Question: please, answer the question below. 12 Karla Salons leased equipment from Smith Co. on July 1, 2021, in a finance lease. The present value of

please, answer the question below.

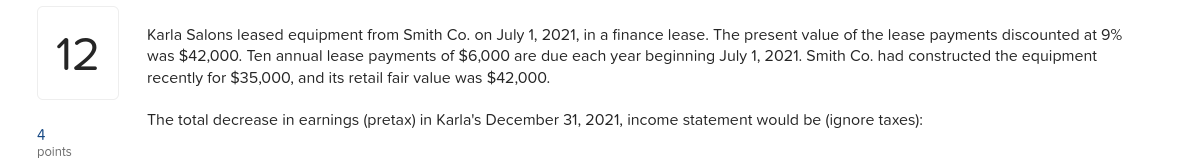

12 Karla Salons leased equipment from Smith Co. on July 1, 2021, in a finance lease. The present value of the lease payments discounted at 9% was $42,000. Ten annual lease payments of $6,000 are due each year beginning July 1, 2021. Smith Co. had constructed the equipment recently for $35,000, and its retail fair value was $42,000. The total decrease in earnings (pretax) in Karla's December 31, 2021, income statement would be ignore taxes): 4 points 12 Multiple Choice 4 points $3,720. Skipped O $2.280. O $3,780, O O O $4,380

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts