Question: please answer the question accordingly and type. its Urgent Question 3 The directors of Manuff (steel) limited are considering closing one of the business's factories.

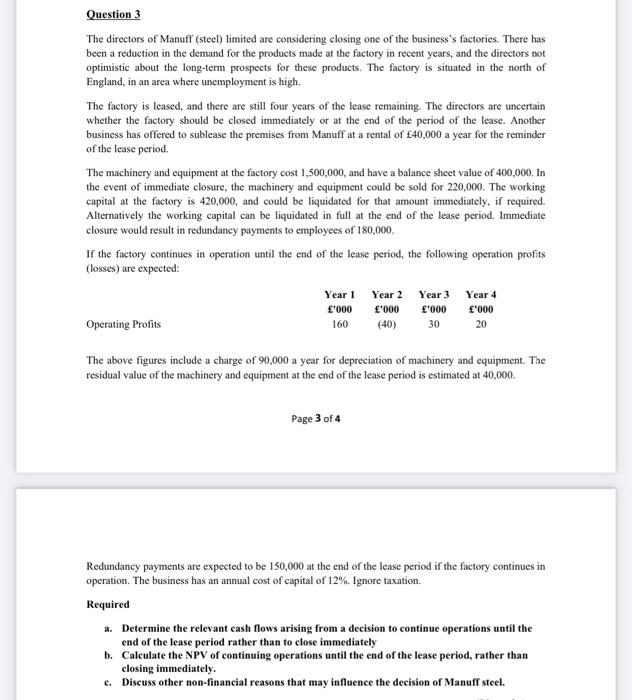

Question 3 The directors of Manuff (steel) limited are considering closing one of the business's factories. There has been a reduction in the demand for the products made at the factory in recent years, and the directors not optimistic about the long-term prospects for these products. The factory is situated in the north of England, in an arca where unemployment is high. The factory is leased, and there are still four years of the lease remaining. The directors are uncertain whether the factory should be closed immediately or at the end of the period of the lease. Another business has offered to sublease the premises from Manuff at a rental of 40,000 a year for the reminder of the case period The machinery and equipment at the factory cost 1,500,000, and have a balance sheet value of 400,000. In the event of immediate closure, the machinery and equipment could be sold for 220,000. The working capital at the factory is 420,000, and could be liquidated for that amount immediately, if required. Alternatively the working capital can be liquidated in full at the end of the lease period. Immediate closure would result in redundancy payments to employees of 180,000 If the factory continues in operation until the end of the lease period, the following operation profits (losses) are expected: Year 1 Year 2 Year 3 Year 4 '000 '000 {'000 '000 Operating Profits 160 (40) 30 20 The above figures include a charge of 90,000 a year for depreciation of machinery and equipment. The residual value of the machinery and equipment at the end of the lease period is estimated at 40,000. Page 3 of 4 Redundancy payments are expected to be 150,000 at the end of the lease period if the factory continues in operation. The business has an annual cost of capital of 12%. Ignore taxation Required a. Determine the relevant cash flows arising from a decision to continue operations until the end of the lease period rather than to close immediately b. Calculate the NPV of continuing operations until the end of the lease period, rather than closing immediately. c. Discuss other non-financial reasons that may influence the decision of Manuff steel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts