Question: PLEASE ANSWER THE QUESTION FULLY AND CORRECTLY. I NEED THE DECISION TREE FOR ALL 3 PARTS. THANK YOU IN ADVANCE! Question 1 After its recent

PLEASE ANSWER THE QUESTION FULLY AND CORRECTLY. I NEED THE DECISION TREE FOR ALL 3 PARTS. THANK YOU IN ADVANCE!

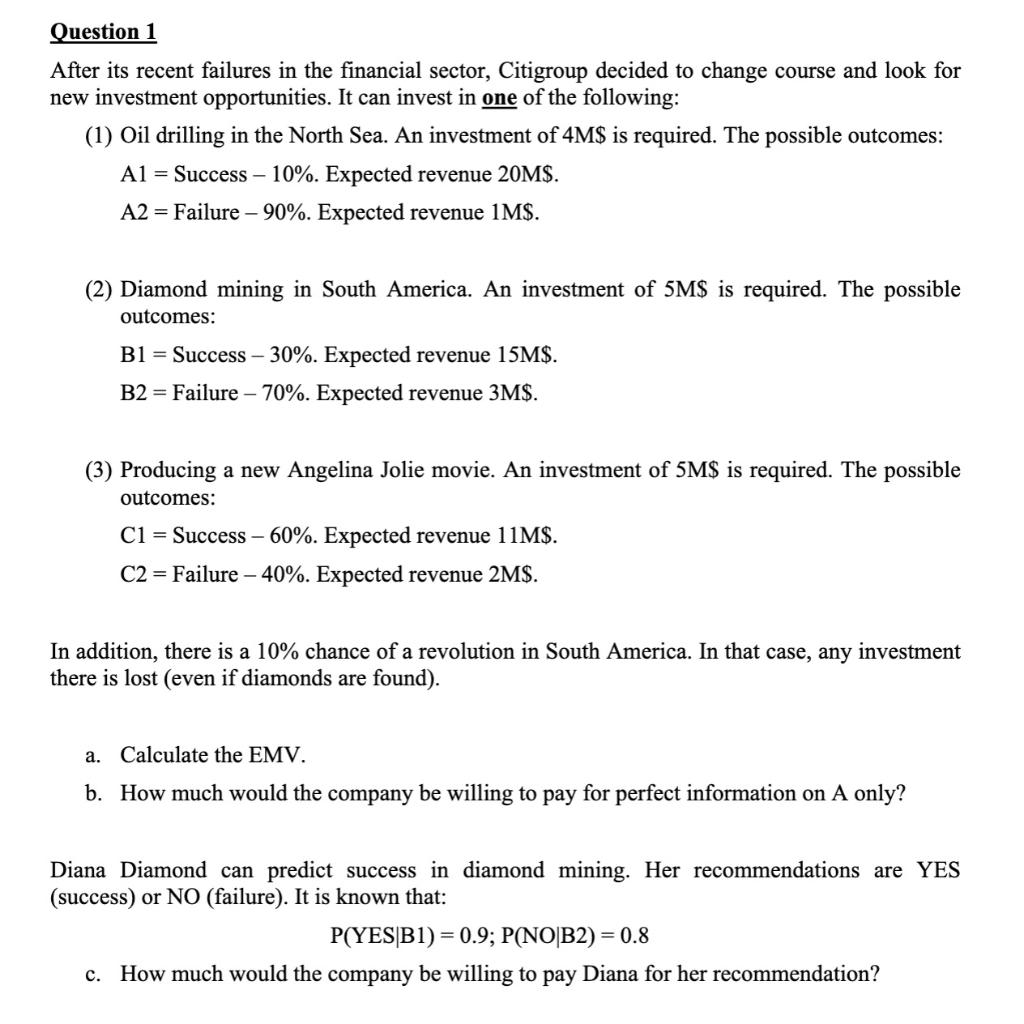

Question 1 After its recent failures in the financial sector, Citigroup decided to change course and look for new investment opportunities. It can invest in one of the following: (1) Oil drilling in the North Sea. An investment of 4M$ is required. The possible outcomes: A1 = Success - 10%. Expected revenue 20M$. A2 = Failure - 90%. Expected revenue 1M$. (2) Diamond mining in South America. An investment of 5M$ is required. The possible outcomes: B1 = Success - 30%. Expected revenue 15M$. B2 = Failure - 70%. Expected revenue 3M$. (3) Producing a new Angelina Jolie movie. An investment of 5M$ is required. The possible outcomes: C1 = Success 60%. Expected revenue 11M$. C2 = Failure -40%. Expected revenue 2M$. In addition, there is a 10% chance of a revolution in South America. In that case, any investment there is lost (even if diamonds are found). a. Calculate the EMV. b. How much would the company be willing to pay for perfect information on A only? Diana Diamond can predict success in diamond mining. Her recommendations are YES (success) or NO (failure). It is known that: P(YES|B1) = 0.9; P(NO|B2) = 0.8 c. How much would the company be willing to pay Diana for her recommendationStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts