Question: PLEASE ANSWER THE QUESTION BELOW: Calculate the following amounts and ratios for 2020 and 2021: a) working capital, b) current ratio, c) acid-test ratio, d)

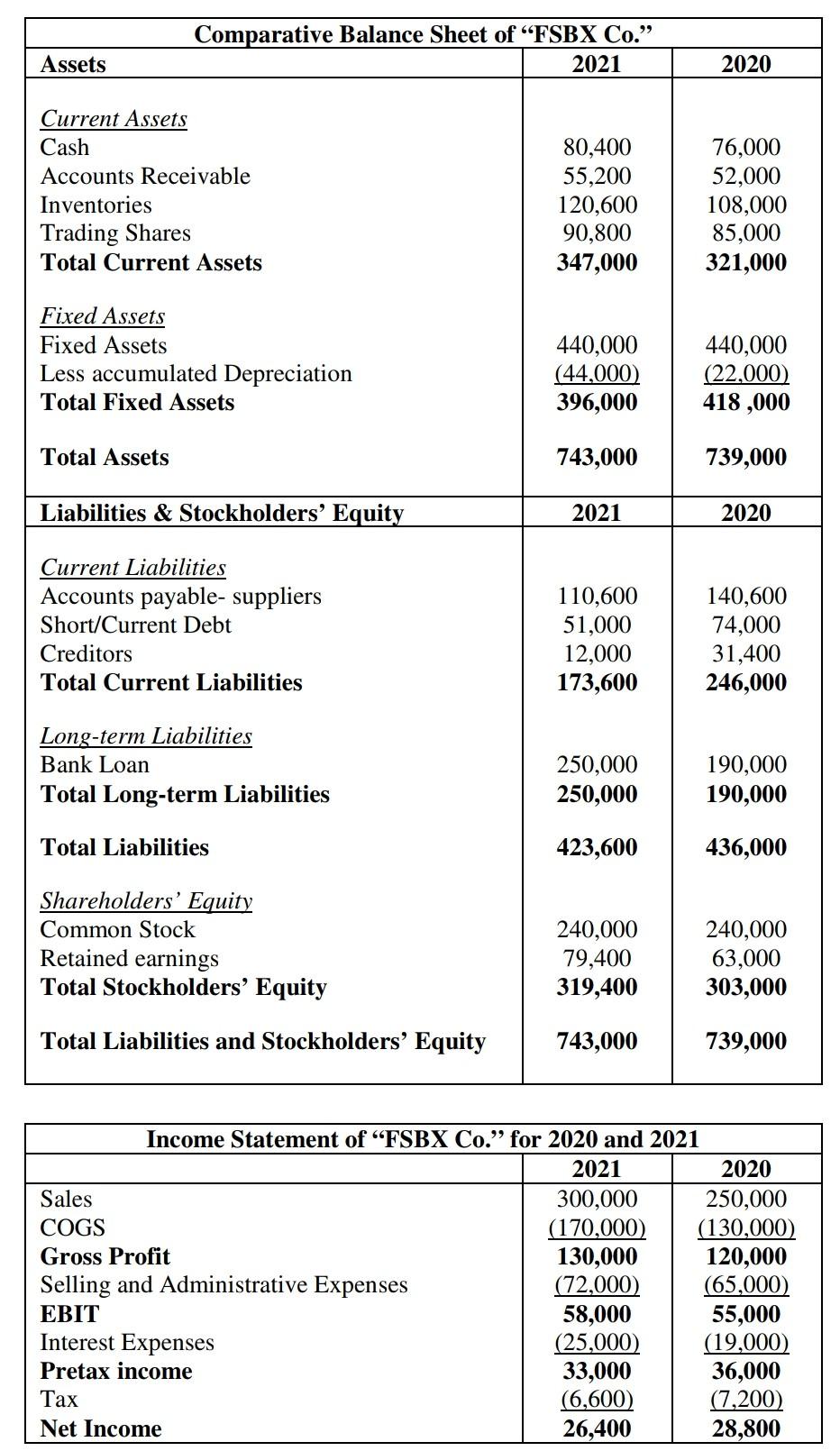

PLEASE ANSWER THE QUESTION BELOW: Calculate the following amounts and ratios for 2020 and 2021: a) working capital, b) current ratio, c) acid-test ratio, d) cash over current liabilities ratio, e) debt to asset ratio, f) interest coverage ratio and g) return on assets. Then reflect on those numbers. Your answer should not be more than 350 words and should cover the following questions: - Would you consider investing on FBSX Co. when assessing its performance and liquidity profile? - Has the performance and liquidity of FBSX Co. improved?

Comparative Balance Sheet of FSBX Co. 2021 Assets 2020 Current Assets Cash Accounts Receivable Inventories Trading Shares Total Current Assets 80,400 55,200 120,600 90,800 347,000 76,000 52,000 108,000 85,000 321,000 Fixed Assets Fixed Assets Less accumulated Depreciation Total Fixed Assets 440,000 (44,000) 396,000 440,000 (22,000) 418 ,000 Total Assets 743,000 739,000 Liabilities & Stockholders' Equity 2021 2020 Current Liabilities Accounts payable- suppliers Short/Current Debt Creditors Total Current Liabilities 110,600 51,000 12,000 173,600 140,600 74,000 31,400 246,000 Long-term Liabilities Bank Loan Total Long-term Liabilities 250,000 250,000 190,000 190,000 Total Liabilities 423,600 436,000 Shareholders' Equity Common Stock Retained earnings Total Stockholders' Equity 240,000 79,400 319,400 240,000 63,000 303,000 Total Liabilities and Stockholders' Equity 743,000 739,000 Income Statement of FSBX Co." for 2020 and 2021 2021 2020 Sales 300,000 250,000 COGS (170,000) (130,000) Gross Profit 130,000 120,000 Selling and Administrative Expenses (72,000) (65,000) EBIT 58,000 55,000 Interest Expenses (25,000) (19,000) Pretax income 33,000 36,000 Tax (6,600) (7,200) Net Income 26,400 28,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts