Question: Please answer the question. Could not copy paste as the tables would be unclear. Considering the calculagnsyou have done so far, you need to attend

Please answer the question. Could not copy paste as the tables would be unclear.

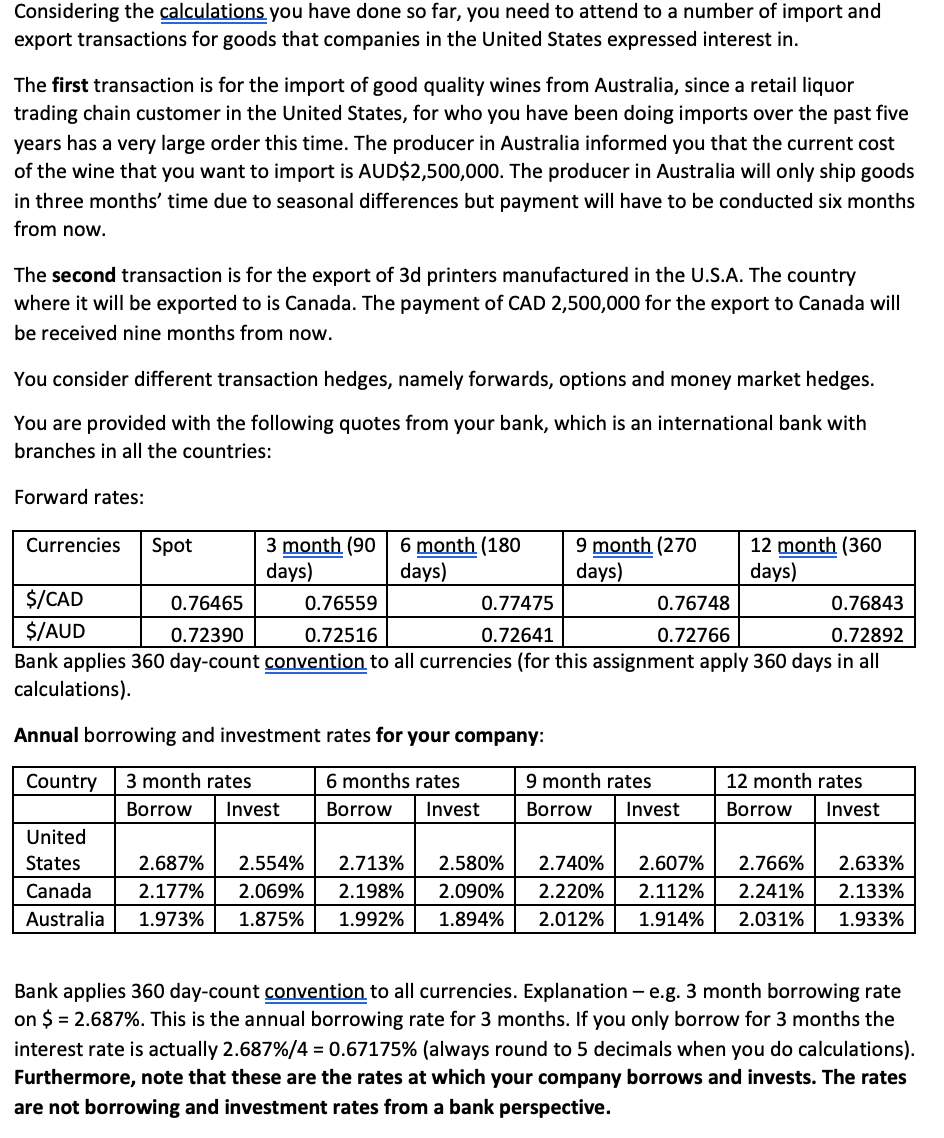

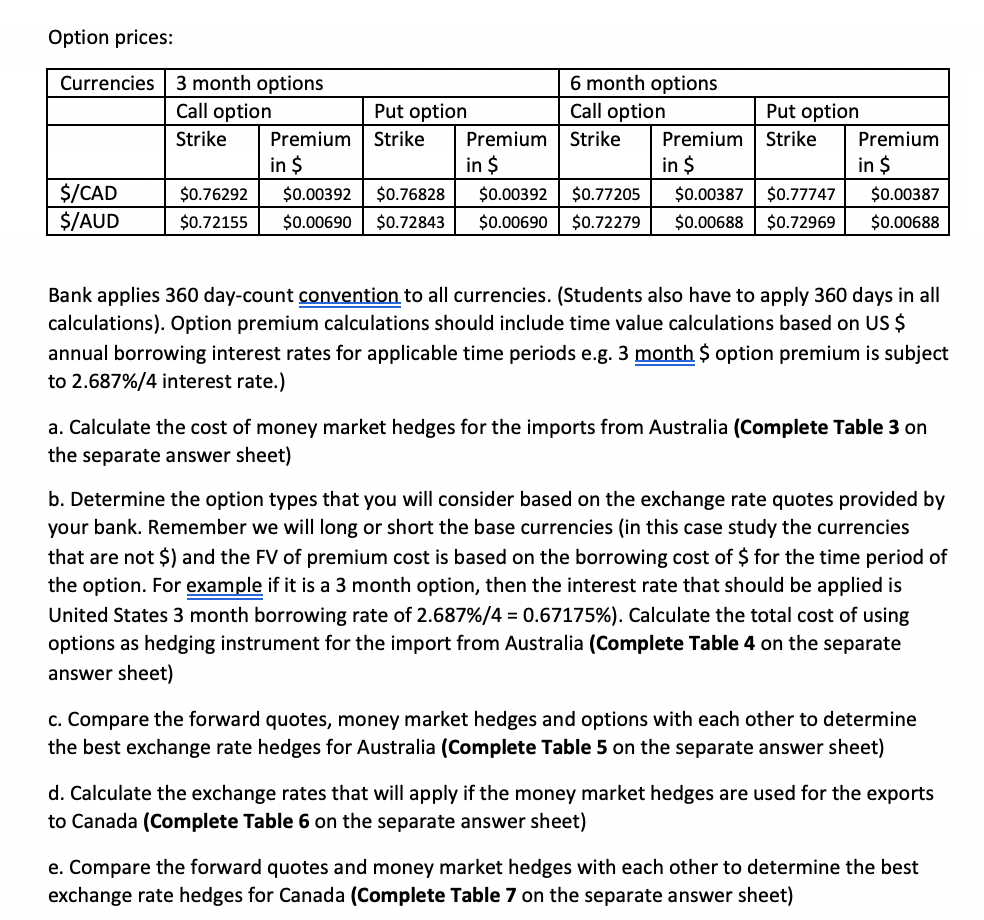

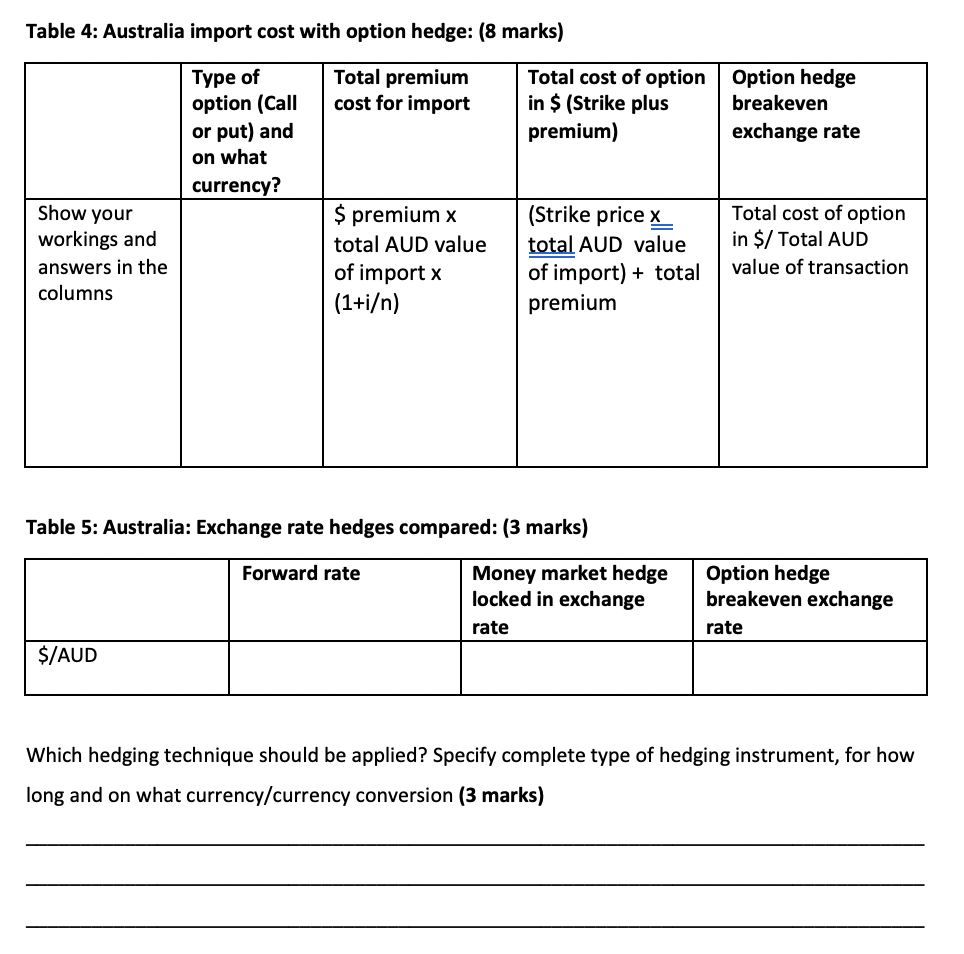

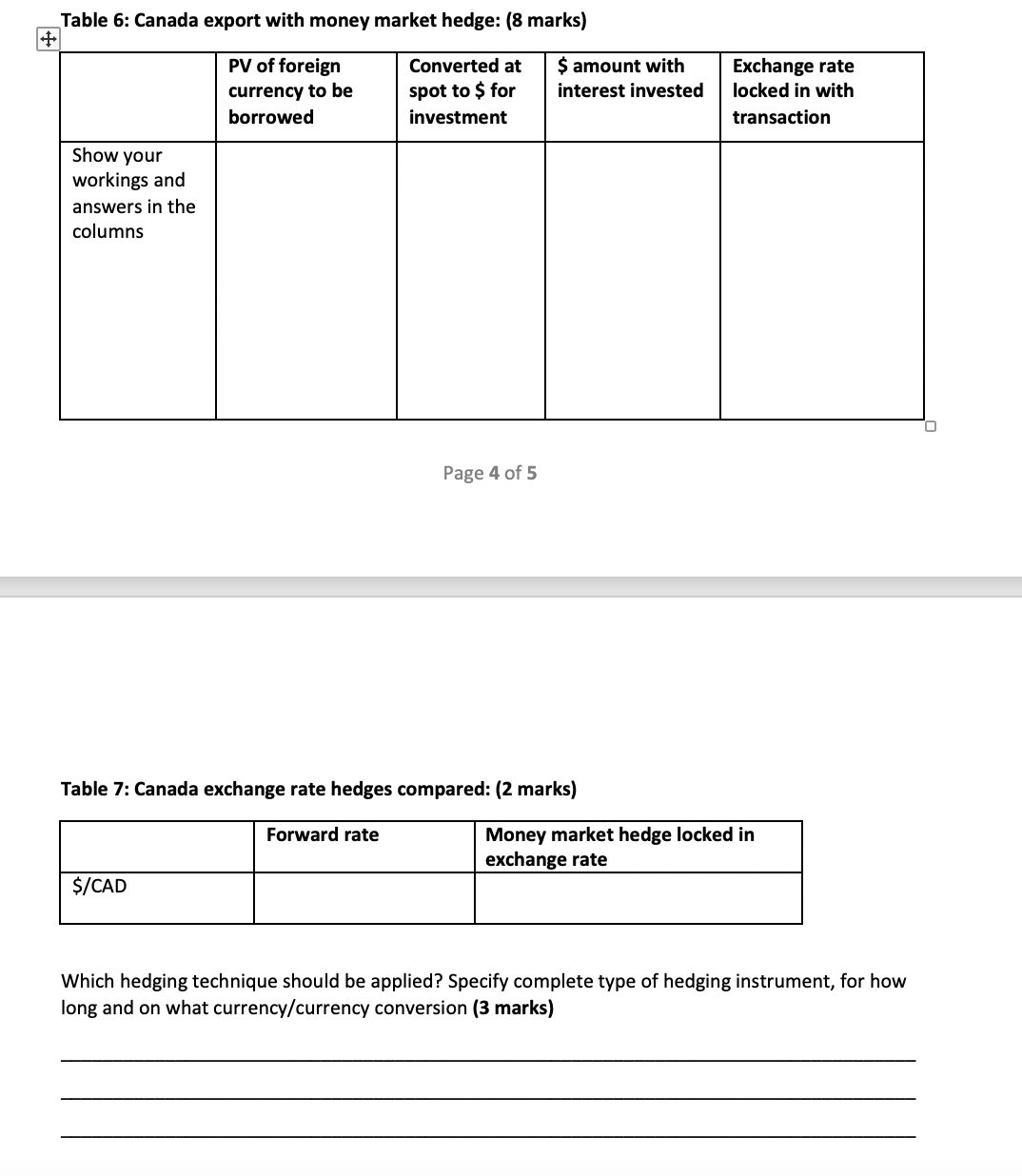

Considering the calculagnsyou have done so far, you need to attend to a number of import and export transactions for goods that companies in the United States expressed interest in. The first transaction is for the import of good quality wines from Australia, since a retail liquor trading chain customer in the United States, for who you have been doing imports over the past five years has a very large order this time. The producer in Australia informed you that the current cost of the wine that you want to import is AUDSZ,500,000. The producer in Australia will only ship goods in three months' time due to seasonal differences but payment will have to be conducted six months from now. The second transaction is for the export of 3d printers manufactured in the U.5.A. The country where it will be exported to is Canada. The payment of CAD 2,500,000 for the export to Canada will be received nine months from now. You consider different transaction hedges, namely forwards, options and money market hedges. You are provided with the following quotes from your bank, which is an international bank with branches in all the countries: Fonva rd rates: Currencies Spot 3 010.0111 (90 6 month (180 9 month (270 12 month (360 days) days] days) days) 0-76843 0.72390 0.72516 0.72641 0.72755 0.72392 Bank applies 360 day-count canvamjonto all currencies (for this assignment apply 360 days in all calculations). Annual borrowing and investment rates for your company: _M m United 113396 mun\"1.933% Bank applies 360 day-count cammjnnto all currencies. Explanation e.g. 3 month borrowing rate on S = 2.687%. This is the annual borrowing rate for 3 months. If you only borrow for 3 months the interest rate is actually 2.687%!4 = 0.6717596 (always round to 5 decimals when you do calculations). Furthermore, note that these are the rates at which your company borrows and invests. The rates are not borrowing and investment rates from a bank perspective. Option prices: 3 month options 6 month options _ Call option Put option Call option Put option Strike Premium Strike Premium Strike Premium ins n I n S/CAD 50.76292 50.00392 50.76828 50.00392 50.77205 50.00387 50.77747 50.00387 SIAUD 50.72155 50.00690 50.72843 50.00690 50.72279 50.00688 50.72969 50.00688 Bank applies 360 day-count campnnto all currencies. (Students also have to apply 360 days in all calculations). Option premium calculations should include time value calculations based on USS annual borrowing interest rates for applicable time periods e.g. 3 monthS option premium is subject to 2.6879614 interest rate.) a. Calculate the cost of money market hedges for the imports from Australia (Complete Table 3 on the separate answer sheet) b. Determine the option types that you will consider based on the exchange rate quotes provided by your bank. Remember we will long or short the base currencies (in this case study the currencies that are not 5) and the FV of premium cost is based on the borrowing cost of $ for the time period of the option. For example if it is a 3 month option, then the interest rate that should be applied is United States 3 month borrowing rate of 2.687%!4 = 0.6717596). Calculate the total cost of using options as hedging instrument for the import from Australia (Complete Table 4 on the separate answer sheet} c. Compare the fonNard quotes, money market hedges and options with each other to determine the best exchange rate hedges for Australia (Complete Table 5 on the separate answer sheet) d. Calculate the exchange rates that will apply if the money market hedges are used for the exports to Canada (Complete Table 6 on the separate answer sheet) e. Compare the forward quotes and money market hedges with each other to determine the best exchange rate hedges for Canada (Complete Table 7 on the separate answer sheet} Table 4: Australia import cost with option hedge: (8 marks) Type of Total premium Total cost of option Option hedge option (Call cost for import in $ (Strike plus breakeven or put) and premium) exchange rate on what currency? Show your 5 premium x (Strike price x: Total cost of option workings and total AUD value LojalAUD value in 5/ Total AUD answers in the of import x of import) + total value of transaction columns (1+i) premium Table 5: Australia: Exchange rate hedges compared: (3 marks) Forward rate Money market hedge Option hedge locked in exchange breakeven exchange rate '\"\" __ Which hedging technique should be applied? Specify complete type of hedging instrument, for how long and on what currency/currency conversion (3 marks) Table 6: Canada export with money market hedge: (8 marks) W of foreign Converted at 5 amount with Exchange rate currency to be spot to $ for interest invested locked in with borrowed investment transaction Show your workings and answers in the columns Page 4 of 5 Table 7: Canada exchange rate hedges compared: (2 marks) Forward rate Money market hedge locked in exchange rate __ Which hedging technique should be applied? Specify complete type of hedging instrument, for how long and on what currency/currency conversion