Question: Please, answer the question in detail Thanks ! Willis and Gouw manufacturing company produces PVC pipes and drainage ducts for use in the agriculture industry.

Please, answer the question in detail

Thanks !

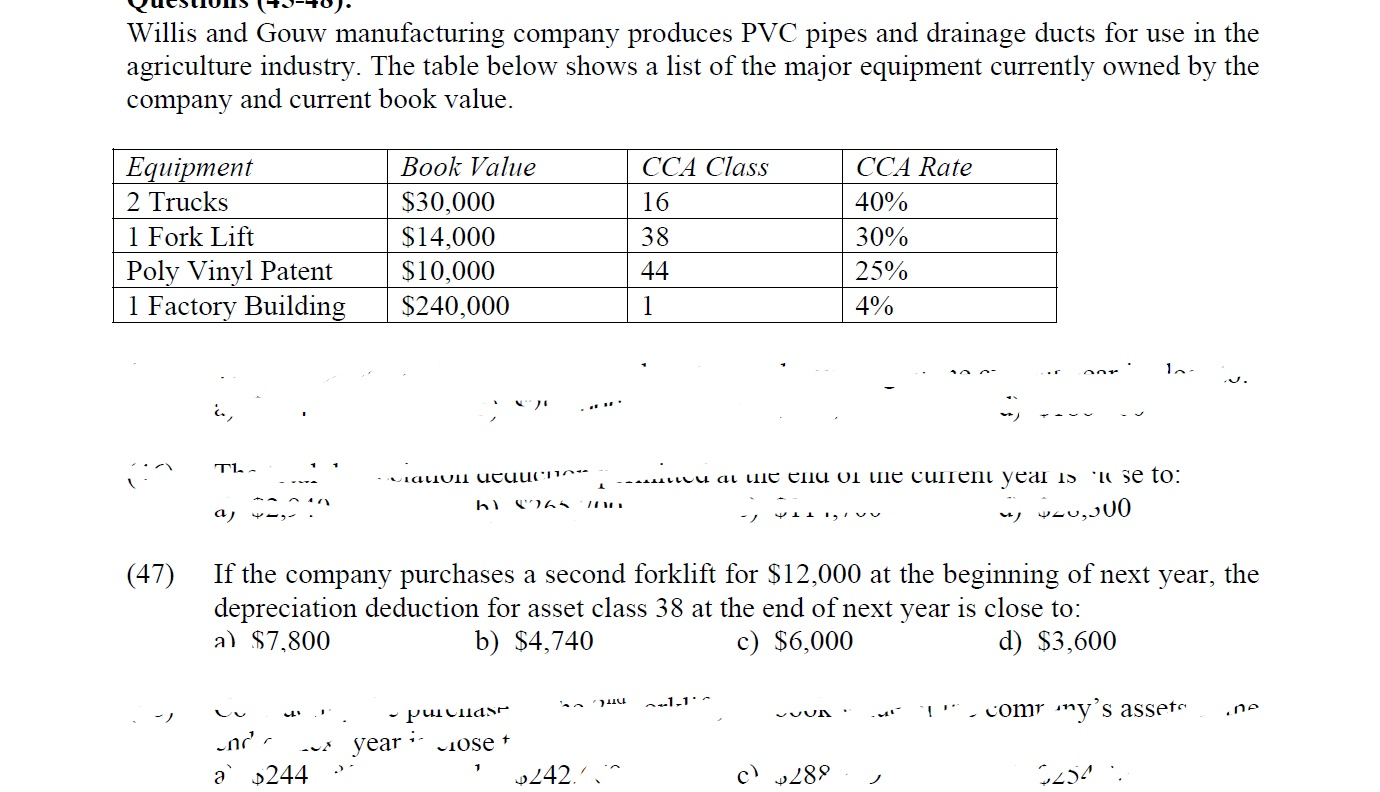

Willis and Gouw manufacturing company produces PVC pipes and drainage ducts for use in the agriculture industry. The table below shows a list of the major equipment currently owned by the company and current book value. Equipment 2 Trucks 1 Fork Lift Poly Vinyl Patent 1 Factory Building Book Value $30,000 $14,000 $10,000 $240,000 CCA Class 16 38 44 CCA Rate 40% 30% 25% 4% 12 . TI ali ucuuciin nu ai uie enu or the current year is 'lose to: hl a) 111,1vu VLU,J10 (47) If the company purchases a second forklift for $12,000 at the beginning of next year, the depreciation deduction for asset class 38 at the end of next year is close to: a) $7,800 b) $4,740 c) $6,000 d) $3,600 114 21.1' VUN - comr iny's assets .na nr 244 puillas year lose + -242.' a 2289 9254

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts