Question: Please answer the question. A. Other things being equal, do both companies appear to have the ability to meet their obligations as measured by the

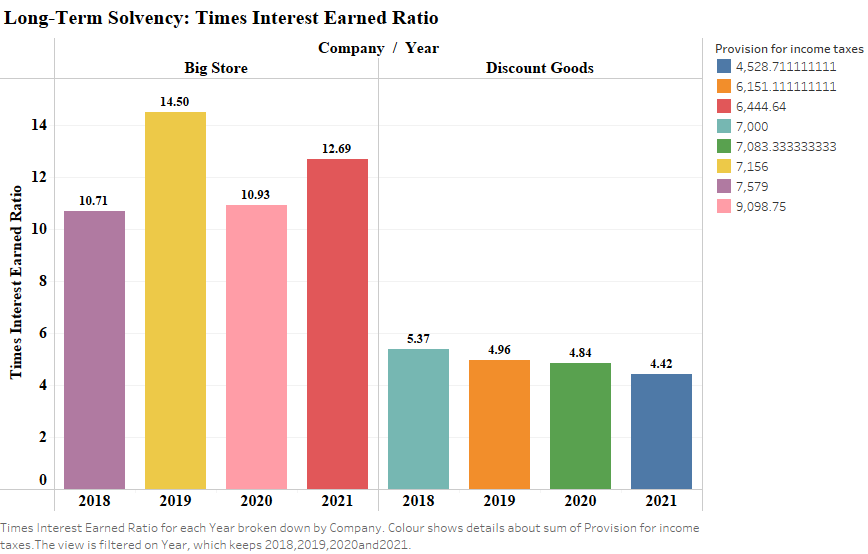

Please answer the question. A. Other things being equal, do both companies appear to have the ability to meet their obligations as measured by the debt to equity ratio? B. Based solely on the times interest earned ratios, do you reach the same conclusion as in Requirement 1? C. Is the margin of safety provided to creditors by Discount Goods improving or declining in recent years as measured by the average times interest earned ratio?

Please answer the question. A. Other things being equal, do both companies appear to have the ability to meet their obligations as measured by the debt to equity ratio? B. Based solely on the times interest earned ratios, do you reach the same conclusion as in Requirement 1? C. Is the margin of safety provided to creditors by Discount Goods improving or declining in recent years as measured by the average times interest earned ratio?

Long-Term Solvency: Times Interest Earned Ratio Company Year Big Store 14 12.69 12 10 Discount Goods 10.93 5.37 4.96 4.84 4.42 2 0 2018 2019 2020 2021 2018 2019 2020 2021 Times Interest Earned Ratio for each Year broken down by Company. Colour shows details about sum of Provision for income taxes.The view is filtered on Year, which keeps 2018,2019,2020and2021. Times Interest Earned Ratio 8 10.71 14.50 Provision for income taxes 4,528.711111111 6,151.111111111 6,444.64 7,000 7,083.333333333 7,156 7,579 9,098.75 Long-Term Solvency: Times Interest Earned Ratio Company Year Big Store 14 12.69 12 10 Discount Goods 10.93 5.37 4.96 4.84 4.42 2 0 2018 2019 2020 2021 2018 2019 2020 2021 Times Interest Earned Ratio for each Year broken down by Company. Colour shows details about sum of Provision for income taxes.The view is filtered on Year, which keeps 2018,2019,2020and2021. Times Interest Earned Ratio 8 10.71 14.50 Provision for income taxes 4,528.711111111 6,151.111111111 6,444.64 7,000 7,083.333333333 7,156 7,579 9,098.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts