Question: Please Answer The Question 3 9 How do the price earnings ratio and the market to book value ratio provide a sense for the firm's

Please Answer The Question

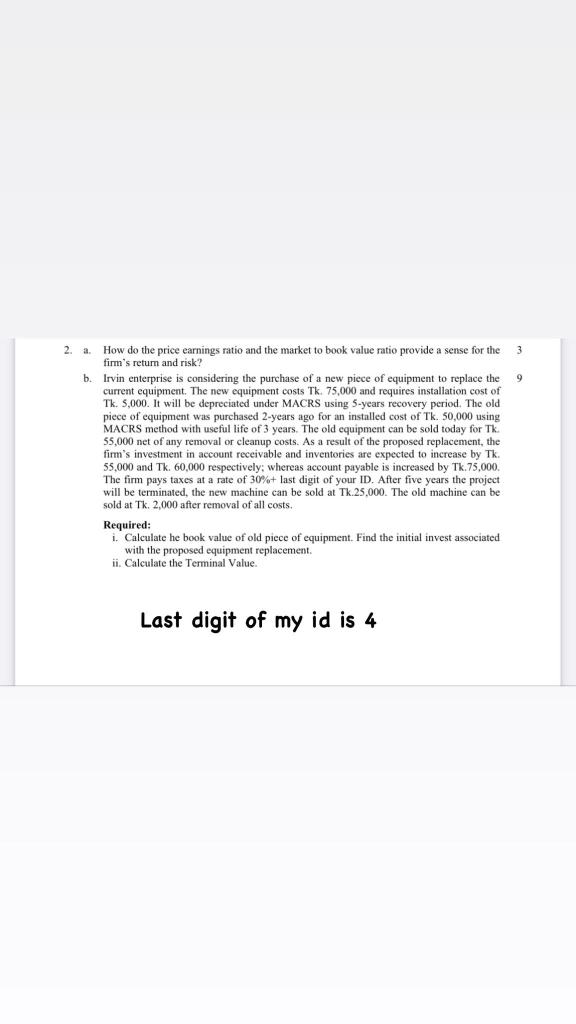

3 9 How do the price earnings ratio and the market to book value ratio provide a sense for the firm's return and risk? b. Irvin enterprise is considering the purchase of a new piece of equipment to replace the current equipment. The new equipment costs Tk. 75,000 and requires installation cost of Tk. 5,000. It will be depreciated under MACRS using 5-years recovery period. The old piece of equipment was purchased 2-years ago for an installed cost of Tk. 50,000 using MACRS method with useful life of 3 years. The old equipment can be sold today for Tk 55,000 net of any removal or cleanup costs. As a result of the proposed replacement, the firm's investment in account receivable and inventories are expected to increase by Tk. 55,000 and Tk. 60,000 respectively, whereas account payable is increased by Tk.75,000 The firm pays taxes at a rate of 30%+ last digit of your ID. After five years the project will be terminated, the new machine can be sold at Tk.25,000. The old machine can be sold at Tk. 2.000 after removal of all costs. Required: 1. Calculate he book value of old piece of equipment. Find the initial invest associated with the proposed equipment replacement ii. Calculate the Terminal Value Last digit of my id is 4 3 9 How do the price earnings ratio and the market to book value ratio provide a sense for the firm's return and risk? b. Irvin enterprise is considering the purchase of a new piece of equipment to replace the current equipment. The new equipment costs Tk. 75,000 and requires installation cost of Tk. 5,000. It will be depreciated under MACRS using 5-years recovery period. The old piece of equipment was purchased 2-years ago for an installed cost of Tk. 50,000 using MACRS method with useful life of 3 years. The old equipment can be sold today for Tk 55,000 net of any removal or cleanup costs. As a result of the proposed replacement, the firm's investment in account receivable and inventories are expected to increase by Tk. 55,000 and Tk. 60,000 respectively, whereas account payable is increased by Tk.75,000 The firm pays taxes at a rate of 30%+ last digit of your ID. After five years the project will be terminated, the new machine can be sold at Tk.25,000. The old machine can be sold at Tk. 2.000 after removal of all costs. Required: 1. Calculate he book value of old piece of equipment. Find the initial invest associated with the proposed equipment replacement ii. Calculate the Terminal Value Last digit of my id is 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts