Question: Please answer the question 7, 8 and 9 thank you Chapter 11 7) compare and contrast the internal revenue code and treasury regulations with respect

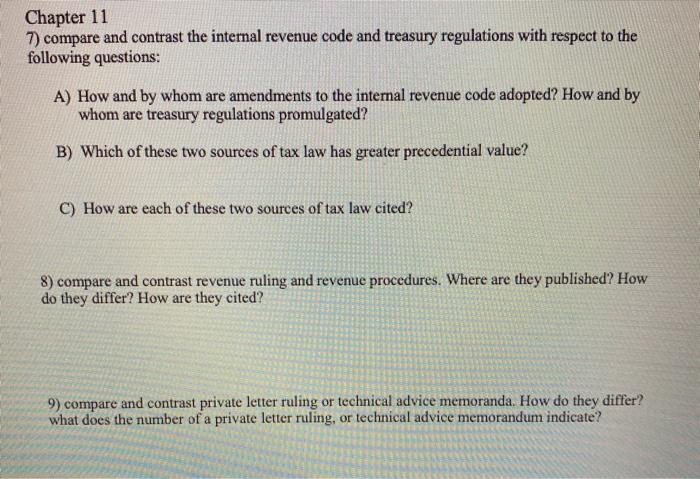

Chapter 11 7) compare and contrast the internal revenue code and treasury regulations with respect to the following questions: A) How and by whom are amendments to the internal revenue code adopted? How and by whom are treasury regulations promulgated? B) Which of these two sources of tax law has greater precedential value? C) How are each of these two sources of tax law cited? 8) compare and contrast revenue ruling and revenue procedures. Where are they published? How do they differ? How are they cited? 9) compare and contrast private letter ruling or technical advice memoranda. How do they differ? what does the number of a private letter ruling, or technical advice memorandum indicate? Chapter 11 7) compare and contrast the internal revenue code and treasury regulations with respect to the following questions: A) How and by whom are amendments to the internal revenue code adopted? How and by whom are treasury regulations promulgated? B) Which of these two sources of tax law has greater precedential value? C) How are each of these two sources of tax law cited? 8) compare and contrast revenue ruling and revenue procedures. Where are they published? How do they differ? How are they cited? 9) compare and contrast private letter ruling or technical advice memoranda. How do they differ? what does the number of a private letter ruling, or technical advice memorandum indicate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts