Question: please answer the question in one and half hour, professor don't accept later work, even you haven't finish all the question, post it please! Larry

please answer the question in one and half hour, professor don't accept later work, even you haven't finish all the question, post it please!

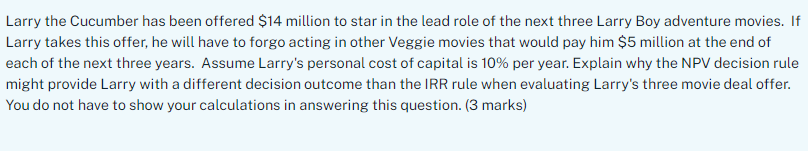

Larry the Cucumber has been offered $14 million to star in the lead role of the next three Larry Boy adventure movies. If Larry takes this offer, he will have to forgo acting in other Veggie movies that would pay him $5 million at the end of each of the next three years. Assume Larry's personal cost of capital is 10% per year. Explain why the NPV decision rule might provide Larry with a different decision outcome than the IRR rule when evaluating Larry's three movie deal offer. You do not have to show your calculations in answering this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts