Question: Please answer the question clear. Thank you Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The

Please answer the question clear. Thank you

Please answer the question clear. Thank you

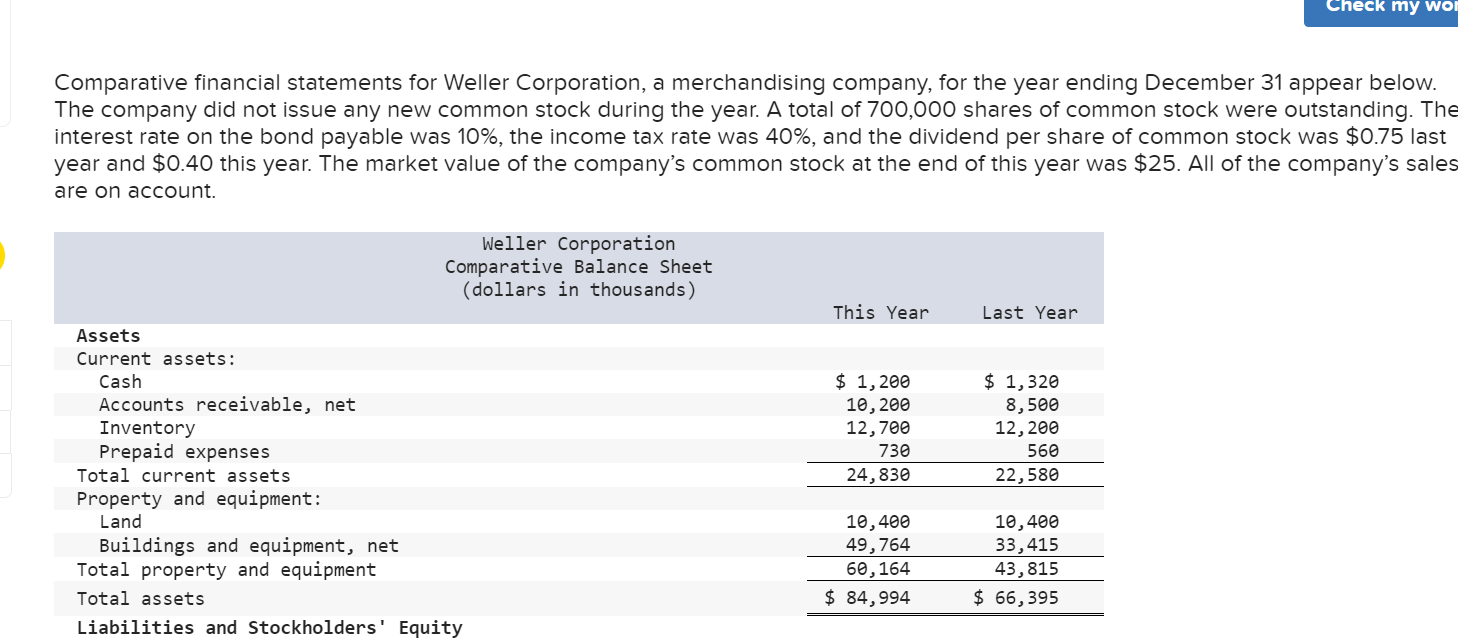

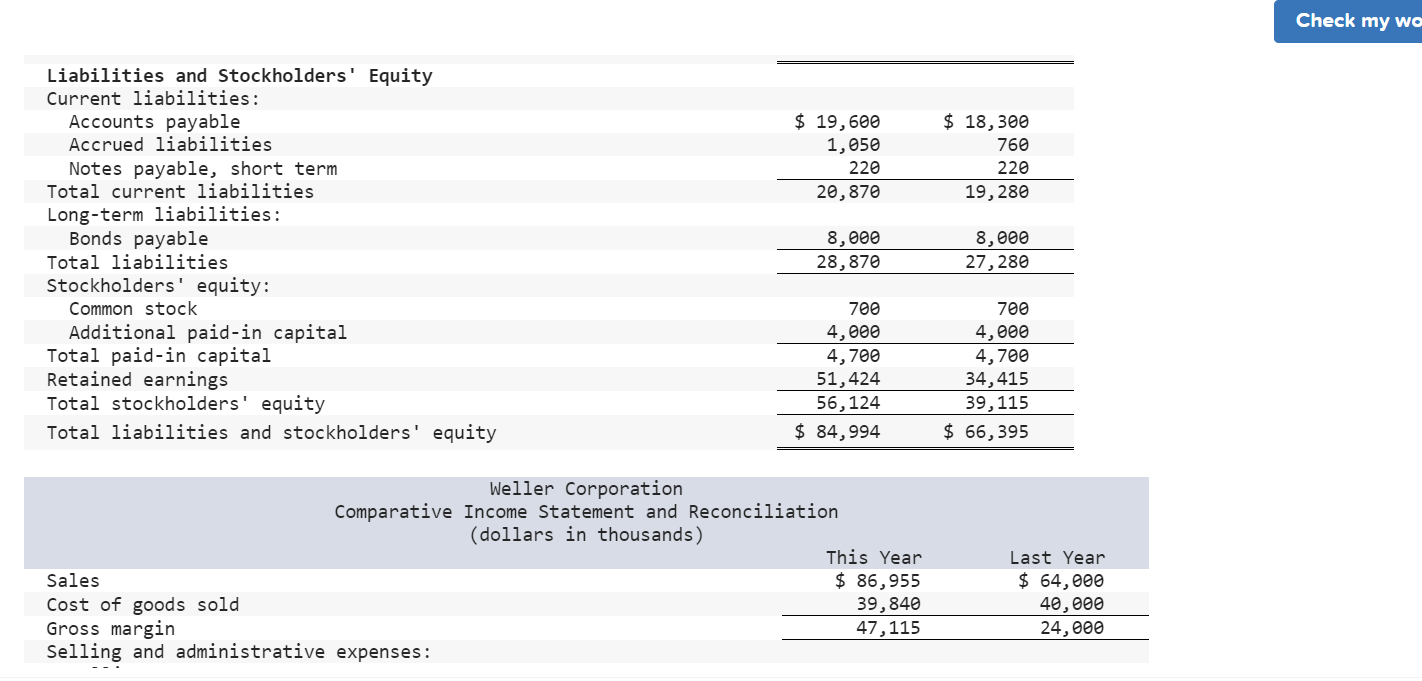

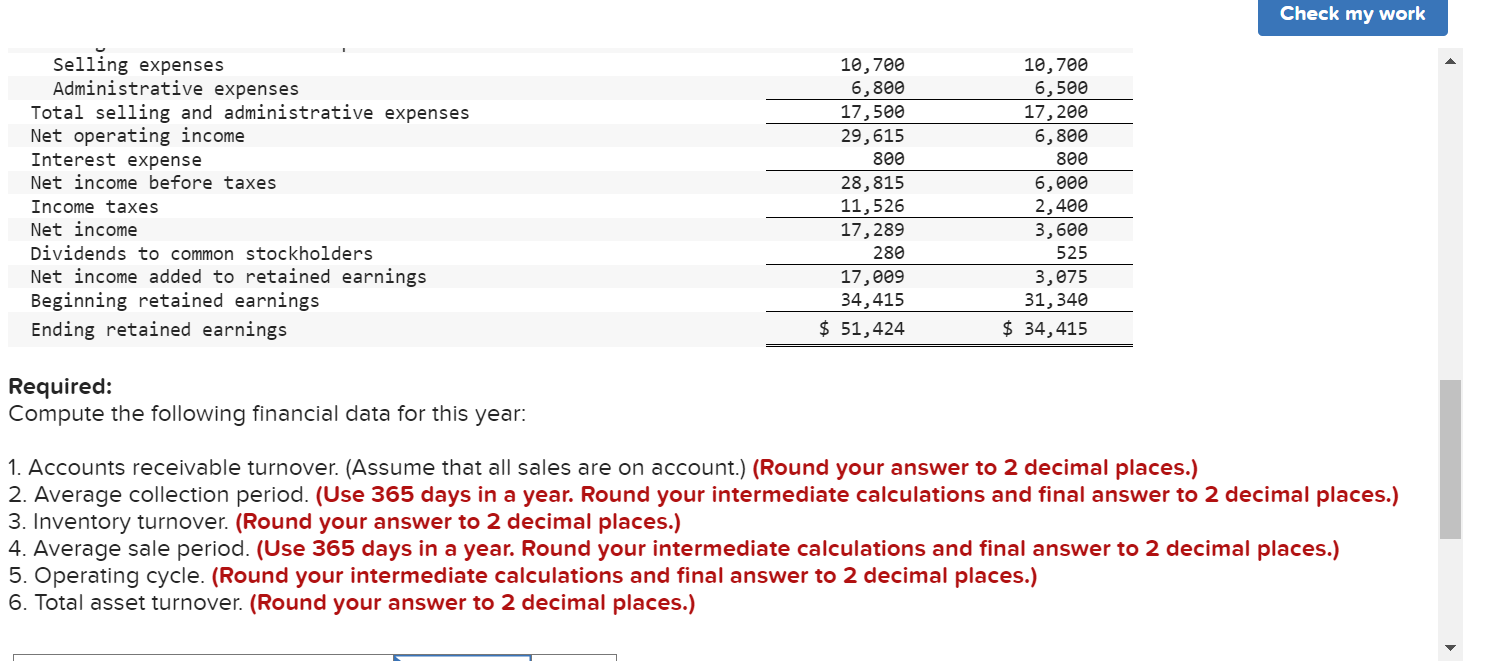

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 700,000 shares of common stock were outstanding. Th interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $25. All of the company's sale are on account. Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Notes payable, short term Total current liabilities \begin{tabular}{rr} $19,600 & $18,300 \\ 1,050 & 760 \\ 220 & 220 \\ \hline 20,870 & 19,280 \end{tabular} Long-term liabilities: Bonds payable Total liabilities \begin{tabular}{rr} 8,000 & 8,000 \\ \hline 28,870 & 27,280 \\ \hline \end{tabular} Stockholders' equity: Common stock Total paid-in capital \begin{tabular}{rr} 700 & 700 \\ 4,000 & 4,000 \\ \hline 4,700 & 4,700 \end{tabular} Retained earnings Total stockholders' equity Total liabilities and stockholders' equity \begin{tabular}{rr} 51,424 & 34,415 \\ \hline 56,124 & 39,115 \\ \hline$84,994 & $66,395 \\ \hline \hline \end{tabular} Required: Compute the following financial data for this year: 1. Accounts receivable turnover. (Assume that all sales are on account.) (Round your answer to 2 decimal places.) 2. Average collection period. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 decimal places.) 3. Inventory turnover. (Round your answer to 2 decimal places.) 4. Average sale period. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 decimal places.) 5. Operating cycle. (Round your intermediate calculations and final answer to 2 decimal places.) 6. Total asset turnover. (Round your answer to 2 decimal places.) 1. Accounts receivable turnover. (Assume that all sales are on account.) (Round your answer to 2 decimal places.) 2. Average collection period. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 decimal places.) 3. Inventory turnover. (Round your answer to 2 decimal places.) 4. Average sale period. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 decimal places.) 5. Operating cycle. (Round your intermediate calculations and final answer to 2 decimal places.) 6. Total asset turnover. (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts