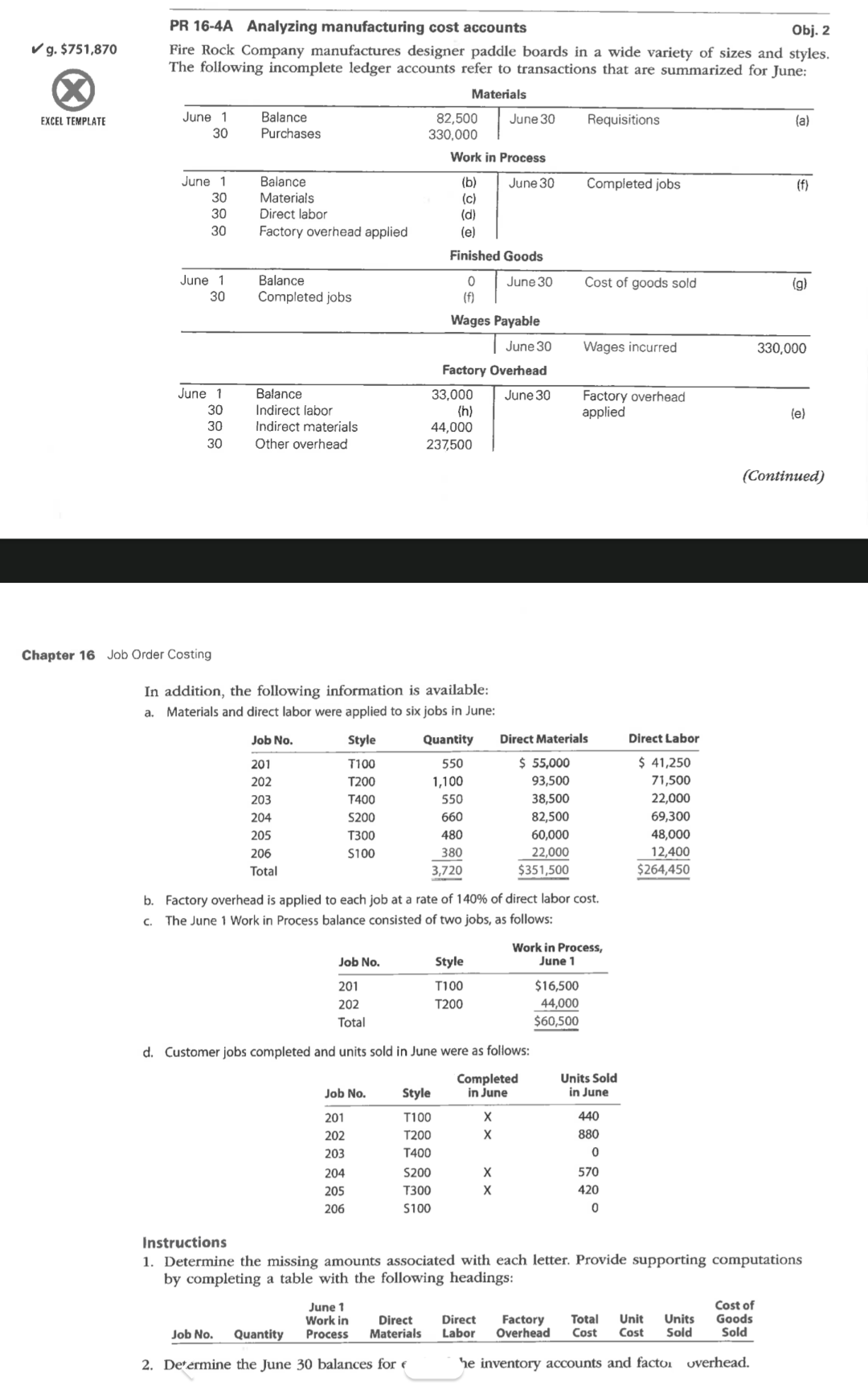

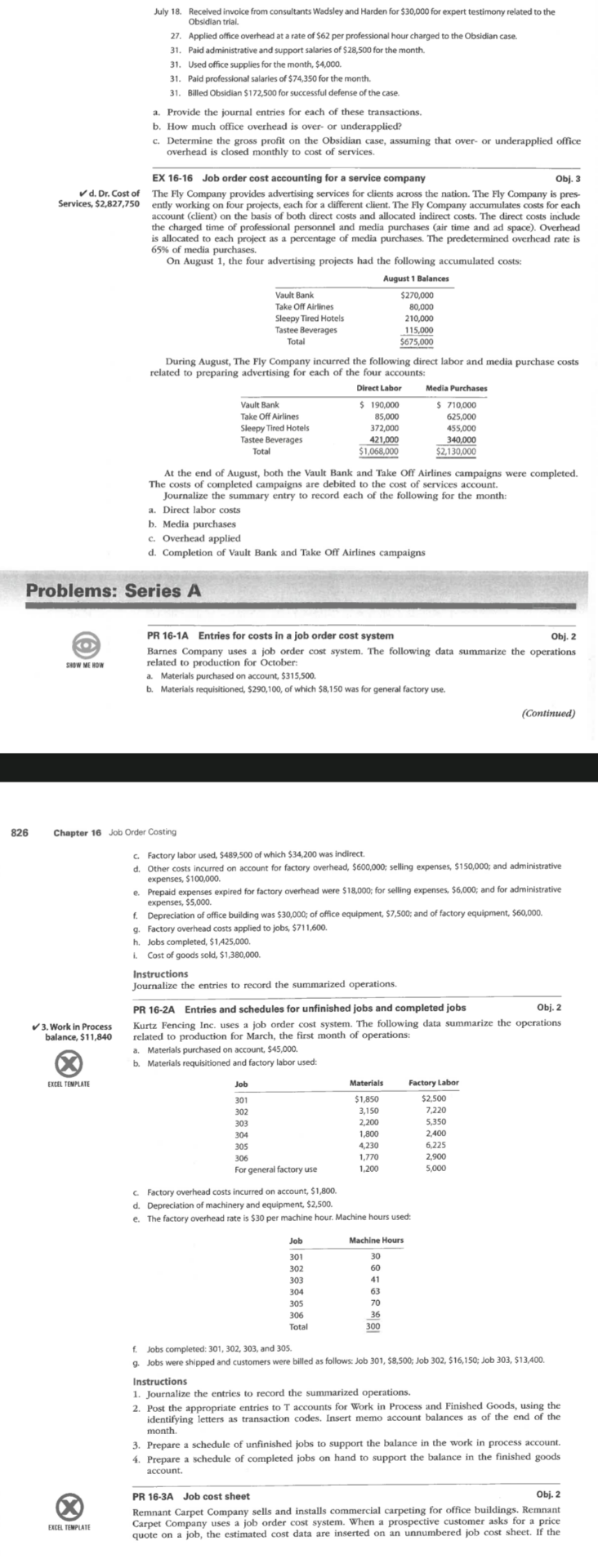

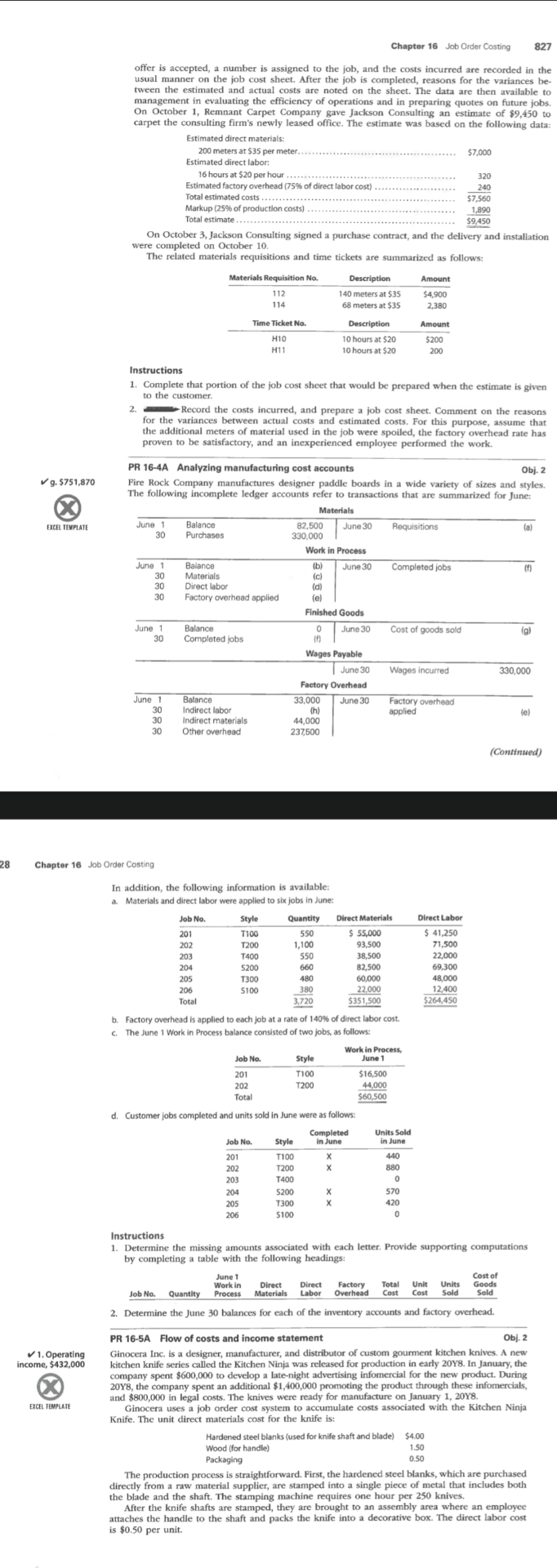

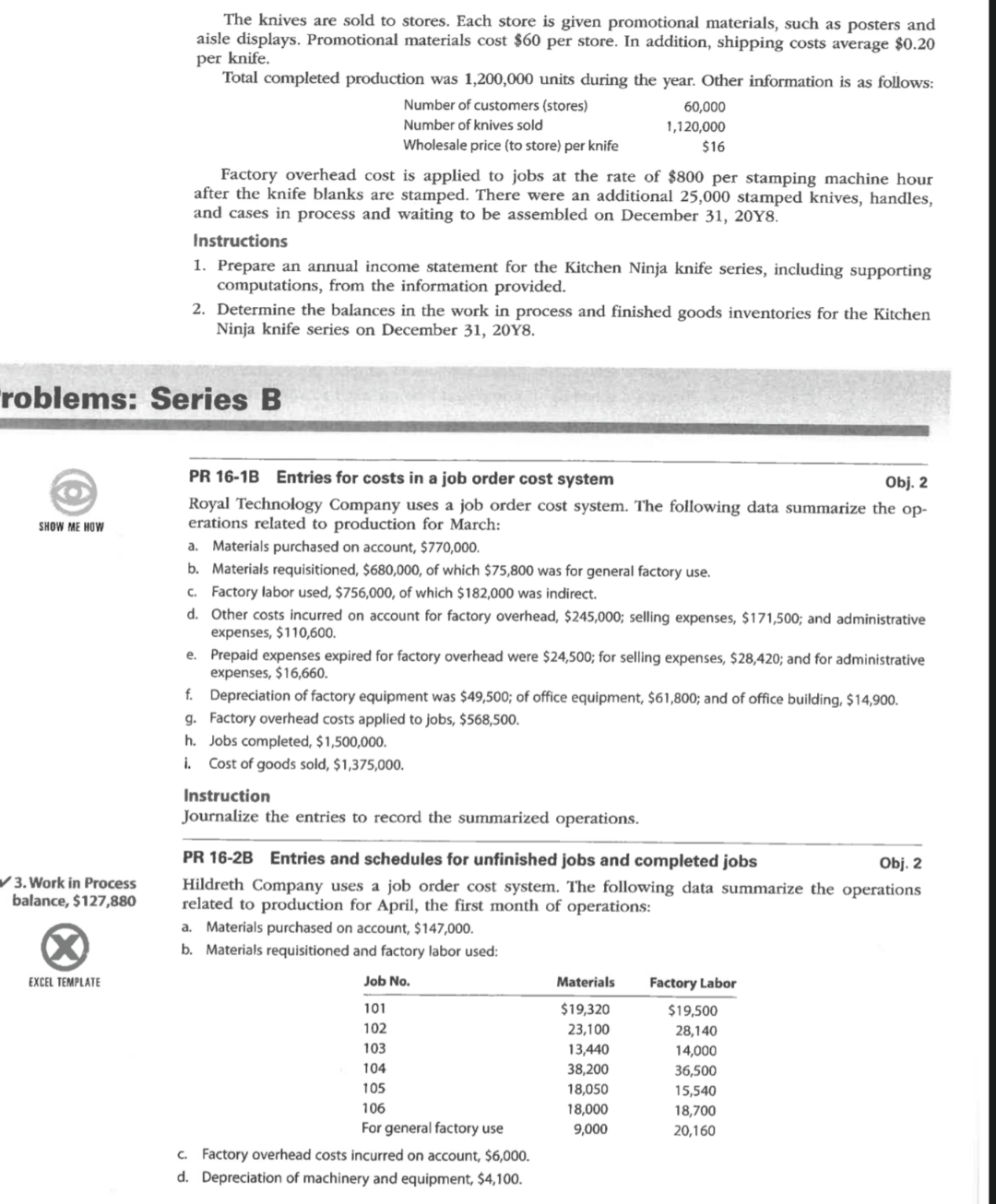

1. Supporting calculations: PR 16-4A Analyzing manufacturing cost accounts Obj. 2 Fire Rock Company manufactures designer paddle boards in a wide variety of sizes and styles. The following incomnlete ledarer arrouinte refar to (Continued) Order Costing In addition, the following information is available: a. Materials and direct labor were applied to six jobs in June: b. Factory overhead is applied to each job at a rate of 140% of direct labor cost. c. The June 1 Work in Process balance consisted of two jobs, as follows: d. Customer jobs completed and units sold in June were as follows: Instructions 1. Determine the missing amounts associated with each letter. Provide supporting computations by completing a table with the following headings: (pantumuo) The knives are sold to stores. Each store is given promotional materials, such as posters and aisle displays. Promotional materials cost $60 per store. In addition, shipping costs average $0.20 per knife. Total completed production was 1,200,000 units during the year. Other information is as follows: Factory overhead cost is applied to jobs at the rate of $800 per stamping machine hour after the knife blanks are stamped. There were an additional 25,000 stamped knives, handles, and cases in process and waiting to be assembled on December 31, 20Y8. Instructions 1. Prepare an annual income statement for the Kitchen Ninja knife series, including supporting computations, from the information provided. 2. Determine the balances in the work in process and finished goods inventories for the Kitchen Ninja knife series on December 31, 20 Y8. roblems: Series B PR 16-1B Entries for costs in a job order cost system Obj. 2 Royal Technology Company uses a job order cost system. The following data summarize the operations related to production for March: a. Materials purchased on account, $770,000. b. Materials requisitioned, $680,000, of which $75,800 was for general factory use. c. Factory labor used, $756,000, of which $182,000 was indirect. d. Other costs incurred on account for factory overhead, $245,000; selling expenses, $171,500; and administrative expenses, $110,600. e. Prepaid expenses expired for factory overhead were $24,500; for selling expenses, $28,420; and for administrative expenses, $16,660. f. Depreciation of factory equipment was $49,500; of office equipment, $61,800; and of office building, $14,900. g. Factory overhead costs applied to jobs, $568,500. h. Jobs completed, $1,500,000. i. Cost of goods sold, $1,375,000. Instruction Journalize the entries to record the summarized operations. PR 16-2B Entries and schedules for unfinished jobs and completed jobs Obj. 2 3. Work in Process Hildreth Company uses a job order cost system. The following data summarize the operations balance, \$127,880 related to production for April, the first month of operations: a. Materials purchased on account, $147,000. b. Materials requisitioned and factory labor used: Excel template c. Factory overhead costs incurred on account, $6,000. d. Depreciation of machinery and equipment, $4,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts