Question: Please answer the question and explain how you solved it. Thank you! My Institution Co Chapter 11 Ho ACC 111:-Principles of Accounting 1 -Section 06

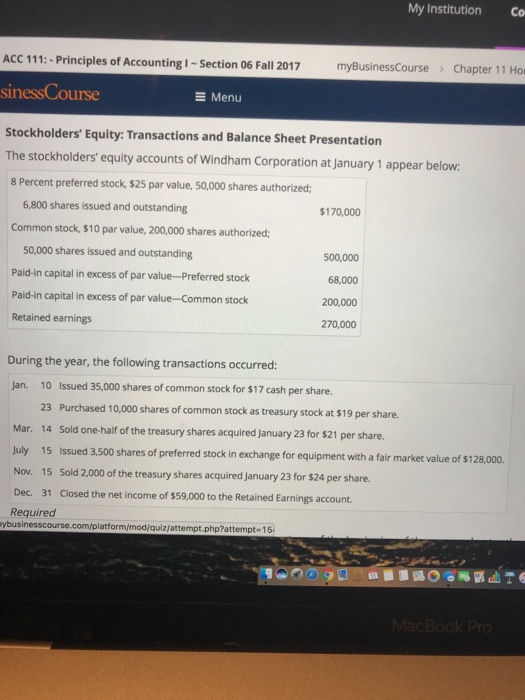

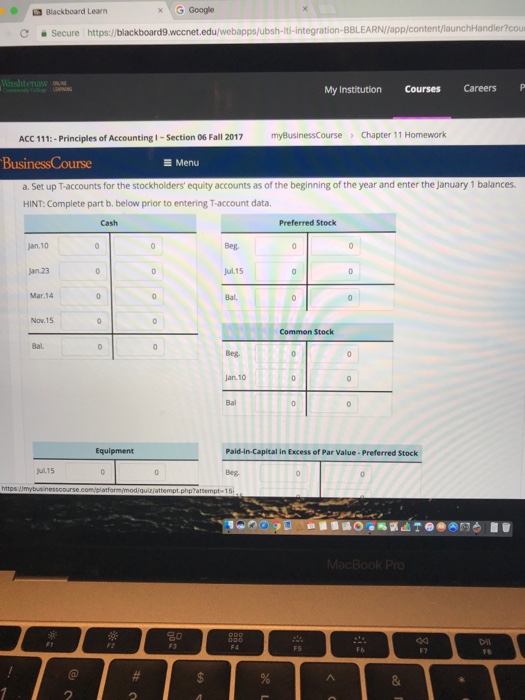

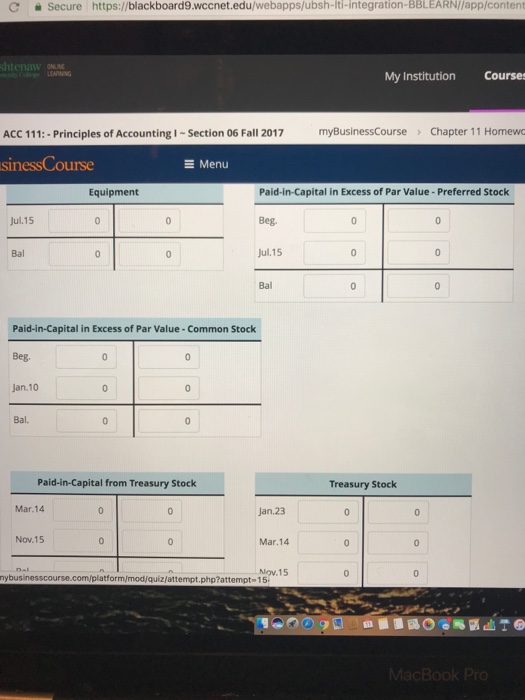

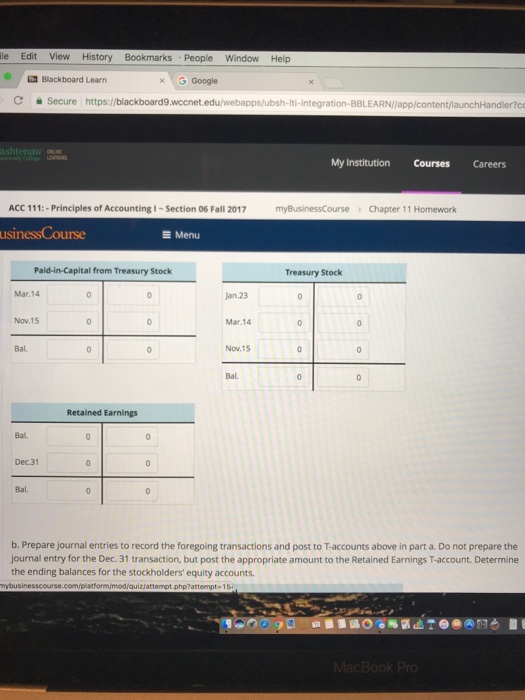

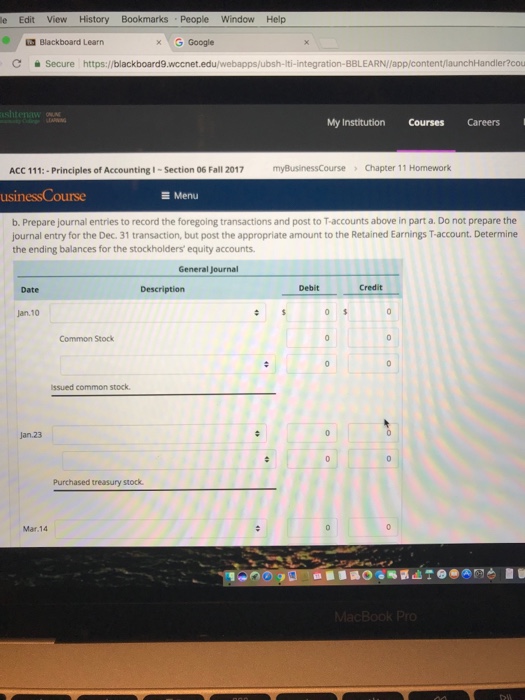

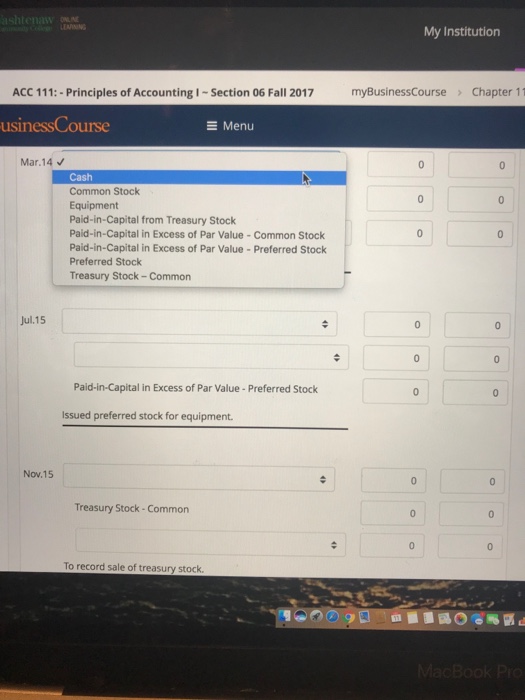

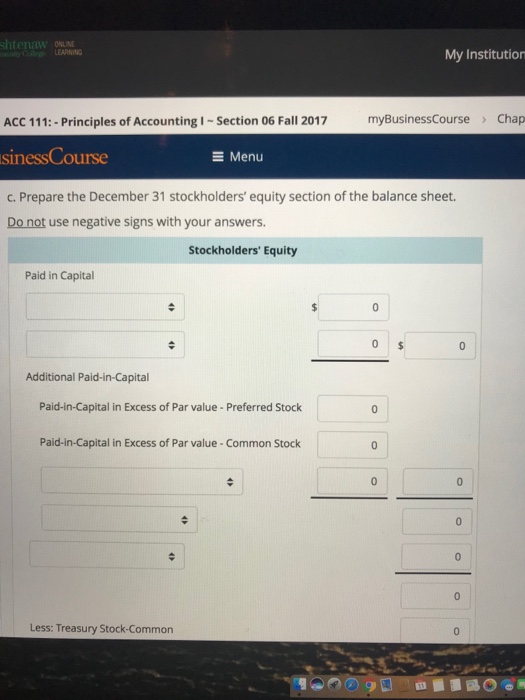

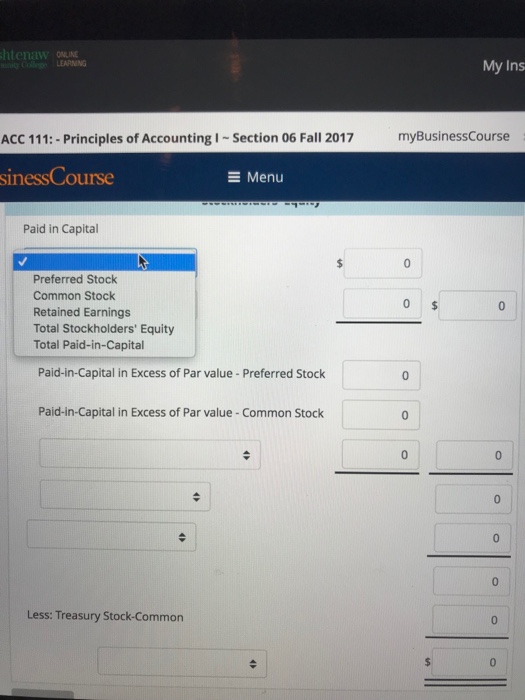

My Institution Co Chapter 11 Ho ACC 111:-Principles of Accounting 1 -Section 06 Fall 2017 myBusinessCourse sinessCourse Stockholders' Equity: Transactions and Balance Sheet Presentation Menu The stockholders' equity accounts of Windham Corporation at January 1 appear below: 8 Percent preferred stock, $25 par value, 50,000 shares authorized; 6,800 shares issued and outstanding Common stock, $10 par value, 200,000 shares authorized; 170,000 50,000 shares issued and outstanding Paid-in capital in excess of par value-Preferred stock Paid-in capital in excess of par value-Common stock Retained earnings 500,000 68,000 200,000 270,000 During the year, the following transactions occurred: Issued 35,000 shares of common stock for $17 cash per share. Purchased 10,000 shares of common stock as treasury stock at $19 per share. Jan. 10 23 Mar. 14 Sold one-half of the treasury shares acquired January 23 for $21 per share. July 15 Issued 3,500 Nov. 15 Sold 2,000 of the treasury shares acquired January 23 for $24 per share. Dec. 31 Closed the net income of s59,000 to the Retained Earnings account. Required shares of preferred stock in exchange for equipment with a fair market value of $128,000. ybusinesscourse.com/platform/mod/quizjattempt.php?attempt-15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts