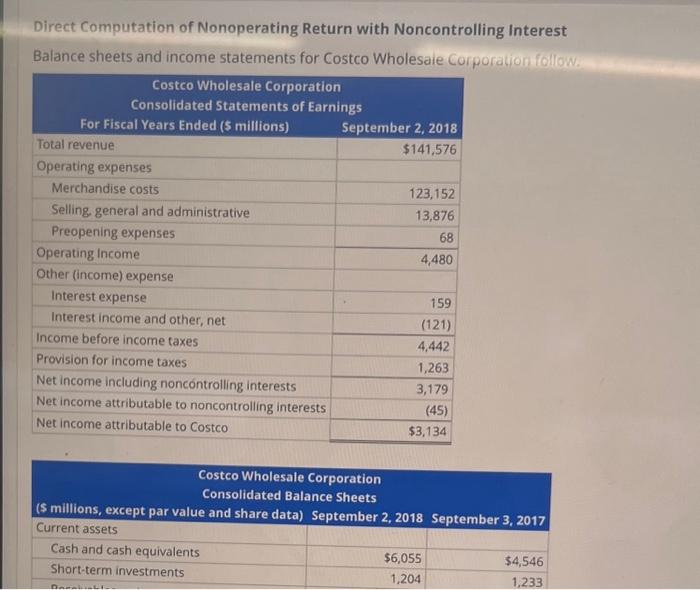

Question: please answer the question Direct Computation of Nonoperating Return with Noncontrolling Interest Balance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation

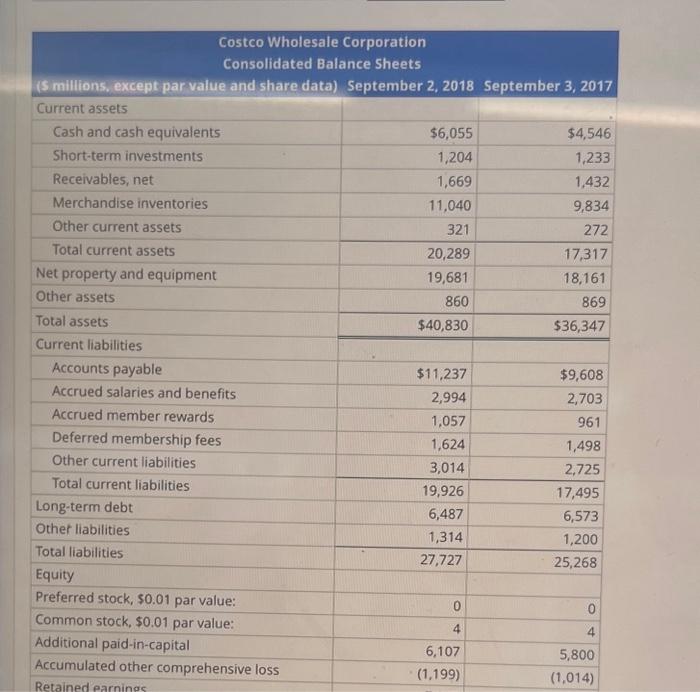

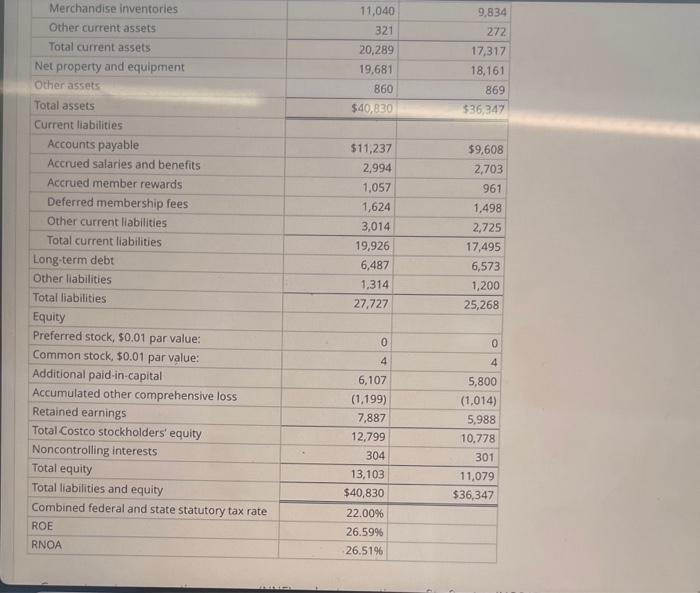

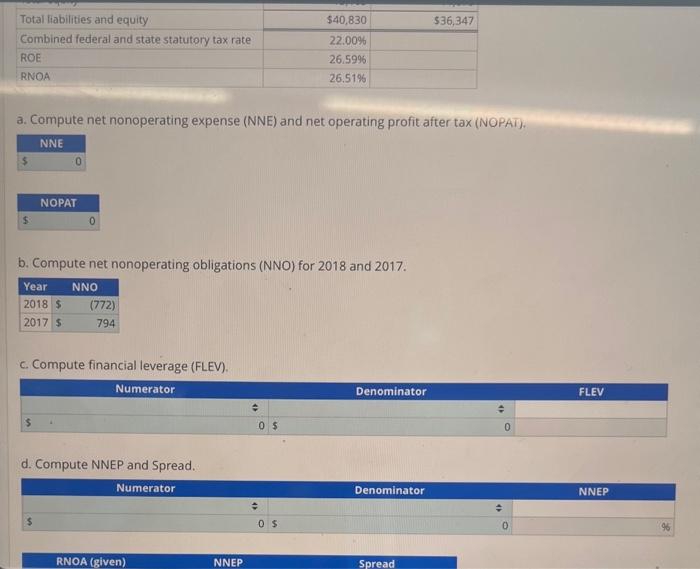

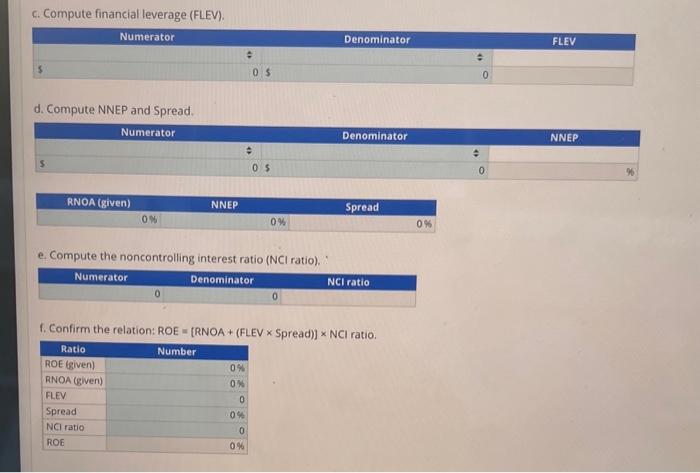

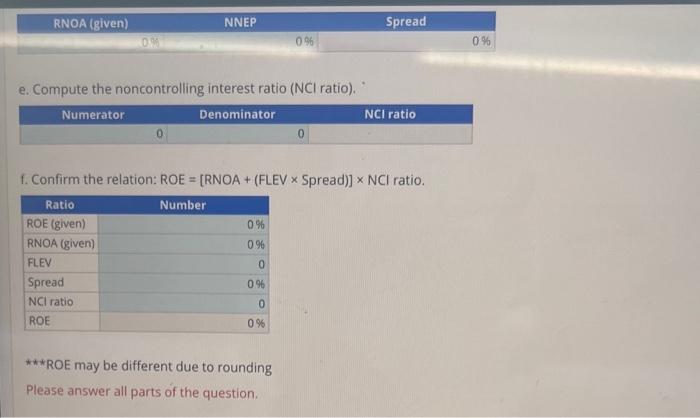

Direct Computation of Nonoperating Return with Noncontrolling Interest Balance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation Consolidated Balance Sheets (S millions, except par value and share data) September 2, 2018 September 3, 2017 Current assets a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). b. Compute net nonoperating obligations (NNO) for 2018 and 2017. c. Compute financial leverage (FLEV). d. Compute NNEP and Spread. c. Compute financial leverage (FLEV). d. Compute NNEP and Spread. e. Compute the noncontrolling interest ratio (NCI ratio), f. Confirm the relation: ROE = [ RNOA + (FLEV Spread )NCI ratio. e. Compute the noncontrolling interest ratio (NCl ratio). f. Confirm the relation: ROE=[ RNOA +( FLEV Spread )]NCl ratio. ***ROE may be different due to rounding Please answer all parts of the question. Direct Computation of Nonoperating Return with Noncontrolling Interest Balance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation Consolidated Balance Sheets (S millions, except par value and share data) September 2, 2018 September 3, 2017 Current assets a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). b. Compute net nonoperating obligations (NNO) for 2018 and 2017. c. Compute financial leverage (FLEV). d. Compute NNEP and Spread. c. Compute financial leverage (FLEV). d. Compute NNEP and Spread. e. Compute the noncontrolling interest ratio (NCI ratio), f. Confirm the relation: ROE = [ RNOA + (FLEV Spread )NCI ratio. e. Compute the noncontrolling interest ratio (NCl ratio). f. Confirm the relation: ROE=[ RNOA +( FLEV Spread )]NCl ratio. ***ROE may be different due to rounding Please answer all parts of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts