Question: PLEASE ANSWER THE QUESTION BELOW USING THE INFORMATION ABOVE - The company has sold non-core assets during 2022, generating a profit of 15,622. - The

PLEASE ANSWER THE QUESTION BELOW USING THE INFORMATION ABOVE

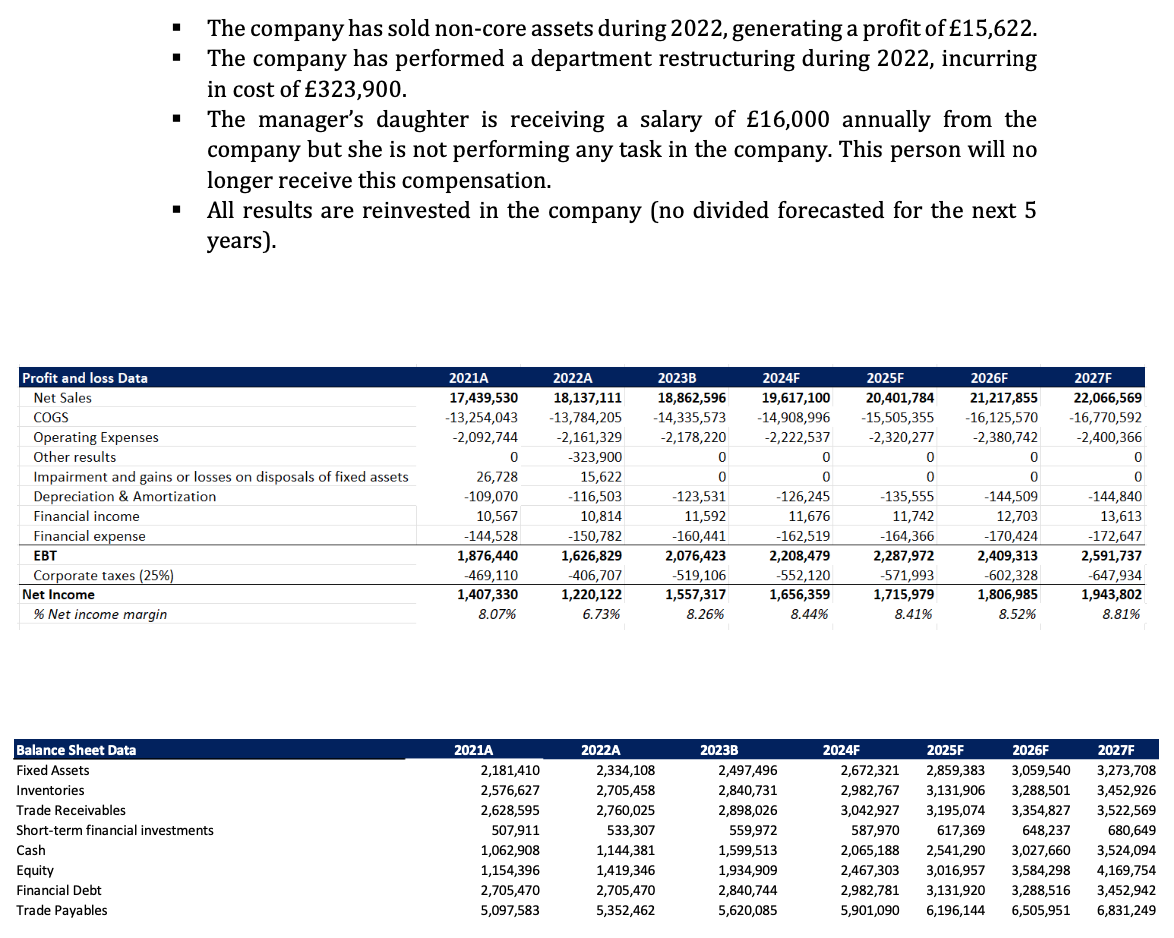

- The company has sold non-core assets during 2022, generating a profit of 15,622. - The company has performed a department restructuring during 2022, incurring in cost of 323,900. - The manager's daughter is receiving a salary of 16,000 annually from the company but she is not performing any task in the company. This person will no longer receive this compensation. - All results are reinvested in the company (no divided forecasted for the next 5 years). alculate the Weighted Average Cost of Capital (WACC) - Calculate the cost of equity with the CAPM - Get the beta of the industry (Damodaran 1 ) - Get the equity risk premium (Damodaran) - Get the risk-free rate from a 10-year sovereign bond - Get the objective capital structure of the industry (Damodaran) - Calculate the cost of debt based on what the company is currently paying for its debt - The company has sold non-core assets during 2022, generating a profit of 15,622. - The company has performed a department restructuring during 2022, incurring in cost of 323,900. - The manager's daughter is receiving a salary of 16,000 annually from the company but she is not performing any task in the company. This person will no longer receive this compensation. - All results are reinvested in the company (no divided forecasted for the next 5 years). alculate the Weighted Average Cost of Capital (WACC) - Calculate the cost of equity with the CAPM - Get the beta of the industry (Damodaran 1 ) - Get the equity risk premium (Damodaran) - Get the risk-free rate from a 10-year sovereign bond - Get the objective capital structure of the industry (Damodaran) - Calculate the cost of debt based on what the company is currently paying for its debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts