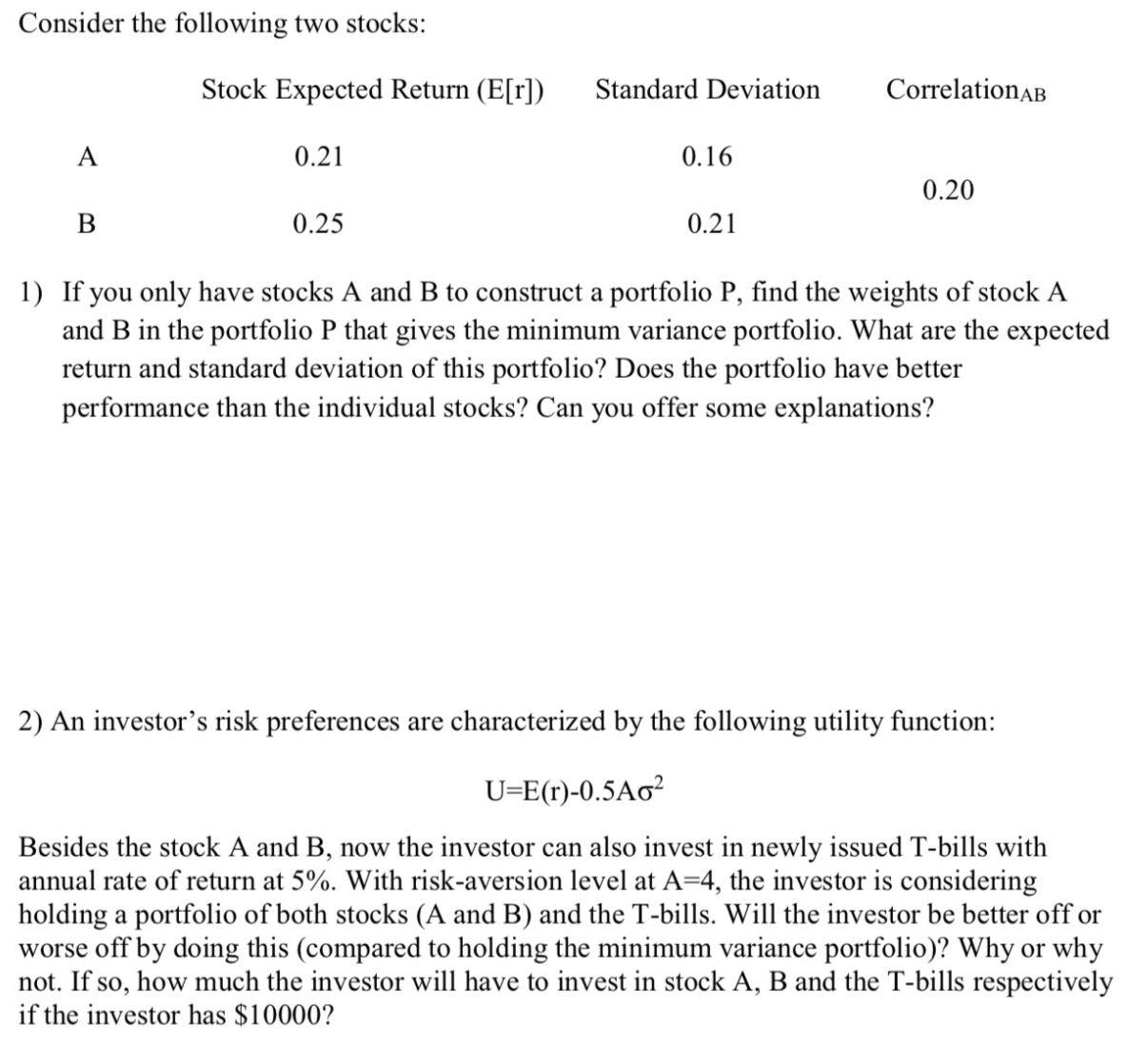

Question: Please answer the question in detail Consider the following two stocks: Stock Expected Return (E[r]) Standard Deviation Correlation; A 0.21 0.16 0.20 B 0.25 0.21

Please answer the question in detail

![Stock Expected Return (E[r]) Standard Deviation Correlation"; A 0.21 0.16 0.20 B](https://s3.amazonaws.com/si.experts.images/answers/2024/06/666217a38e2b1_611666217a36b0e2.jpg)

Consider the following two stocks: Stock Expected Return (E[r]) Standard Deviation Correlation"; A 0.21 0.16 0.20 B 0.25 0.21 I) If you only have stocks A and B to construct a portfolio P, nd the weights of stock A and B in the portfolio P that gives the minimum variance portfolio. What are the expected return and standard deviation of this portfolio? Does the portfolio have better performance than the individual stocks? Can you offer some explanations? 2) An investor's risk preferences are characterized by the following utility function: U=E(r)-0.5Aoz Besides the stock A and B, now the investor can also invest in newly issued T-bills with annual rate of return at 5%. With risk-aversion level at A=4, the investor is considering holding a portfolio of both stocks (A and B) and the T-bills. Will the investor be better off or worse off by doing this (compared to holding the minimum variance portfolio)? Why or why not. If so, how much the investor will have to invest in stock A, B and the T-bills respectively if the investor has $10000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts