Question: Please answer the question by computer, so I can see it clearly, thank you!!! In March 2022, Vladimir Putin, the Russian president, announced a decree

Please answer the question by computer, so I can see it clearly, thank you!!!

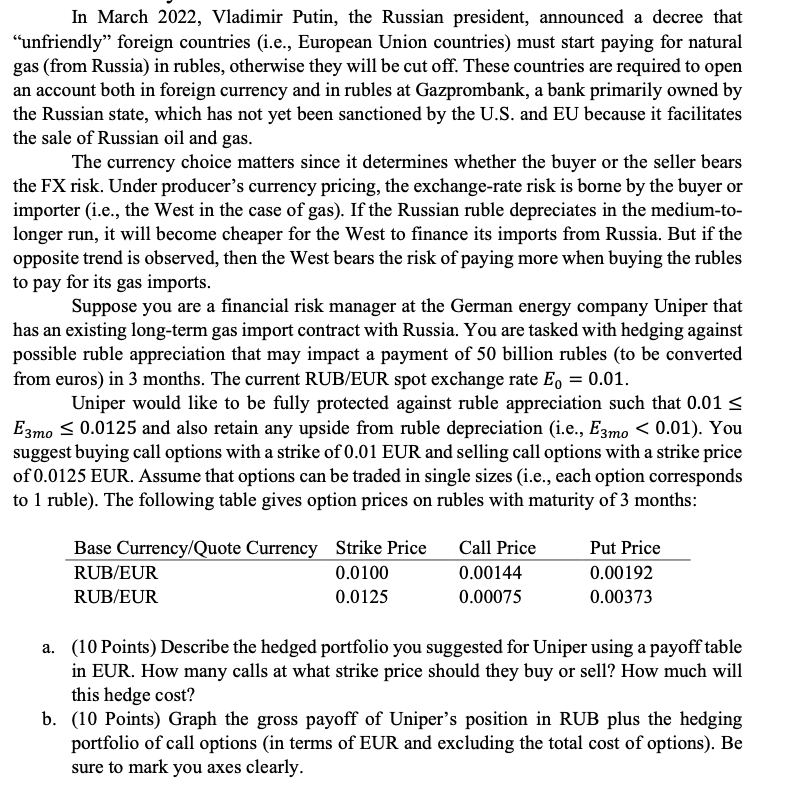

In March 2022, Vladimir Putin, the Russian president, announced a decree that "unfriendly foreign countries (i.e., European Union countries) must start paying for natural gas (from Russia) in rubles, otherwise they will be cut off. These countries are required to open an account both in foreign currency and in rubles at Gazprombank, a bank primarily owned by the Russian state, which has not yet been sanctioned by the U.S. and EU because it facilitates the sale of Russian oil and gas. The currency choice matters since it determines whether the buyer or the seller bears the FX risk. Under producer's currency pricing, the exchange-rate risk is borne by the buyer or importer (i.e., the West in the case of gas). If the Russian ruble depreciates in the medium-to- longer run, it will become cheaper for the West to finance its imports from Russia. But if the opposite trend is observed, then the West bears the risk of paying more when buying the rubles to pay for its gas imports. Suppose you are a financial risk manager at the German energy company Uniper that has an existing long-term gas import contract with Russia. You are tasked with hedging against possible ruble appreciation that may impact a payment of 50 billion rubles (to be converted from euros) in 3 months. The current RUB/EUR spot exchange rate E. = 0.01. Uniper would like to be fully protected against ruble appreciation such that 0.01 Ezmo s 0.0125 and also retain any upside from ruble depreciation (i.e., Ezmo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts