Question: Please answer the question , A + B show your work please 55AY. Write your answer in the space provided or on a separate sheet

Please answer the question , A + B

show your work please

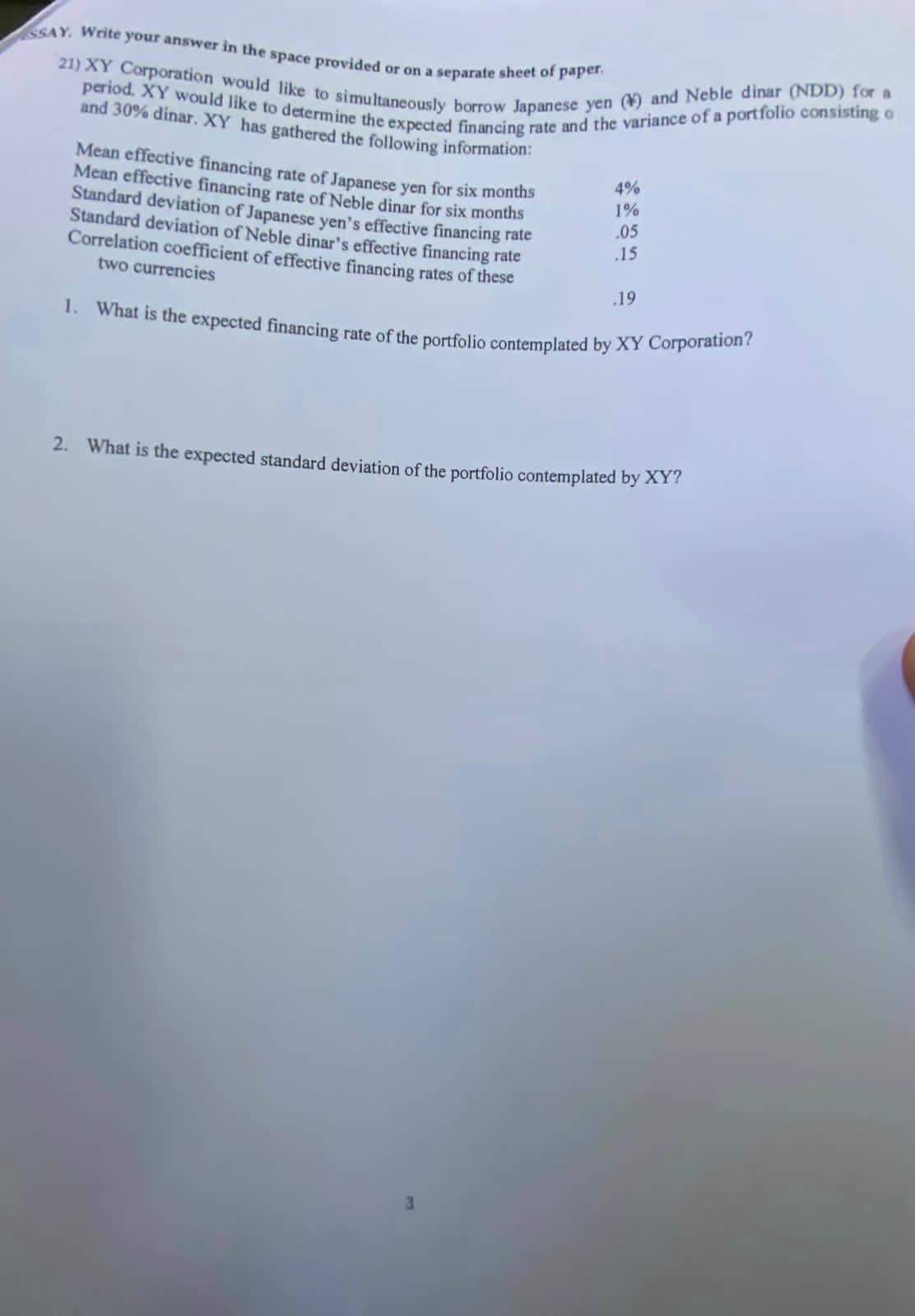

55AY. Write your answer in the space provided or on a separate sheet of paper. 21) XY Corporation would like to simultaneously borrow Japanese yen ( ) and Neble dinar (NDD) for a period. XY would like to determine the expected financing rate and the variance of a portfolio consisting o and 30% dinar. XY has gathered the following information: Mean effective financing rate of Japanese yen for six months Mean effective financing rate of Neble dinar Standard deviation of Japanese Neble dinar for six months 1% Standard deviation of Neble din's effective financing rate .05 Correlationcoefficientofefinarseffectivefinancingrate.15 two currencies 1. What is the expected financing rate of the portfolio contemplated by XY Corporation? 2. What is the expected standard deviation of the portfolio contemplated by XY ? 55AY. Write your answer in the space provided or on a separate sheet of paper. 21) XY Corporation would like to simultaneously borrow Japanese yen ( ) and Neble dinar (NDD) for a period. XY would like to determine the expected financing rate and the variance of a portfolio consisting o and 30% dinar. XY has gathered the following information: Mean effective financing rate of Japanese yen for six months Mean effective financing rate of Neble dinar Standard deviation of Japanese Neble dinar for six months 1% Standard deviation of Neble din's effective financing rate .05 Correlationcoefficientofefinarseffectivefinancingrate.15 two currencies 1. What is the expected financing rate of the portfolio contemplated by XY Corporation? 2. What is the expected standard deviation of the portfolio contemplated by XY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts