Question: Please answer the question (a) What is the impact on a country's currency that faces a higher interest rate relative to its trading partners? Demonstrate

Please answer the question

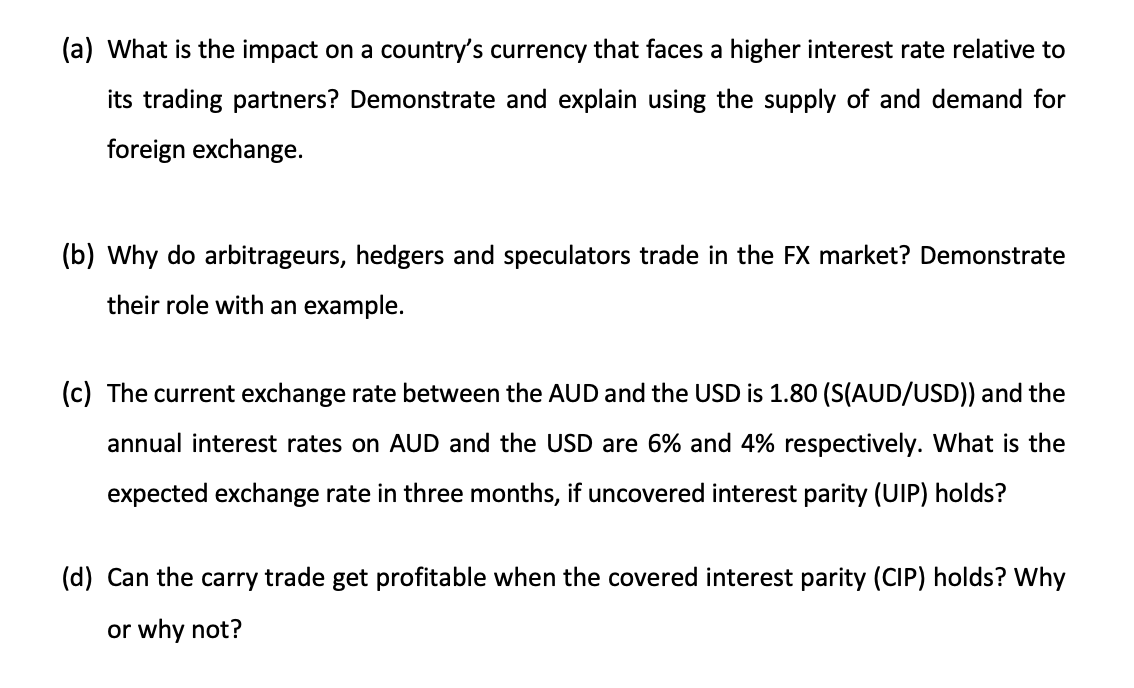

(a) What is the impact on a country's currency that faces a higher interest rate relative to its trading partners? Demonstrate and explain using the supply of and demand for foreign exchange. (b) Why do arbitrageurs, hedgers and speculators trade in the FX market? Demonstrate their role with an example. (c) The current exchange rate between the AUD and the USD is 1.80 (S(AUD/USD)) and the annual interest rates on AU!) and the USD are 6% and 4% respectively. What is the expected exchange rate in three months, if uncovered interest parity (UIP) holds? (d) Can the carry trade get profitable when the covered interest parity (CIP) holds? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts