Question: ----------- please answer the question below ...... Wayzata Cleaning, Inc Income Statement For the Month Ended September 30, 2015 Wayzata Cleaning, Inc Balance Sheet September

----------- please answer the question below ......

please answer the question below ......

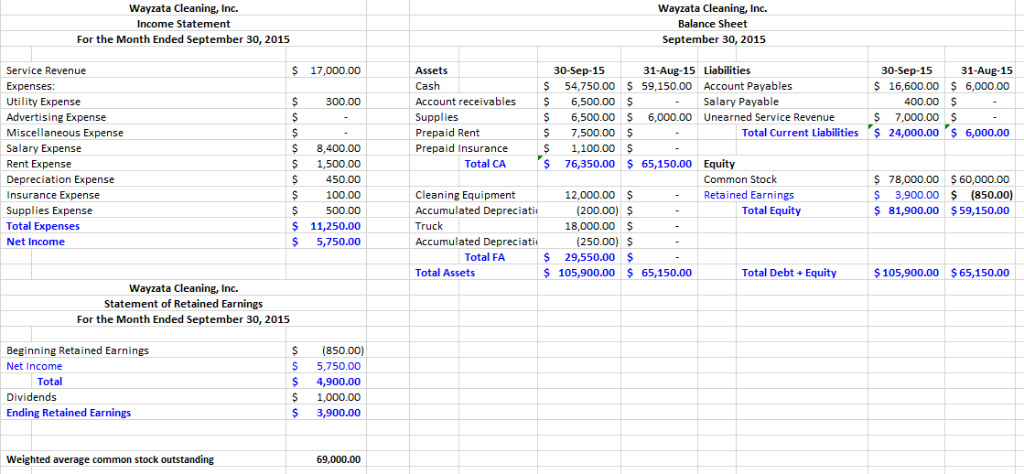

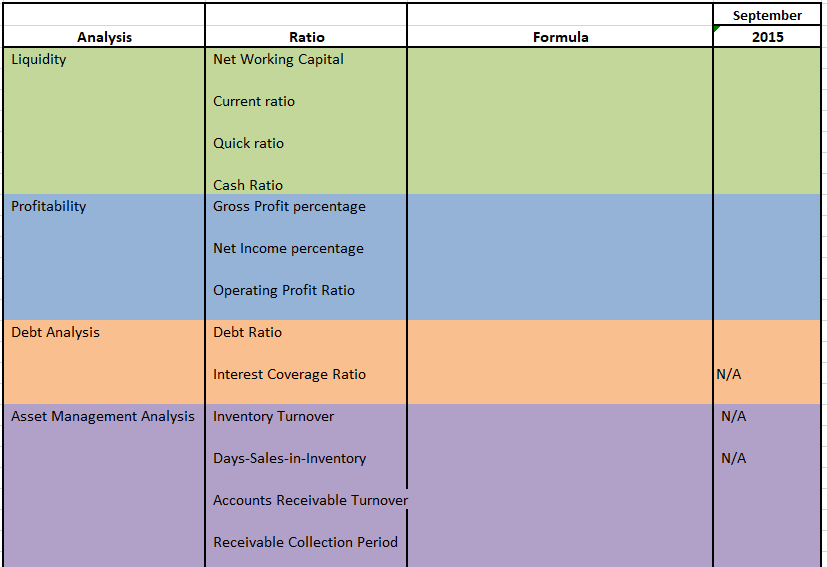

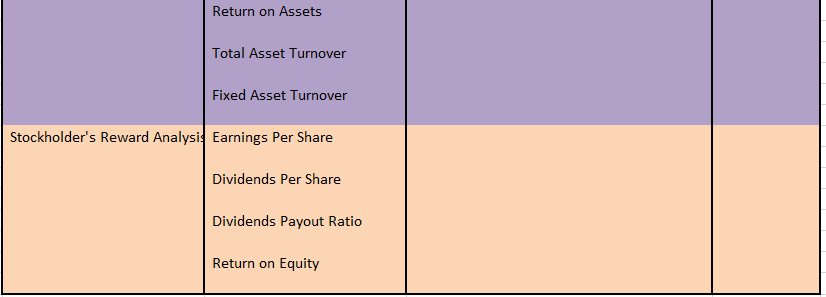

Wayzata Cleaning, Inc Income Statement For the Month Ended September 30, 2015 Wayzata Cleaning, Inc Balance Sheet September 30, 2015 $17,000.00 31-Aug-15 Liabilities Service Revenue Expenses Utility Expense Advertising Expense Miscellaneous Expense Salary Expense Rent Expense Depreciation Expense Insurance Expense Supplies Expense Total Expenses Net Income Assets Cash Account receivables Supplies Prepaid Rent Prepaid Insurance 30-Sep-15 54,750.00$ 59,150.00 Account Payables 30-Sep-15 31-Aug-15 16,600.00 $ 6,000.00 300.00 6,500.00 $ Salary Payable 400.00 $ 6,500.00 $ 6,000.00 Unearned Service Revenue s 7,000.00 Total Current Liabilities $ 24 $ 7,500.00 1,100.00 24,000.00 6,000.00 $ 8,400.00 1,500.00 $450.00 $ 100.00 500.00 11,250.00 $ 5,750.00 Total CA $76,350.00 65,150.00 Equity Common Stock $ 78,000.00 $ 60,000.00 $ 3,900.00$(850.00) $81,900.00 $59,150.00 -Retained Earnings Cleaning Equipment Accumulated Depreciati Truck Accumulated Depreciati 12,000.00 S (200.00) $ 18,000.00 Total Equity (250.00 $ 29,550.00 Total FA Total Assets 105,900.00 65,150.00 Total Debt+Equity 105,900.00 $65,150.00 Wayzata Cleaning, Inc Statement of Retained Earnings For the Month Ended September 30, 2015 $ (850.00) 5,750.00 $ 4,900.00 1,000.00 3,900.00 Beginning Retained Earnings Net Income Total Dividends Ending Retained Earnings Weighted average common stock outstanding 69,000.00 Analysis Ratio Formula 2015 Liquidity Net Working Capital Current ratio Quick ratio Cash Ratio Profitability Gross Profit percentage Net Income percentage Operating Profit Ratio Debt Ratio Debt Analysis Interest Coverage Ratio N/A Asset Management Analysis Inventory Turnover N/A Days-Sales-in-Inventory Accounts Receivable Turnover Receivable Collection Period N/A Return on Assets Total Asset Turnover Fixed Asset Turnover Stockholder's Reward Analysi Earnings Per Share Dividends Per Share Dividends Payout Ratio Return on Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts